- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $50.00

0 out of 5 main slots sold

Nova CBO Trader MT5 – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert Nova CBO Trader MT5

Name: Nova CBO Trader

Version: Latest Version

Developer by: Anita Monus

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is Nova CBO Trader MT5?

Nova CBO Trader MT5 is a precise Expert Advisor (EA) for MT5, built purely on Candle Breakout (CBO) price action — capturing explosive momentum moves after periods of tight consolidation or key candle patterns, without relying on lagging indicators.

Core Concept Price tends to consolidate (inside bars, narrow ranges, volatility contraction) before strong directional expansion. Nova CBO Trader identifies these structured pauses in real time and enters aggressively on a confirmed breakout of the consolidation high/low, trading the momentum continuation with strict filters to eliminate false breaks and chop.

- Official Website: See here

Main Features

- Clean Breakout Logic — Pure price action: no oscillators, no MAs — entries based solely on candle structure and breakout confirmation.

- Dynamic Range Filtering — Rejects low-volatility, wide-spread, or low-quality setups to focus only on high-probability expansions.

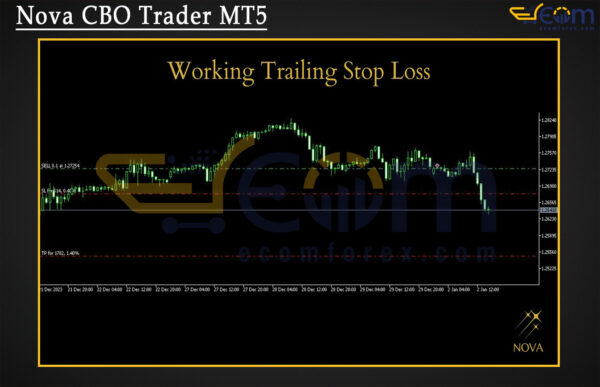

- Risk-Defined Execution — Fixed stop loss (below/above consolidation), dynamic trailing stop, no martingale, no grid — capital always protected.

- Simple & Effective — Lightweight, transparent logic — ideal for price-action purists who distrust indicator-heavy systems.

- Multi-Timeframe Flexibility — Works on M5–H4 for scalps or swings; adapts seamlessly across forex, indices, commodities.

Trading Strategy

- Scans for consolidation patterns: inside bars, tight ranges, or volatility squeezes (e.g., narrow candle series).

- Defines breakout level: high/low of the consolidation zone or mother candle.

- Triggers entry on close beyond the level (or wick breakout with confirmation filter).

- Places stop below/above opposite side of range; trails stop as momentum builds (e.g., ATR or swing-based).

- Exits via trailing stop, fixed TP at measured move, or opposite structure break.

- Skips setups in low-liquidity hours or during news via built-in filters.

Why Choose Nova CBO Trader MT5?

- Pure price-action breakout is one of the most timeless edges — institutions still drive markets this way.

- No indicator clutter means less lag, fewer false signals, and better real-market survival.

- Extremely disciplined risk setup — survives ranging markets and drawdowns without revenge entries.

- High-quality, low-frequency trades — avoids over-trading, perfect for part-time or prop traders.

- Simple, transparent, and non-curve-fitted — holds up in forward testing far better than complex “AI” EAs.

