- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $140.00

0 out of 5 main slots sold

FundPass Pro EA MT5 – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert FundPass Pro EA MT5

Name: FundPass Pro

Version: Latest Version

Developer by: Faith Wairimu Kariuki

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is FundPass Pro EA MT5?

FundPass Pro EA MT5 is a fully automated, professional-grade Expert Advisor (EA) engineered specifically for proprietary trading firm evaluations while remaining highly effective on standard retail trading accounts.

Unlike generic EAs that focus purely on short-term profits, FundPass Pro was designed from the ground up around real prop firm rules used by major firms such as FTMO, MyForexFunds, The Funded Trader, and similar platforms. These rules are enforced directly at the code level, ensuring disciplined trading behavior rather than risky rule-evasion tactics.

With a true plug-and-play architecture, traders simply attach the EA to a chart, enable the recommended settings, and allow FundPass Pro to handle the entire process — market analysis, risk management, trade execution, and exits — all without emotional interference.

- Official Website: See here

Core Features

🔹 Prop Firm Rule Compliance at System Level

FundPass Pro integrates critical prop firm constraints directly into its logic:

Automatic daily equity tracking

Lot size limitation based on account balance

Intraday drawdown capping with early trade closure

High-impact news filter to avoid extreme volatility

Strict trading session control to bypass risky market hours

This dramatically reduces the risk of disqualification, one of the most common reasons traders fail prop firm challenges.

🔹 Intelligent AI-Powered Architecture

FundPass Pro is driven by machine learning algorithms and a proprietary adaptive intelligence engine that continuously analyzes real-time market conditions, including:

Volatility changes

Market structure shifts

Price action anomalies

Momentum and trend stability

Compatibility with prop firm risk rules

Based on these inputs, the system dynamically decides when to:

Enter trades with high statistical confidence

Exit positions when risk or instability increases

Avoid trading during news spikes or abnormal spread conditions

This makes FundPass Pro far more than a traditional EA — it is a self-adjusting, learning-based trading system.

🔹 No High-Risk Trading Methods

FundPass Pro follows a clean, risk-conscious trading methodology:

❌ No Martingale

❌ No Grid Trading

❌ No Arbitrage or Tick Exploits

❌ No Market Maker Manipulation

Each trade is executed with fixed, transparent risk parameters, including clearly defined stop-loss and take-profit logic, making the EA suitable for both real-money accounts and evaluation accounts.

FundPass Pro EA MT5 Trading Strategy Explained

FundPass Pro EA MT5 applies a high-probability, consistency-focused trading strategy designed to prioritize account survival and rule compliance over aggressive profit chasing.

Core strategic principles include:

Trading only under stable market conditions

Avoiding high-impact news and abnormal spreads

Evaluating risk before every entry

Exiting positions immediately when market structure deteriorates

Focusing on smooth equity growth rather than oversized winning trades

This approach reflects a true prop firm mindset:

👉 Passing the evaluation matters more than winning fast.

Why Choose FundPass Pro EA MT5?

🔹 Built Specifically for Prop Firms

FundPass Pro is not a modified retail EA — it is engineered from inception to operate within prop firm constraints.

🔹 Reduced Stress, Increased Discipline

The EA removes emotional decision-making, overtrading, and rule violations from the trading process.

🔹 Suitable for All Experience Levels

From beginners to professional traders, mentors, and trading coaches.

🔹 Ideal for Busy & Remote Traders

FundPass Pro monitors, analyzes, and trades the market automatically while you focus on other priorities.

🔹 Transparent, Professional, and Sustainable

No gimmicks, no hidden tactics — real trading under real market conditions.

