- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $60.00

0 out of 5 main slots sold

Dynamic Portfolio MT5 – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert Dynamic Portfolio MT5

Name: Dynamic Portfolio

Version: Latest Version

Developer by: Salvatore Caligiuri

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is Dynamic Portfolio MT5?

Dynamic Portfolio MT5 – A Multi-Strategy Automated Trading Solution for MT5

The Dynamic Portfolio MT5 is an Expert Advisor (EA) for MetaTrader 5, designed to deliver stability, flexibility, and exceptional adaptability across diverse market conditions. Unlike many trading robots that focus on a single strategy, this EA functions as a “dynamic portfolio system”, constantly updating and expanding its supported pairs to capture more opportunities from the market.

What makes it stand out is its authenticity. Instead of relying on unrealistic backtests, it provides live verified trading results, giving traders a transparent and reliable foundation to evaluate its real performance.

- Official Website: See here

Core Features

1. Dynamic Updates with Expanding Portfolio

The EA is regularly updated with new supported trading pairs (such as XAUUSD, EURUSD, and additional pairs added periodically). This ensures continuous evolution, allowing traders to benefit from a wider range of opportunities and enhanced adaptability.

2. Multiple Trading Strategies

Dynamic Portfolio EA integrates a variety of strategies, including Scalping, Trend Following, Level Trading, Neural Network models, and Multi-currency trading. This versatility enables the EA to select and adjust the most effective approach depending on current market conditions.

3. Flexible Money Management

Traders can fine-tune risk levels, lot sizes, and percentage allocations based on their personal objectives. This allows for a customized balance between profit maximization and capital safety.

4. Advanced Risk Management

Built-in tools such as percentage-based stop-loss and drawdown control help protect trading accounts during periods of high volatility, minimizing potential losses and preserving capital.

5. Robust Performance & Transparent Reporting

The EA is designed to perform reliably across both trending and ranging markets. It comes with comprehensive reporting, visuals, and tutorials, enabling traders to track results easily and optimize their trading setups.

6. User-Friendly Interface

Whether you are a beginner or a seasoned trader, the EA provides an intuitive interface and ready-made set files tailored to different trading styles. In addition, dedicated support is available to help with setup and optimization.

Benefits of Using Dynamic Portfolio MT5

✅ Diversified Risk: Reduces reliance on a single strategy or currency pair, lowering concentrated risks.

✅ Time-Saving: Operates 24/5, scanning the markets and executing trades automatically without the need for constant monitoring.

✅ Long-Term Profit Optimization: By integrating multiple strategies and continuous updates, it aims to provide sustainable growth and account stability.

✅ Stronger Risk Control: Built-in capital protection features allow traders to trade confidently even during volatile market conditions.

✅ Real & Transparent Results: Offers live certified account monitoring, making it different from EAs that only showcase inflated backtest performances.