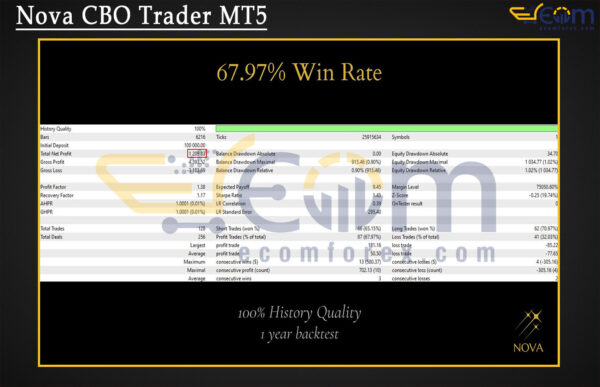

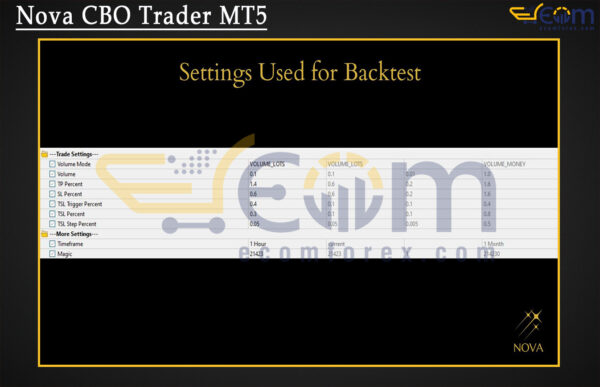

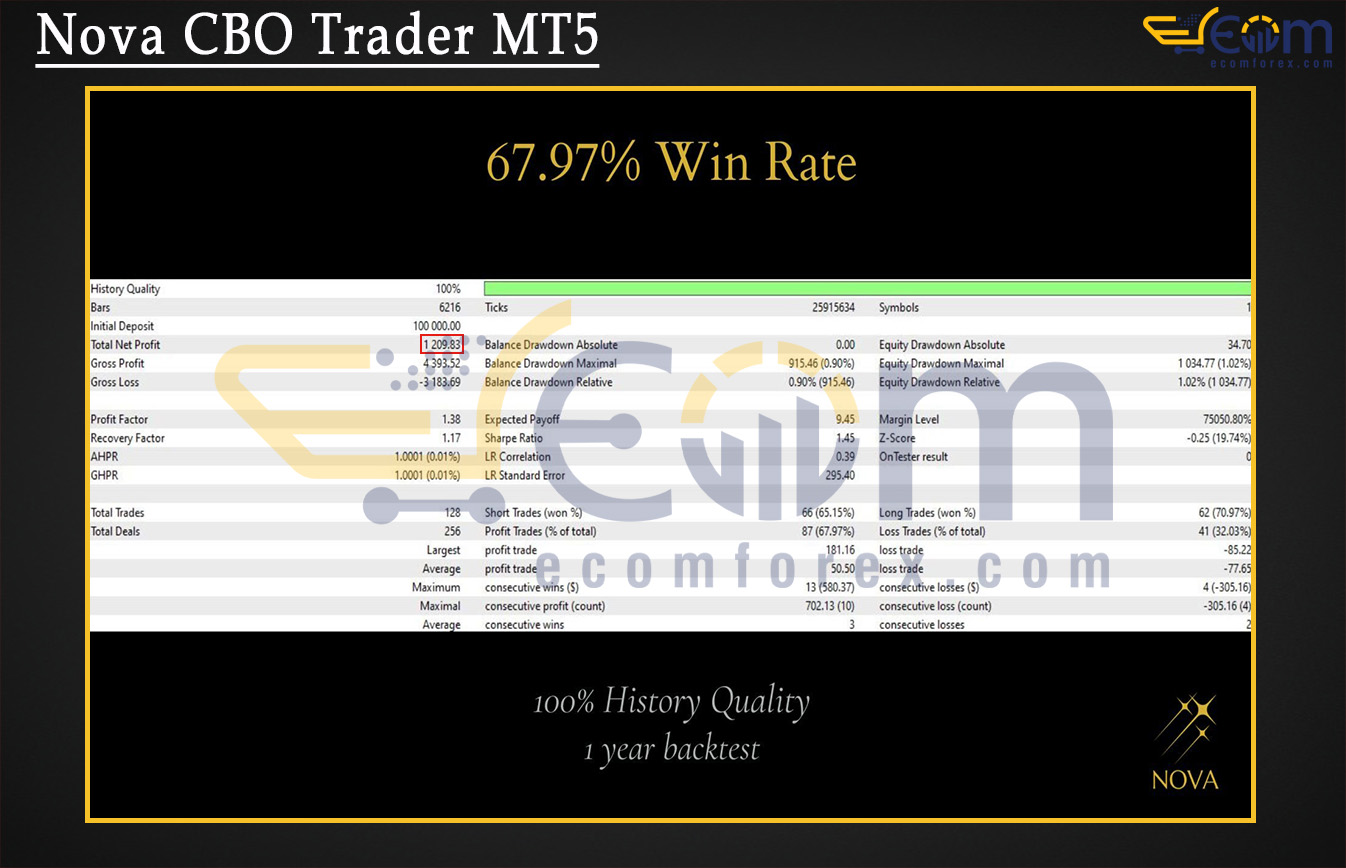

Performance of Nova CBO Trader MT5

Nova Trader delivered balanced and reliable performance in this 1-year backtest, achieving a solid 67.97% win rate with very controlled drawdown and consistent risk-adjusted returns — all verified on 100% quality historical data.

The EA executes with discipline (128 trades over 12 months), shows a healthy profit factor of 1.38, good recovery strength (1.17), and keeps maximum equity drawdown at just 1.02% ($1,034.77) — demonstrating excellent capital preservation even during occasional basket fluctuations.

Key Backtest Highlights

- Initial Deposit: $100,000

- Total Net Profit: $1,209.83

- Win Rate: 67.97% (87 winning trades out of 128)

- Maximum Equity Drawdown: 1.02% ($1,034.77)

- Maximum Balance Drawdown: 0.90% ($915.46)

Recommended Configuration for Nova CBO Trader MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | Any |

| Currency pairs | Any |

| Min / Recommended deposit | Any |

| Min / Recommended leverage | Any |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