- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Professor Moriarty MT4 v1.0 – Unlimited | Available

people are currently looking at this product!

Professor Moriarty MT4 is a professionally engineered automated trading system optimized for GBPUSD, EURUSD, USDJPY, USDCAD, and EURGBP.

Its performance has been validated under real-market trading conditions, demonstrating disciplined execution, correlation-based logic, and reliable risk control across multiple major currency pairs.

Introducing the Expert Professor Moriarty MT4

Name: Professor Moriarty MT4

Version: V1.0 New Version

Developer by: Evgeniy Zhdan

The Right Platform: Meta Trader 4 (MT4)

Our Telegram Team: Join now

Our Youtube Channel: Click here

- Delivery time 24h-48h after payment.

What is Professor Moriarty MT4?

Professor Moriarty MT4 is a professional correlation arbitrage Expert Advisor (EA) designed to exploit short-term price inefficiencies between correlated currency pairs and metals.

Instead of predicting the market direction, the EA focuses on statistical mispricing between related instruments and trades the corrective move back to equilibrium.

Built for precision and discipline, Professor Moriarty operates on the M1 timeframe across 5 major instruments, using a proprietary position-tracking and risk-control algorithm — without Martingale, averaging, or any form of dangerous recovery logic.

This makes it a low-latency, rules-based arbitrage system suitable for traders who value speed, structure, and controlled risk exposure.

- Official Website: See here

Core Features

🔹 Cross-Currency & Metal Correlation Analysis

Continuously monitors price relationships between correlated instruments to detect short-lived market imbalances.

🔹 Statistical Arbitrage Logic

Trades only when measurable price deviations appear, targeting fast corrective moves rather than long-term trends.

🔹 Proprietary Position Tracking Algorithm

Actively manages open positions to ensure profit dominance over loss, maintaining balance even during rapid market fluctuations.

🔹 Mandatory Stop Loss & Take Profit

Every trade is protected with predefined SL and TP levels, enforcing strict and transparent risk management.

🔹 No High-Risk Techniques

Absolutely no Martingale, no Grid, no Averaging, ensuring predictable exposure and capital protection.

🔹 Sensitivity Control Parameter

Allows traders to fine-tune entry precision and trade frequency based on market conditions and broker execution quality.

Professor Moriarty MT4 Trading Strategy Explained

At its core, Professor Moriarty uses cross-pair statistical arbitrage, a strategy widely applied in professional trading environments.

The EA compares real-time price movements between correlated instruments (currency crosses or metals).

When a temporary imbalance appears, the system anticipates a mean-reversion or corrective movement and executes trades on the primary instrument to capture that correction.

Strategy Components

🔹 Correlation-Based Entries

Trades are opened only when price deviations exceed predefined statistical thresholds.

🔹 Correction-Focused Execution

Targets fast pullbacks toward equilibrium, reducing exposure time and market risk.

🔹 Advanced Trailing Profit System

Uses a multi-stage trailing mechanism:

Trailing Start

First Trailing Level

Trailing Step

This allows profits to be locked in dynamically as price corrects.

🔹 Time-Filtered Trading (Optional)

Trading activity can be limited to specific sessions to avoid low-liquidity or high-risk periods.

Why Choose Professor Moriarty MT4?