Performance of Dynamic Portfolio MT5

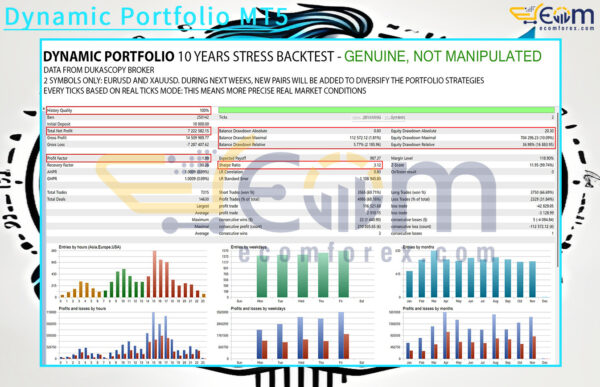

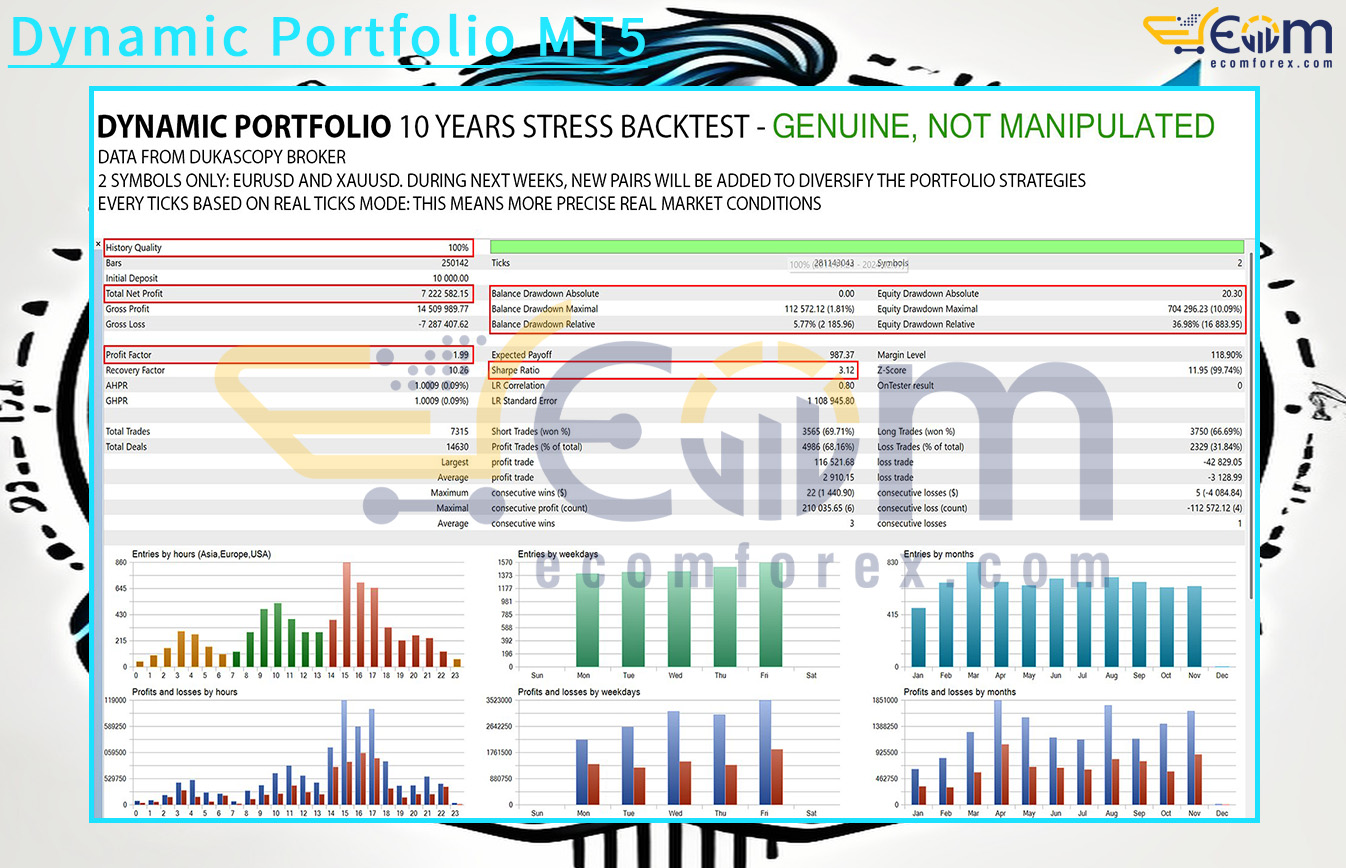

The Dynamic Portfolio EA backtest highlights exceptional profitability and disciplined execution across a 10-year stress test period using only EURUSD and XAUUSD pairs. The strategy maintained consistent growth while managing risks effectively, supported by a strong profit factor and a high recovery ratio. With precise tick-based testing on real data from Dukascopy broker, this backtest provides a more accurate reflection of real market conditions. These results emphasize the EA’s robustness, adaptability, and potential as a long-term trading solution.

Key Backtest Metrics

Initial Deposit: $10,000

Total Net Profit: $7,222,582.15

Profit Factor: 1.99

Win Rate: ~66.7% (3,750 long trades won, 3,565 short trades won)

Maximum Drawdown: 36.98% (~$704,296.23)

The Dynamic Portfolio EA backtest demonstrates strong profitability and disciplined execution over a 10-year stress test period. The strategy maintained a steady growth trajectory while controlling risk through advanced portfolio management and multi-strategy diversification. With a solid profit factor and impressive recovery ratio, the system proves its resilience and adaptability across changing market conditions, making it a reliable solution for traders seeking sustainable long-term performance.

