- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $330.00

0 out of 5 main slots sold

Agro Algo EA MT5 – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert Agro Algo EA MT5

Name: Agro Algo

Version: Latest Version

Developer by: Dewald Nel

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is Agro Algo EA MT5?

Agro Algo EA MT5 is a next-generation AI-powered Expert Advisor (EA) from Synapse Dynamics LLC for MetaTrader 5 (MT5), built around a deep-thinking adaptive AI core that connects to an external Python-based brain via API for real-time market intelligence and precise trade decisions.

With 20 years trading across cycles and prop challenges, I see Agro Algo as one of the more serious attempts to blend institutional-grade risk management with modern AI — especially valuable for traders who need consistent, compliant performance without over-optimization traps common in pure backtest EAs.

- API-connected AI hybrid — The EA acts as a smart executor that relies on an external Python brain for adaptive analysis, pattern recognition, and signal generation — delivering decisions far beyond static indicators.

- Designed for prop-firm compatibility and multi-market expansion — works in both netting and hedging modes, with frequent quarterly set-file updates to cover more pairs/assets.

- Official Website: See here

Core Features

- Dynamic risk & trade management — Per-trade risk limits, daily drawdown caps, intelligent SL placement, auto break-even triggers, trailing exits, and partial close logic.

- Prop-ready controls — Built-in equity protection, max daily loss rules, and compliant behavior to pass and maintain funded challenges.

- API brain integration — Requires owner-provided connection link and set files for full performance (backtests alone won’t match live/chart results).

- Flexible operation — Run fully automated or use signals alongside manual/discretionary trading.

- Multi-market evolution — New set files added regularly — EA adapts to more instruments every quarter.

Trading Strategy

- High-probability adaptive entries — AI core analyzes real-time data (volatility, structure, correlations) to identify momentum, reversal, or breakout setups with high edge.

- Intelligent exits & protection — Dynamic stops, breakeven, trailing, and partials lock profits while capping downside — no blind martingale or grids.

- Regime-aware execution — Adjusts aggressiveness based on market conditions — conservative in chop, aggressive in trends.

- Risk-first framework — Every trade respects strict per-position and daily limits — prioritizes survival and steady compounding.

Why Traders Should Choose Agro Algo EA MT5?

- Real AI advantage — External Python brain + frequent updates give it adaptability that static EAs lose over time.

- Prop-firm excellence — Daily DD limits, per-trade risk, and compliant logic make it one of the strongest choices for funded accounts.

- Institutional-grade safety — Break-even, trailing, dynamic SL — protects capital better than most retail EAs.

- Future-proof design — Quarterly expansions keep it relevant across more markets without constant manual tweaks.

- Balanced flexibility — Full auto or signal-assisted — suits pure automation fans and experienced traders alike.

