- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Adaptive Edge EA MT4 – Latest original version

people are currently looking at this product!

Introducing the Expert Adaptive Edge EA MT4

Name: Adaptive Edge EA

Version: Latest version

Developer by: Davit Beridze

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

- Delivery time 24h-48h after payment.

What is Adaptive Edge EA MT4?

Adaptive Edge EA MT4 – The Quantitative Edge for Long-Term Traders

With over two decades in the financial markets, I’ve learned one timeless truth: consistency comes from statistical clarity, not crystal balls. That’s exactly what Adaptive Edge EA delivers.

This Expert Advisor (EA) doesn’t chase illusions or try to decode the market’s “mystical” behaviors. Instead, it embraces the market for what it truly is — a statistically driven system of recurring patterns and probabilities.

At its core, Adaptive Edge EA MT4 is engineered to identify and exploit high-probability price behaviors using one of the most time-tested tools in technical analysis: the Relative Strength Index (RSI). But it doesn’t stop there. It employs an intelligent scaling-in mechanism, refining entry points during volatility while maintaining ironclad control through max lot caps and tightly managed Stop Losses.

The true power lies in its dynamic optimization engine — a process that continuously fine-tunes the EA’s parameters based on evolving market data. This ensures it never trades on outdated assumptions and always operates with a mathematically sound edge.

- Official Website: See here

Why Adaptive Edge EA MT4 Stands Out

Statistically grounded strategy, not market guessing

RSI-powered entry logic for high-probability setups

Smart scaling-in to optimize average entry prices

Strict risk control: Max lot limits and robust Stop Losses

Dynamic re-optimization to stay aligned with market shifts

Core Advantages of Adaptive Edge EA – Precision, Control, and Statistical Mastery

Data-Driven Intelligence, Not Guesswork

Statistical Price Framework

Adaptive Edge EA approaches the market like a quant: it interprets price behavior as a statistical ecosystem, not random noise. It detects repeatable averages and price patterns that historically trigger predictable reactions, giving traders an analytical edge.RSI-Enhanced Signal Engine

At the heart of its strategy lies the Relative Strength Index (RSI) — a time-tested indicator used to pinpoint statistically probable trade zones. This enables highly focused entries based on historical probability, not gut feeling.Adaptive Scaling-In Logic

The EA doesn’t shy away from temporary market pullbacks. Instead, it uses them to its advantage by dynamically scaling into trades. This smart averaging technique helps improve entry prices and optimize position structure — all while staying within calculated risk bounds.Risk First, Always

Adaptive Edge EA enforces a rigorous risk framework, limiting position sizes with maximum lot caps and solid Stop Loss orders. This ensures the system remains robust even during adverse market moves.Self-Optimizing Engine

One of the EA’s greatest strengths is its continuous dynamic optimization. Rather than relying on outdated presets, the robot re-optimizes parameters based on current market data, preserving its statistical advantage in shifting market cycles.

Advanced Features for Professional Traders

No Fixed Set Files – Just Adaptive Intelligence

This EA isn’t “plug-and-play” — it’s a methodology. You won’t find fixed set files here. Instead, success comes from regular re-optimization, empowering traders to tailor the EA to evolving market conditions.Timeframe-Specific Re-Optimization Guidance

Adaptive Edge EA supports multiple timeframes, each with its own re-optimization schedule:

• M1: Weekly re-optimization using 3–4 months of data

• M5: Weekly, based on 4–6 months of data

• M15: Every two weeks, using 8–12 months of dataMore Than Just an EA – It’s a Professional Framework

This is not a “set-and-forget” tool. It’s a scalable, professional-grade trading framework for those seeking long-term, data-backed success in automated trading. You’re not just getting an EA — you’re adopting a methodology honed by statistical logic.