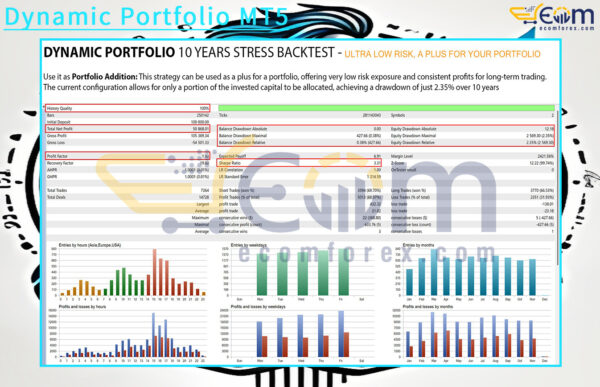

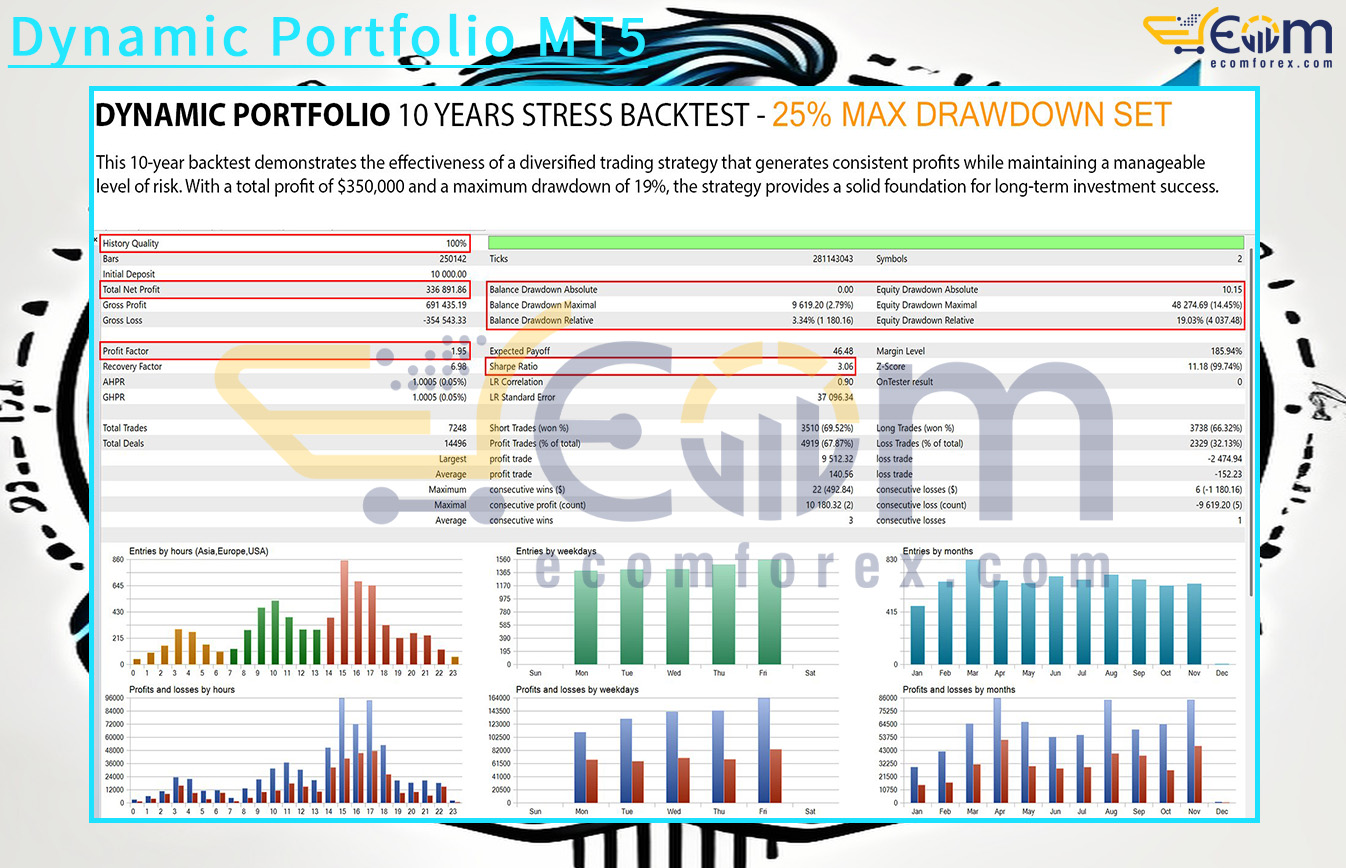

Key Backtest Metrics

Initial Deposit: $10,000

Total Net Profit: $336,991.86

Profit Factor: 1.95

Win Rate: ~66% (3,738 long trades won, 3,510 short trades won)

Maximum Drawdown: 19.03% (~$48,274.69)

