- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $85.00

0 out of 5 main slots sold

Faryan Ai Trade EA MT5 – Latest version | Group Buy

people are currently looking at this product!

Its performance has been verified on real trading accounts, demonstrating disciplined execution, intelligent risk control, and consistent behavior under live market conditions.

Introducing the Expert Faryan Ai Trade EA MT5

Name: Faryan Ai Trade

Version: Latest Version

Developer by: Ehsan Amini

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is Faryan Ai Trade EA MT5?

Faryan AI Trade EA MT5 is a professional-grade, AI-powered Expert Advisor (EA) developed exclusively for US30 (Dow Jones Index) on MetaTrader 5.

Rather than chasing short-term volatility or overtrading, the system is built around precision, patience, and capital preservation, combining artificial intelligence, data mining, and machine learning to evaluate market conditions in real time.

From a seasoned trader’s perspective, Faryan AI Trade EA MT5 is not a speculative robot. It is a disciplined index trading system designed to operate with institutional-style logic — prioritizing risk awareness, controlled exposure, and long-term stability over aggressive profit chasing.

- Official Website: See here

Core Features

🔹 Advanced AI, Machine Learning & Data Mining

The EA integrates modern AI technologies, including:

Advanced language-model intelligence (ChatGPT-01, GPT-4.5)

Machine learning pattern recognition

Deep historical and real-time data analysis

This allows the system to identify high-quality US30 trading opportunities with greater contextual understanding, not just indicator-based signals.

🔹 Intelligent Risk Environment Detection

One of Faryan’s strongest advantages is its ability to detect unfavorable or unstable market conditions.

The EA actively avoids:

Abnormal volatility phases

Structurally risky price behavior

Market environments with poor risk-to-reward characteristics

👉 Sometimes, the best trade is no trade at all.

🔹 Continuous Position Monitoring & Adaptive Management

Faryan AI Trade EA does not rely solely on static SL/TP logic.

Instead, it continuously monitors open positions, adapting trade management dynamically as market behavior evolves — enhancing protection during adverse movement and optimizing exits when conditions improve.

Faryan AI Trade EA MT5 – Trading Strategy Explained

🔹 Precision-First Entry Philosophy

The system trades selectively, waiting for optimal alignment of market structure, volatility conditions, and AI-confirmed signals.

No high-frequency execution.

No impulse trades.

No emotional overexposure.

🔹 Adaptive AI Decision Engine

Once a trade is active, the EA continues to evaluate live market data, adjusting its decision-making process in real time.

This adaptive approach mirrors how experienced traders reassess risk continuously, rather than setting a trade and walking away.

🔹 Structured, Multi-Level Risk Framework

Faryan AI Trade EA automatically calculates and applies three predefined risk tiers, allowing the system to:

Balance opportunity capture

Protect capital during uncertainty

Maintain consistent equity behavior across market cycles

Why Choose Faryan AI Trade EA MT5?

🔹 Zero High-Risk Trading Methods

The EA completely avoids martingale, grid, and aggressive recovery techniques.

This makes it suitable for traders who value:

Account survival

Equity stability

Responsible, sustainable growth

🔹 Purpose-Built for US30 Only

Faryan AI Trade EA is not a generic multi-asset robot.

It is fully optimized for the unique behavior, volatility structure, and session dynamics of the Dow Jones Index (US30).

Focused specialization beats diluted performance — every time.

🔹 Professional Trading Discipline by Design

The logic behind Faryan AI Trade EA reflects how experienced discretionary traders operate:

Trade less, but trade better

Cut risk early

Protect equity first

Let profits grow rationally

This is the mindset that survives long-term — especially in index trading.

Performance of Faryan Ai Trade EA MT5

Faryan AI Trade EA has demonstrated exceptional long-term performance, consistently navigating complex market conditions with disciplined execution and controlled risk exposure.

Over multiple market cycles, the system has proven its ability to identify high-quality opportunities, protect capital, and compound profits with remarkable stability.