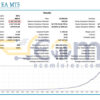

Performance of Agro Algo EA MT5

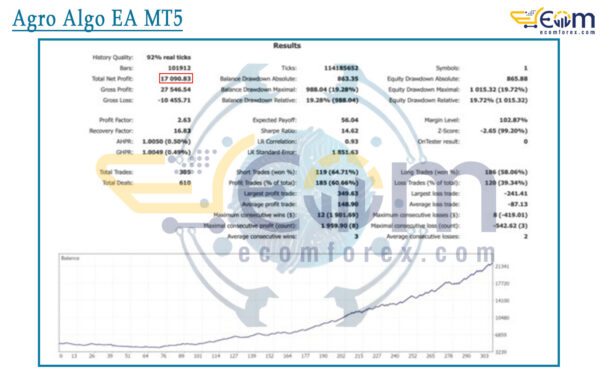

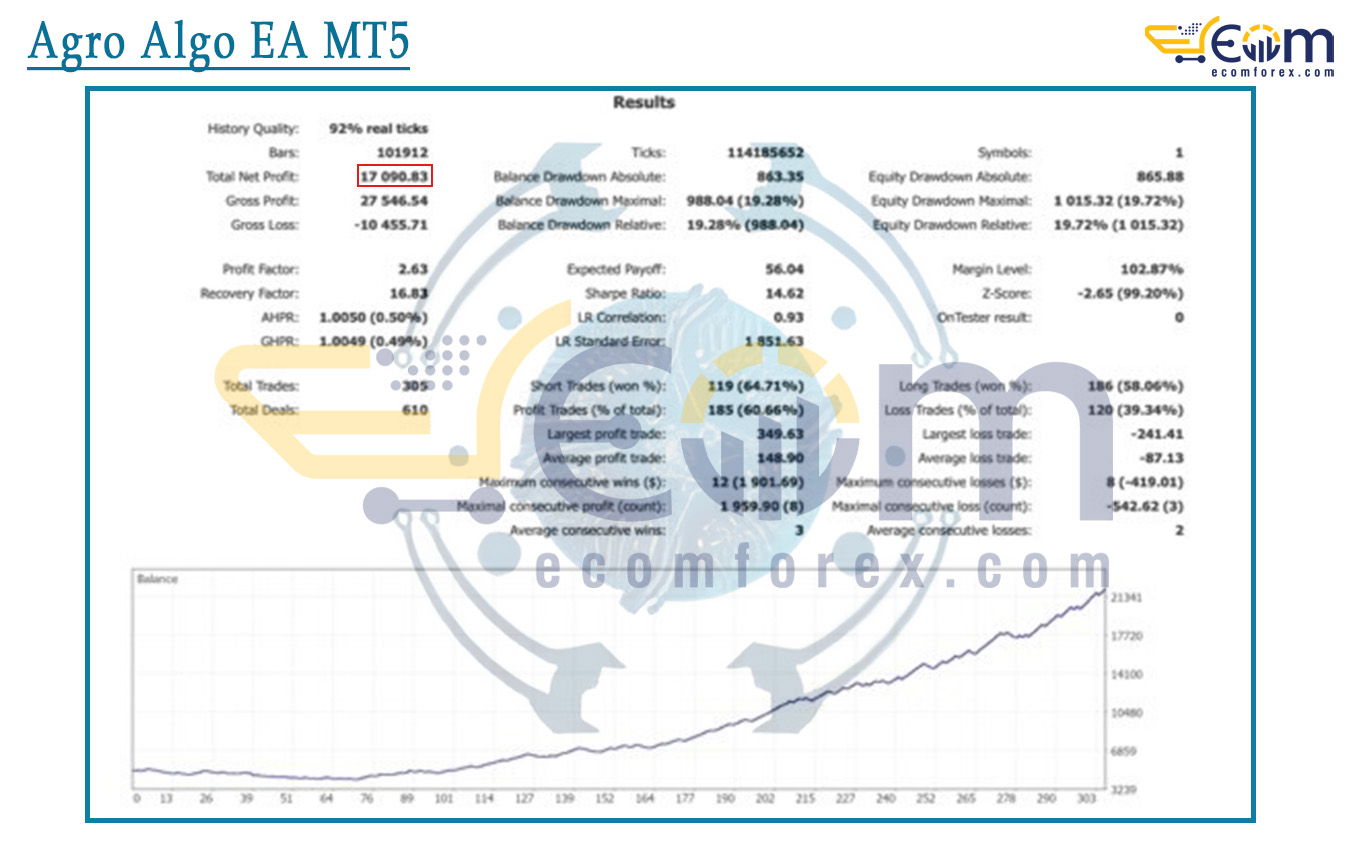

USTEC Algo EA (or Thorus USTEC) delivered solid and consistent profitability in a high-quality backtest (92% real ticks) on the USTEC (Nasdaq 100 index CFD) using the M5 timeframe over approximately 17 months (Mar 2024 – Aug 2025), demonstrating disciplined momentum/trend-following logic with strong recovery and favorable risk-adjusted metrics in a trending equity index environment.

Its high win rate on shorts, excellent profit factor, and very strong recovery factor supported steady compounding while keeping maximum drawdown contained for an index scalper/swing system.

- Initial Deposit: $5,000

- Total Net Profit: $17,090.83 (+341.81% return)

- Profit Factor: 2.63

- Maximum Equity Drawdown: 19.72% (Absolute: $988.35 / 19.04%)