🔹 Designed for fast, short-term arbitrage opportunities

🔹 Ideal for M1 scalping with structure, not randomness

🔹 Built on correlation logic, not indicator clutter

🔹 Fully automated with strict SL/TP discipline

🔹 No emotional trading, no recovery traps

🔹 Suitable for traders seeking consistent, rule-based execution

Performance of Professor Moriarty MT4

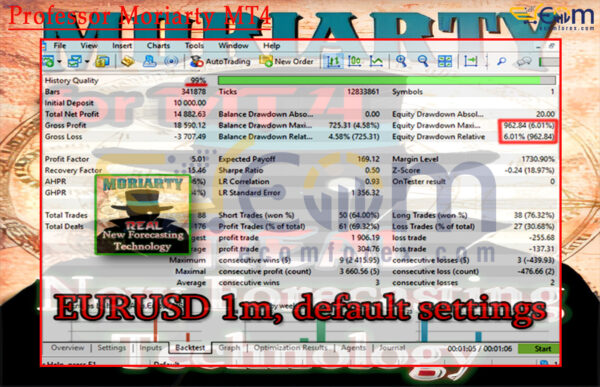

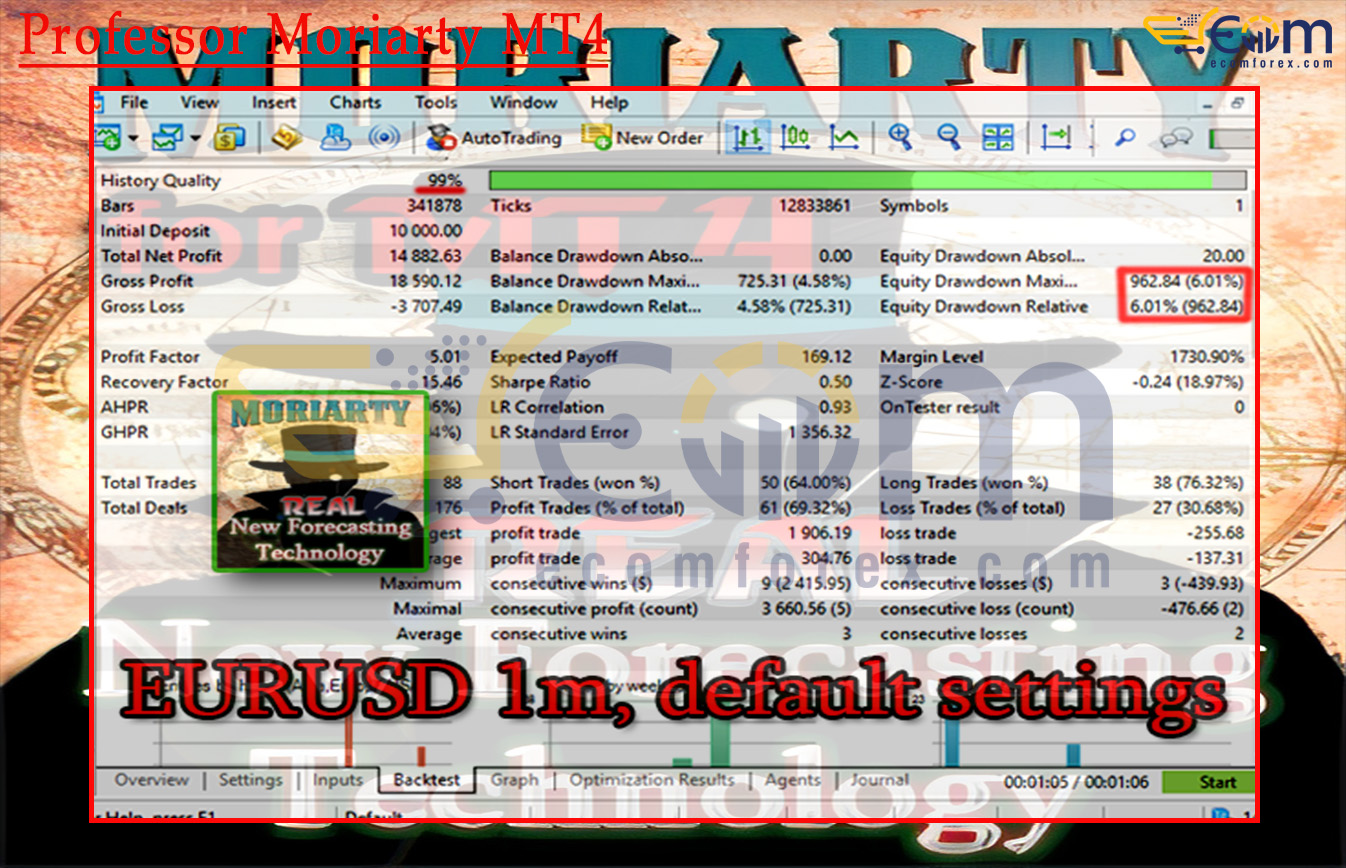

Professor Moriarty EA delivered solid and well-balanced backtest performance on the EURUSD pair using the ultra-fast M1 timeframe.

The system showcased its strength in statistical correlation and corrective-move trading, achieving steady profitability while maintaining disciplined risk exposure in a high-frequency environment.

Despite operating on a 1-minute chart, where execution pressure is extremely high, the EA preserved a healthy win rate and controlled drawdown, reinforcing the robustness of its correlation-arbitrage logic rather than reliance on aggressive recovery methods.

📌 Key Backtest Metrics

- ✅ Initial Deposit: $10,000

- ✅ Total Net Profit: $14,882.63

- ✅ Win Rate: 69.32% profitable trades

- ✅ Maximum Drawdown: 4.58%

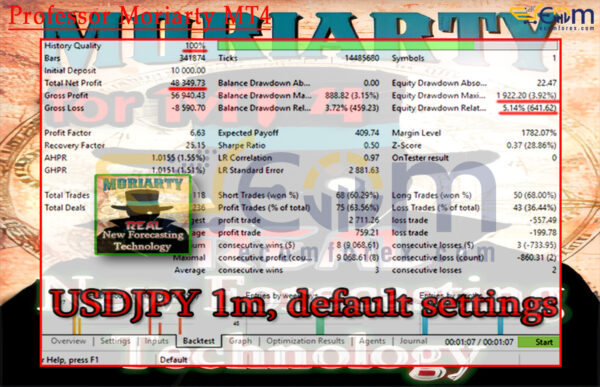

Professor Moriarty EA demonstrated outstanding performance during its backtest on the USDJPY pair using the ultra-fast M1 timeframe.

The results highlight the system’s ability to capitalize on short-term corrective movements with high precision, maintaining strong profitability while keeping risk tightly controlled.