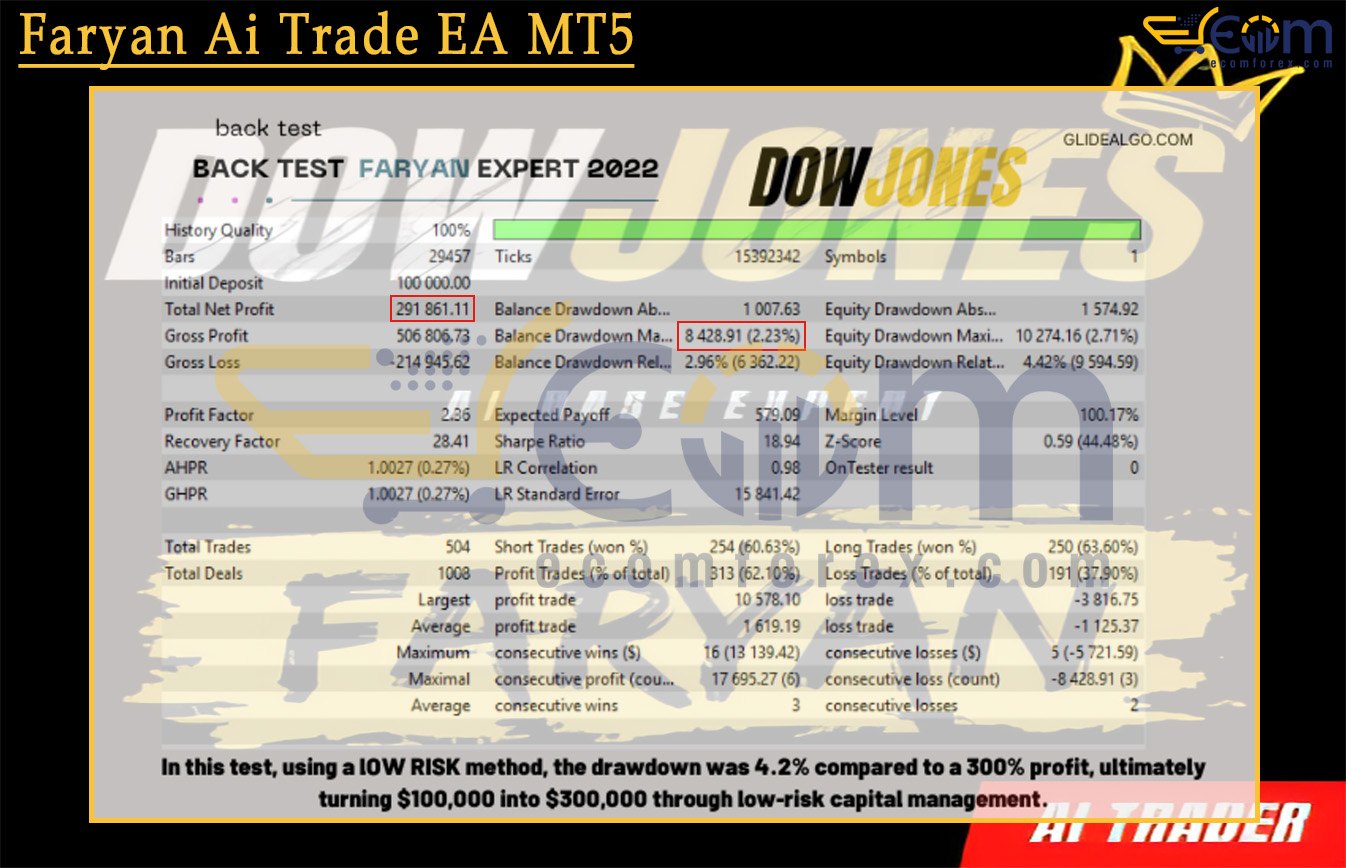

🧩 Reverse Backtest Performance on US30 (2022)

The reverse testing results highlight a professional-grade trading architecture, showcasing strong profitability while maintaining extremely low drawdown — a critical benchmark for serious index traders.

- ✅ Initial Deposit: $100,000

- ✅ Total Net Profit: $291,861.11

- ✅ Maximum Drawdown: 2.23%

The reverse backtest results of Faryan AI Trade EA demonstrate outstanding performance throughout 2024 on the US30 (Dow Jones Index).

During this period, the system consistently delivered strong profitability while maintaining disciplined risk exposure and exceptional drawdown control — even under highly dynamic index market conditions.

🧩 Reverse Backtest Performance on US30 – 2024

- ✅ Initial Deposit: $100,000

- ✅ Total Net Profit: $364,076.03

- ✅ Maximum Drawdown: 2.45%

Recommended Configuration for Faryan Ai Trade EA MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | Any |

| Currency pairs | Dow Jones (US30) |

| Min / Recommended deposit | $100 |

| Min / Recommended leverage | Any |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