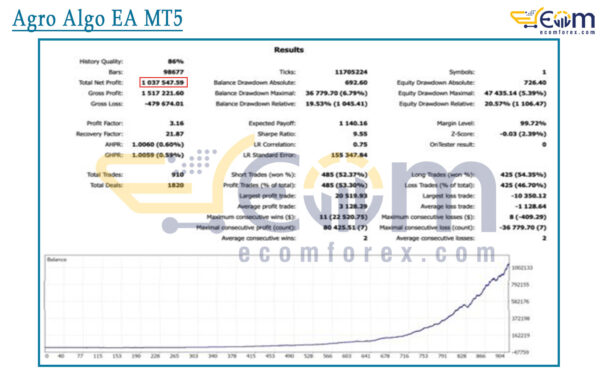

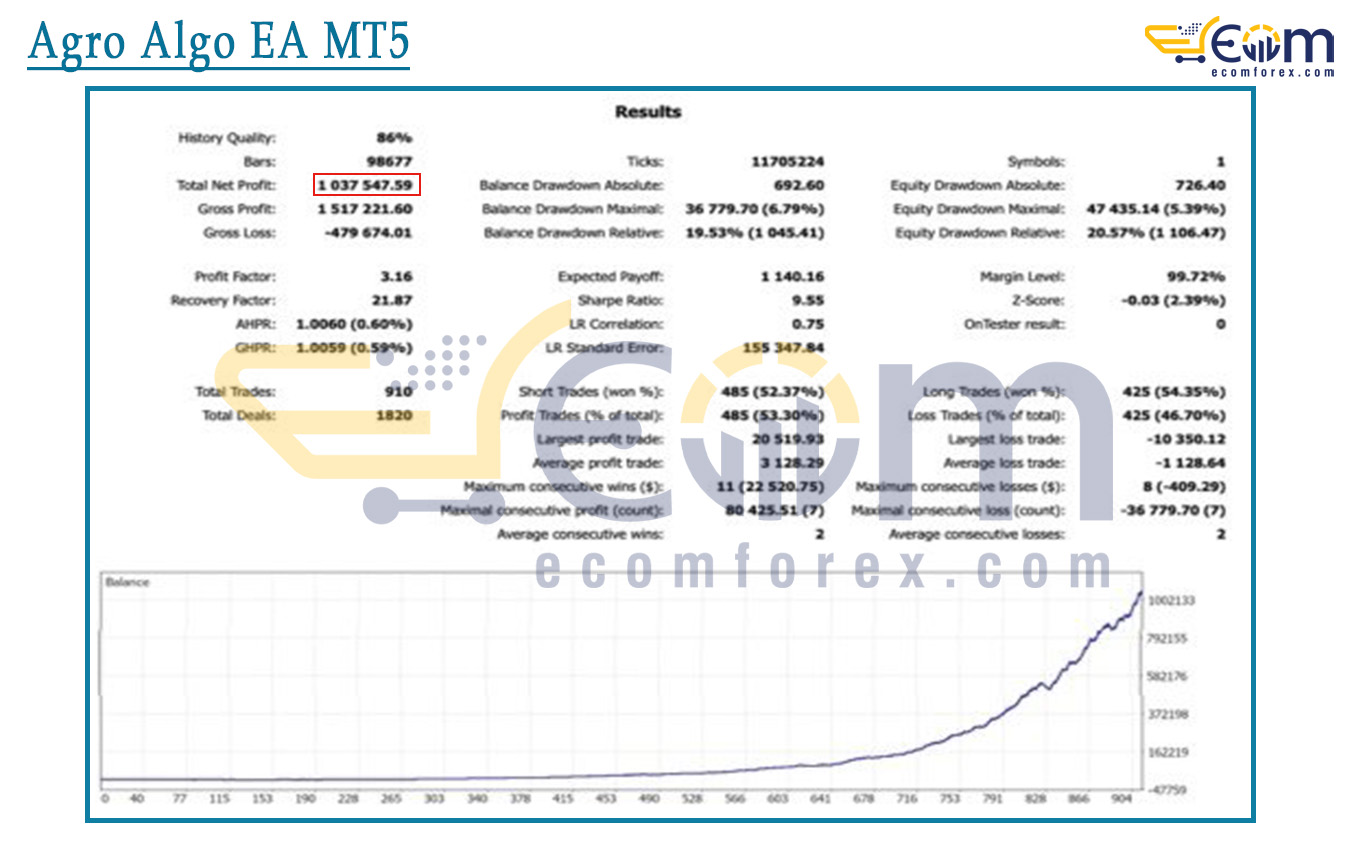

Thorus BTC EA delivered strong and consistent profitability in a long-term backtest spanning over 6 years (Feb 2019 – Aug 2025) on BTCUSD using the M30 timeframe, demonstrating disciplined momentum/trend logic with excellent recovery and risk-adjusted metrics even through Bitcoin’s extreme volatility cycles.

Its balanced win rate, high profit factor, and very strong recovery factor enabled impressive compounding while containing drawdown remarkably well for a cryptocurrency trading system.

- Initial Deposit: $5,000

- Total Net Profit: $1,037,547.59 (+20,751% return)

- Profit Factor: 3.16

- Maximum Equity Drawdown: 20.57% (Absolute: $47,435.14 / 5.39%)