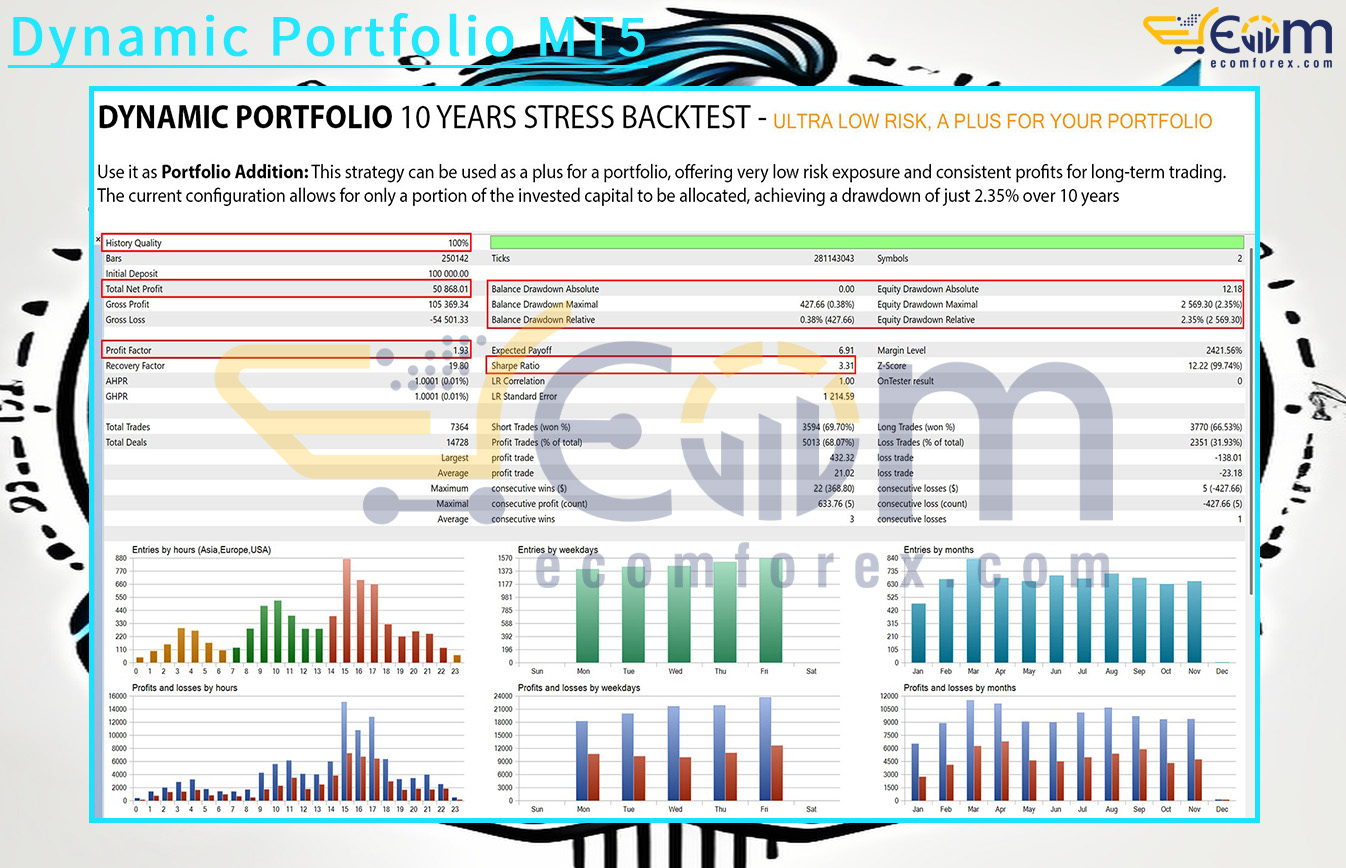

The Dynamic Portfolio EA backtest highlights consistent profitability and ultra-low risk performance over a 10-year stress test using EURUSD and XAUUSD. Designed as a portfolio addition, the strategy emphasizes capital preservation while still achieving solid returns. With a very low maximum drawdown of just 2.35% and a strong Sharpe ratio, the system proves its reliability for long-term trading stability. This makes it an excellent option for traders who prioritize low-risk exposure and steady growth.

Key Backtest Metrics

Initial Deposit: $100,000

Total Net Profit: $50,868.01

Profit Factor: 1.93

Win Rate: ~66.5% (3,770 long trades won, 3,594 short trades won)

Maximum Drawdown: 2.35% (~$2,569.03)

Recommended Configuration for Dynamic Portfolio MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | M15 |

| Currency pairs | EURUSD, XAUUSD |

| Min / Recommended deposit | $1000 |

| Min / Recommended leverage | Minimum leverage 1:30, suggested 1:500 |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