Operating under strict statistical-arbitrage and correlation logic, the EA delivered consistent gains without aggressive exposure, confirming the robustness of its execution model even on the most demanding 1-minute chart environment.

📌 Key Backtest Metrics

- ✅ Initial Deposit: $10,000

- ✅ Total Net Profit: $48,349.73

- ✅ Win Rate: 63.29% profitable trades

- ✅ Maximum Drawdown: 3.15%

Professor Moriarty EA delivered exceptional backtest performance on the GBPUSD pair using the ultra-fast M1 timeframe, highlighting the strength of its cross-currency correlation and statistical arbitrage logic in capturing short-term corrective movements with precision.

Despite operating in a highly demanding 1-minute environment, the system maintained strong profitability with a controlled drawdown, demonstrating disciplined execution and effective risk containment. The equity behavior reflects a strategy focused on high-probability corrections rather than directional guessing, allowing profits to scale while keeping losses in check.

📌 Key Backtest Metrics

- ✅ Initial Deposit: $10,000

- ✅ Total Net Profit: $2.32 million

- ✅ Win Rate: 65.68% profitable trades

- ✅ Maximum Drawdown: 7.22%

Recommended Configuration for Professor Moriarty MT4

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 4 (MT4) |

| Time frames | M1 (1 minute chart) |

| Currency pairs | GBPUSD, EURUSD, USDJPY, USDCAD, EURGBP |

| Min / Recommended deposit | $100 |

| Min / Recommended leverage | Any |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Expert Advisor:

- ProfessorMoriartyMT4_fix.ex4

🤗WISH YOU SUCCESSFUL TRADING🤗