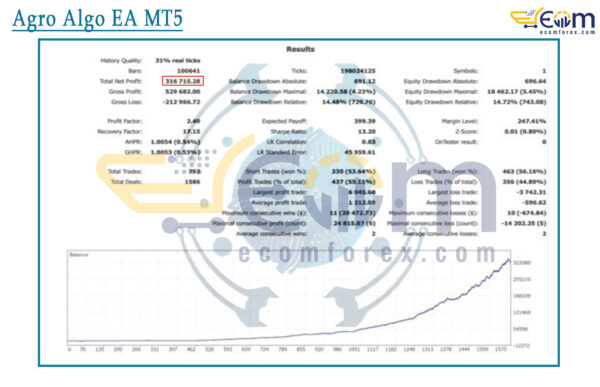

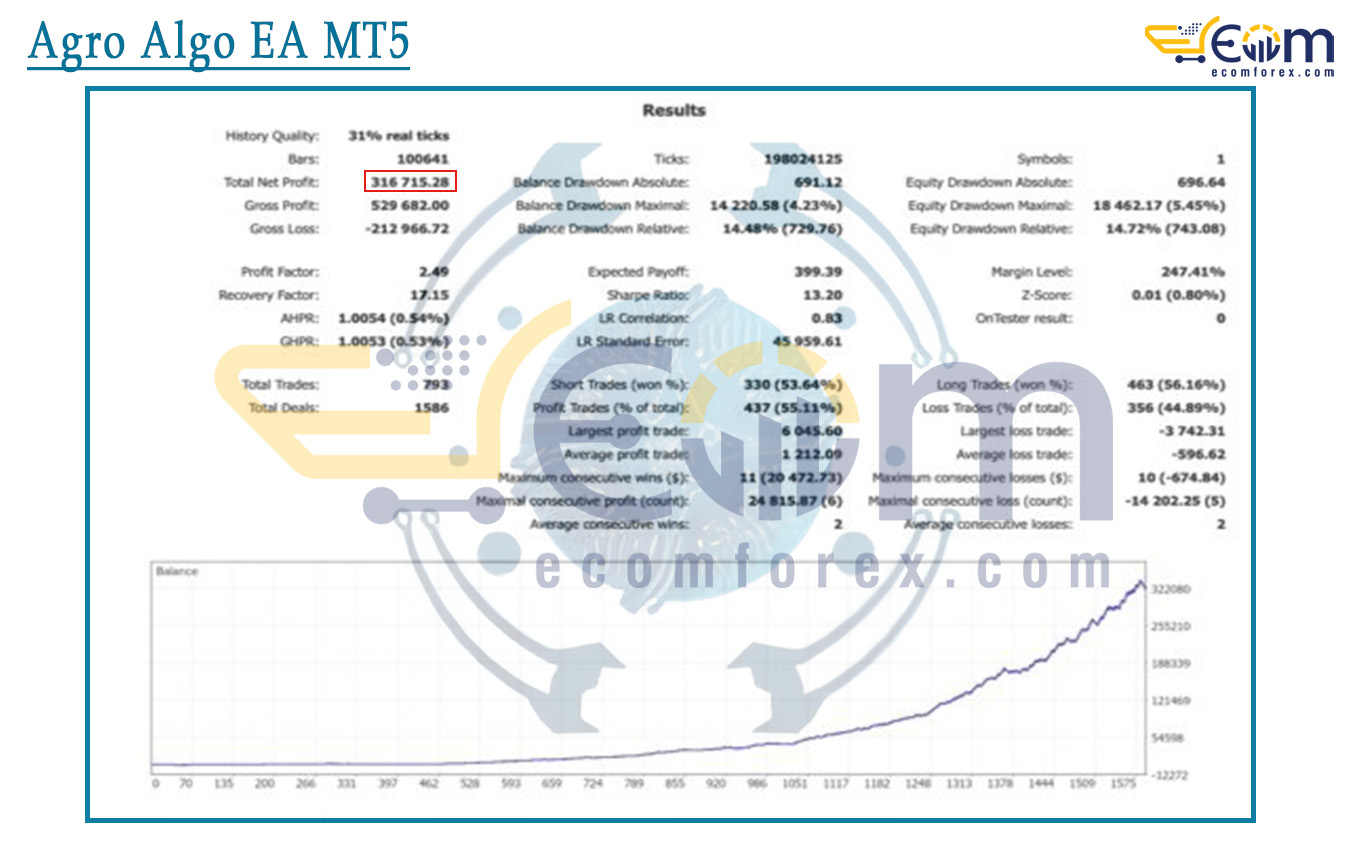

Thorus Gold EA delivered strong and consistent profitability in a multi-year backtest (Nov 2021 – Aug 2025) on XAUUSD (Gold) using the M15 timeframe, showcasing disciplined trend/momentum logic with excellent risk-reward balance and controlled drawdown even through volatile gold cycles.

Its adaptive entry filters, favorable R:R ratio (≈1:2), and intelligent position management produced steady compounding with a high recovery factor and solid Sharpe ratio for a gold trading system.

- Initial Deposit: $500

- Total Net Profit: $316,715.28 (+63,343% return)

- Profit Factor: 2.49

- Maximum Equity Drawdown: 14.72% (Absolute: $18,462.17 / 5.45%)

Recommended Configuration for Agro Algo EA MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | Any |

| Currency pairs | Forex majors, XAUUSD, commodities |

| Min / Recommended deposit | Any |

| Min / Recommended leverage | Any |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