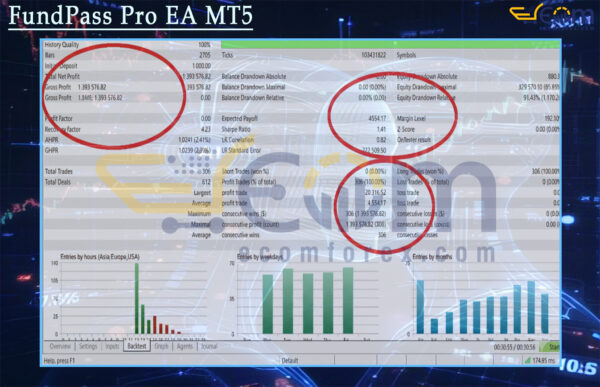

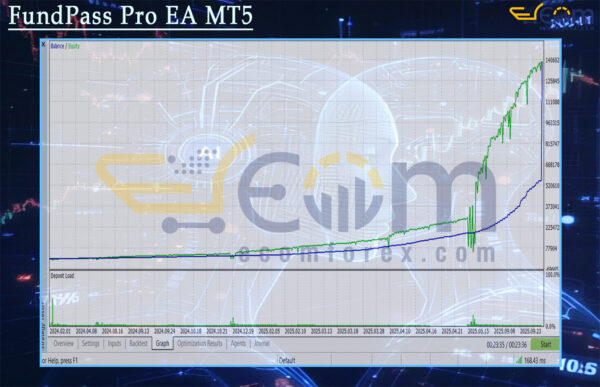

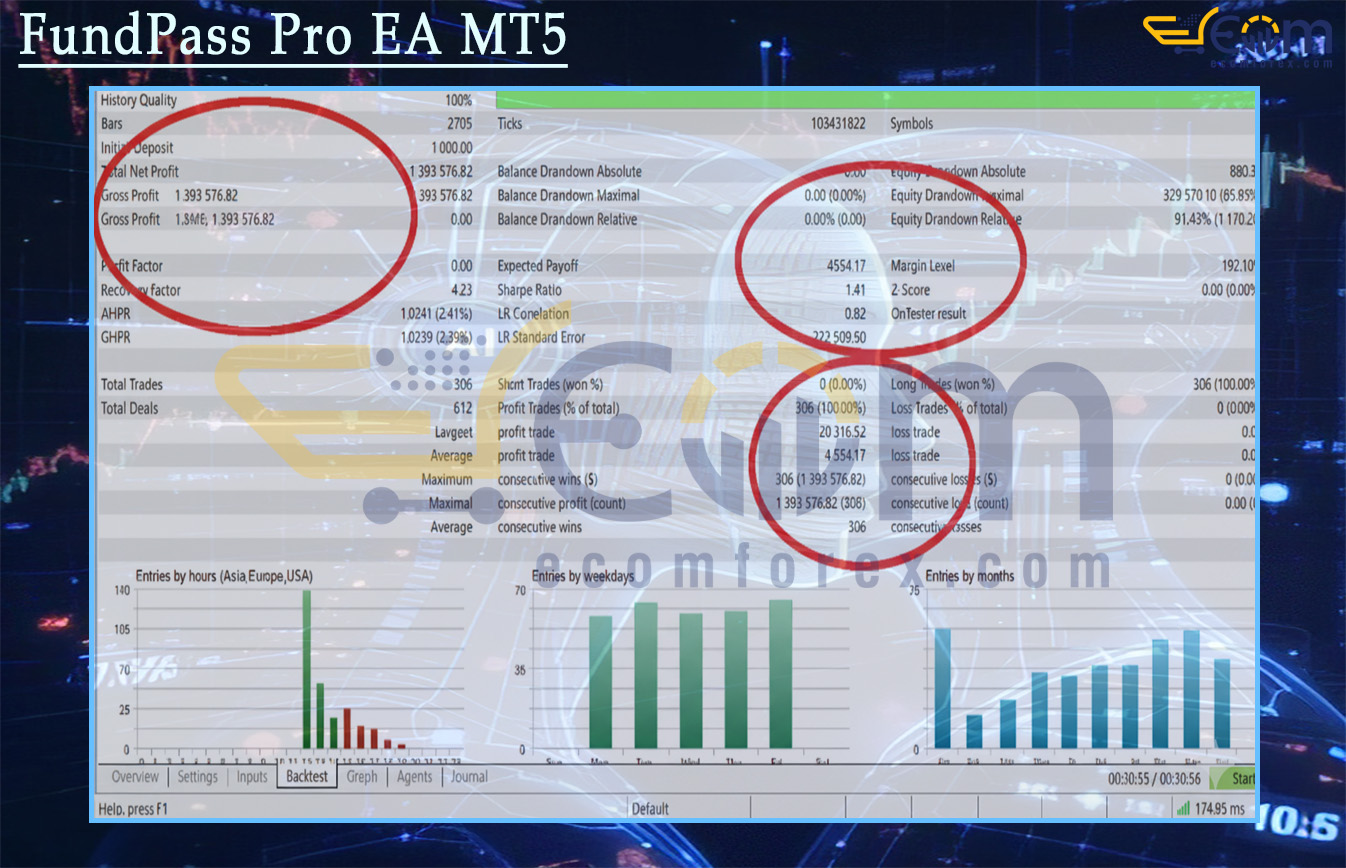

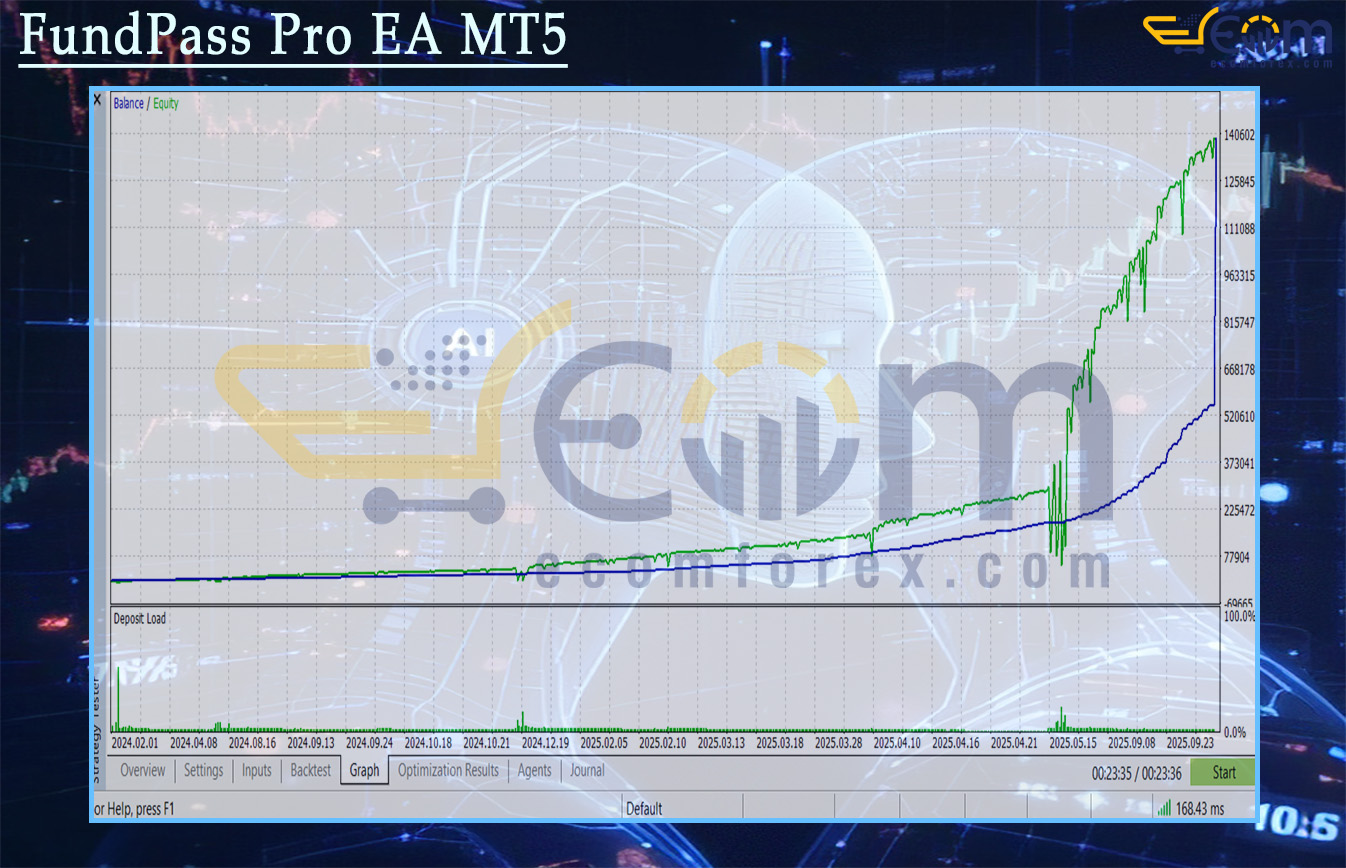

Performance of FundPass Pro EA MT5

FundPass Pro EA delivered exceptional high-growth performance over this backtest on the XAUUSD pair, demonstrating aggressive profit generation driven by a directional, long-only trading approach.

Operating with 100% modeling quality and executing 306 consecutive winning trades, the system produced an explosive equity expansion. However, this performance was accompanied by extremely high equity drawdown, reflecting a strategy that prioritizes growth over capital preservation and requires careful risk calibration in real trading conditions.

📌 Key Backtest Metrics

- ✅ Initial Deposit: $1,000

- ✅ Total Net Profit: $1,393,576.82

- ✅ Total Trades: 306 (100% long positions)

- ✅ Maximum Equity Drawdown: 91.43%

Recommended Configuration for FundPass Pro EA MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | M5 |

| Currency pairs | XAUUSD, EURUSD, US30, and more |

| Min / Recommended deposit | $1000 |

| Min / Recommended leverage | 1:500 |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