Performance of Adaptive Edge EA MT4

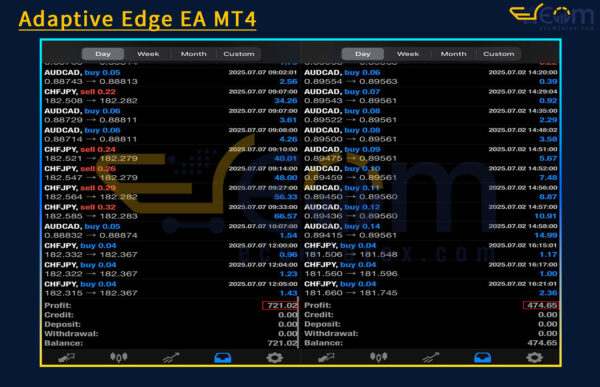

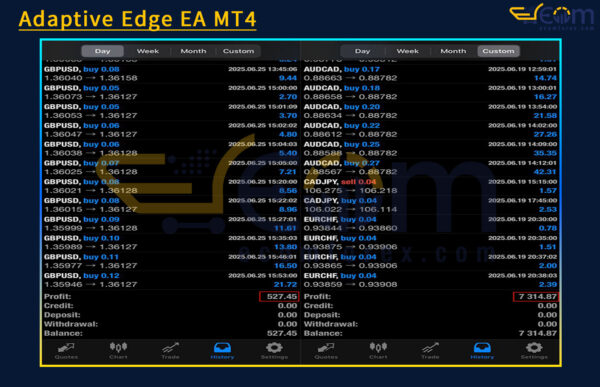

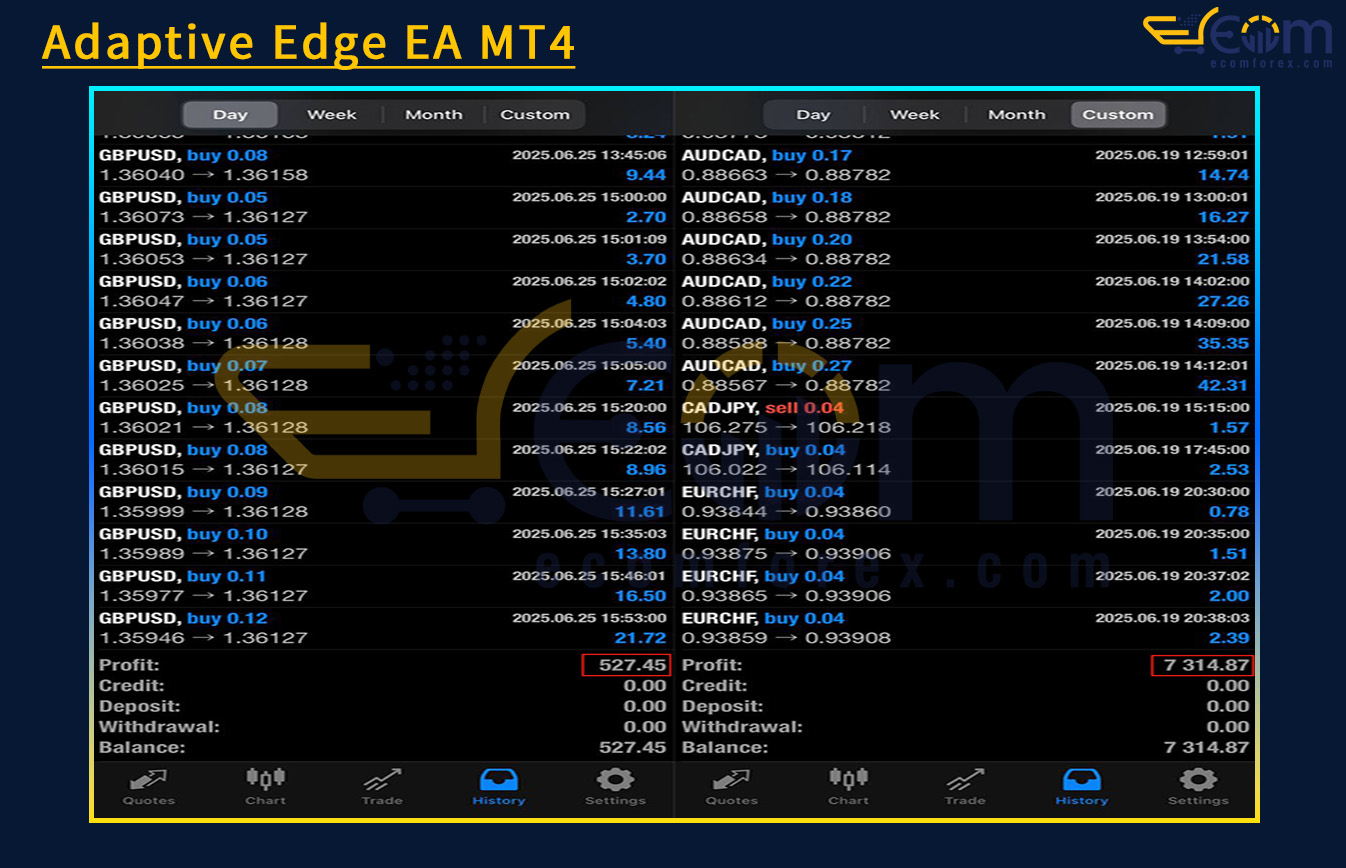

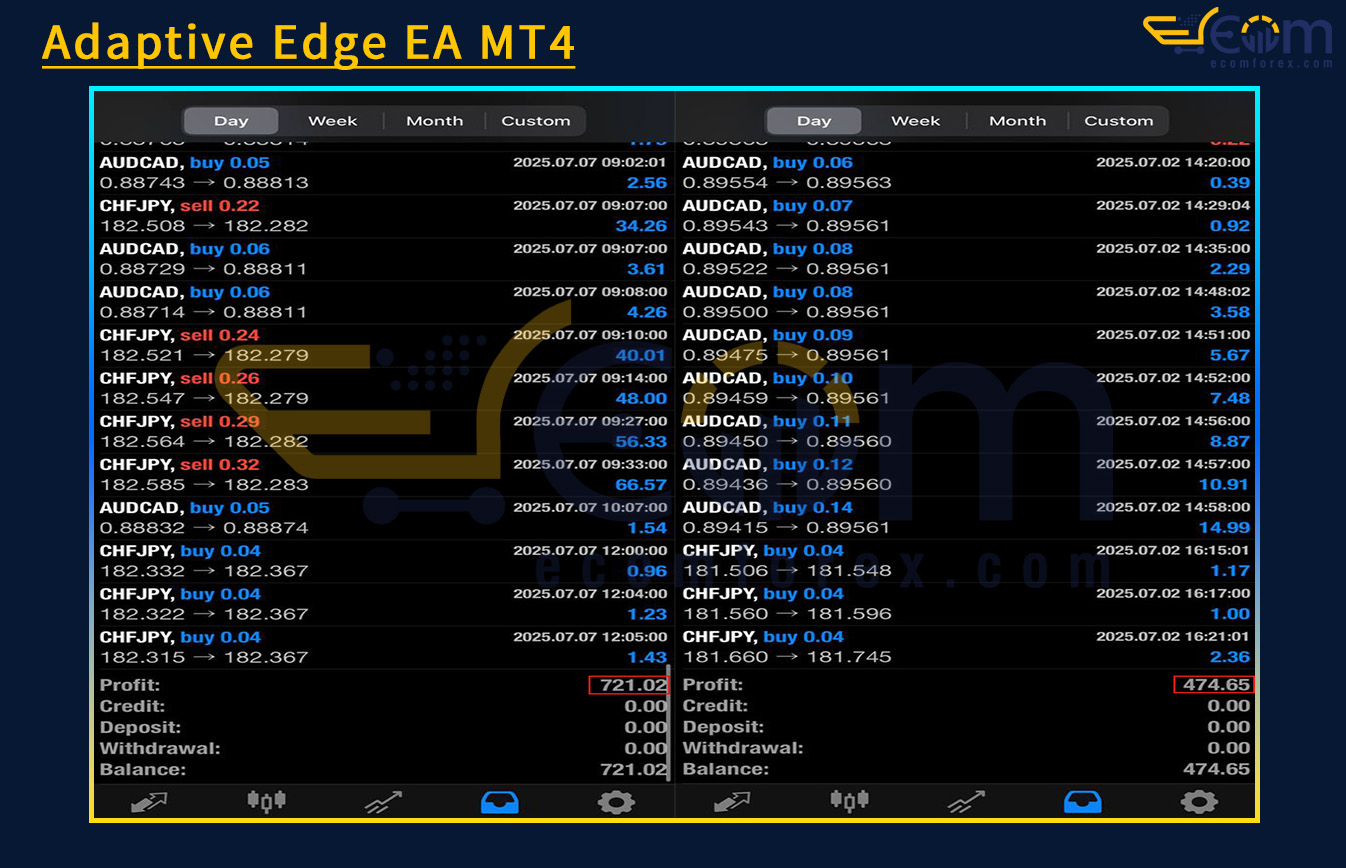

Adaptive Edge EA MT4 Live Trading

Adaptive Edge EA MT4 is a high-frequency trading system developed for MetaTrader 4, engineered to exploit short-term micro-trends in the Forex market with surgical precision. Operating at high speed and frequency, this Expert Advisor is designed to deliver steady, daily profit flow by targeting repeatable intraday price behaviors.

The live trading screenshots speak for themselves — not just backtests, but real verified profits under dynamic market conditions. Whether you’re trading in ranging or trending environments, Adaptive Edge EA proves itself with robust execution and consistent performance, making it a trusted tool for serious traders.

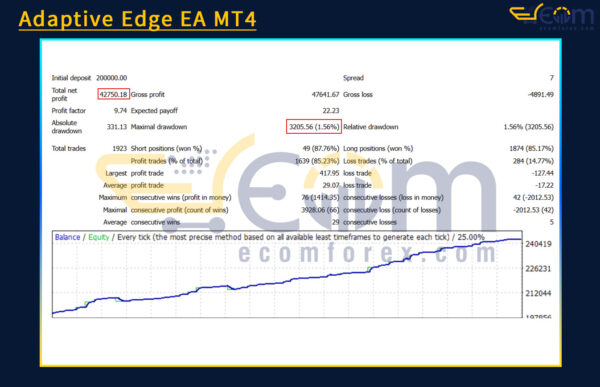

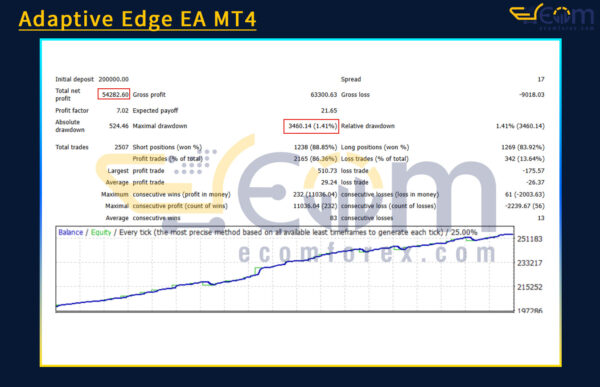

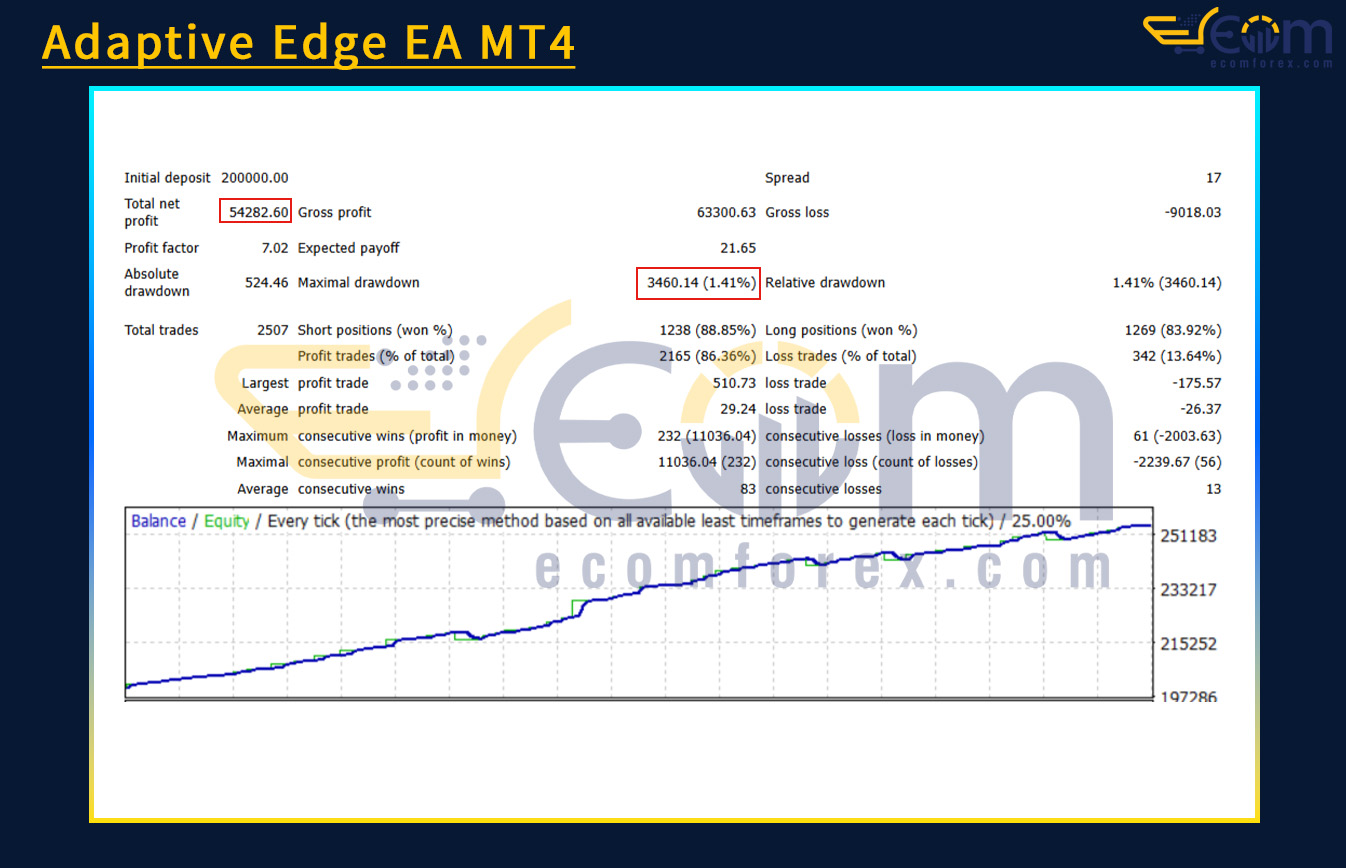

Adaptive Edge EA MT4 Backtest

Adaptive Edge EA is a next-generation automated trading system meticulously engineered to deliver steady profitability with uncompromising drawdown control. Built for real-market adaptability, it excels under pressure by leveraging high-frequency statistical models and robust execution logic.

The backtest report, conducted using every-tick modeling under live-like conditions, demonstrates the EA’s ability to perform reliably in volatile markets, with outcomes that speak for themselves.

- Verified Backtest Highlights:

- Initial Deposit: $200,000

- Total Net Profit: $54,282

- Maximum Drawdown: Just 1.41% – exceptional capital preservation

- Win Rate (Profitable Trades): 86.36% – high statistical consistency

Whether you’re managing a large portfolio or aiming for long-term growth with minimal volatility, Adaptive Edge EA offers the precision, protection, and performance edge that seasoned traders demand.

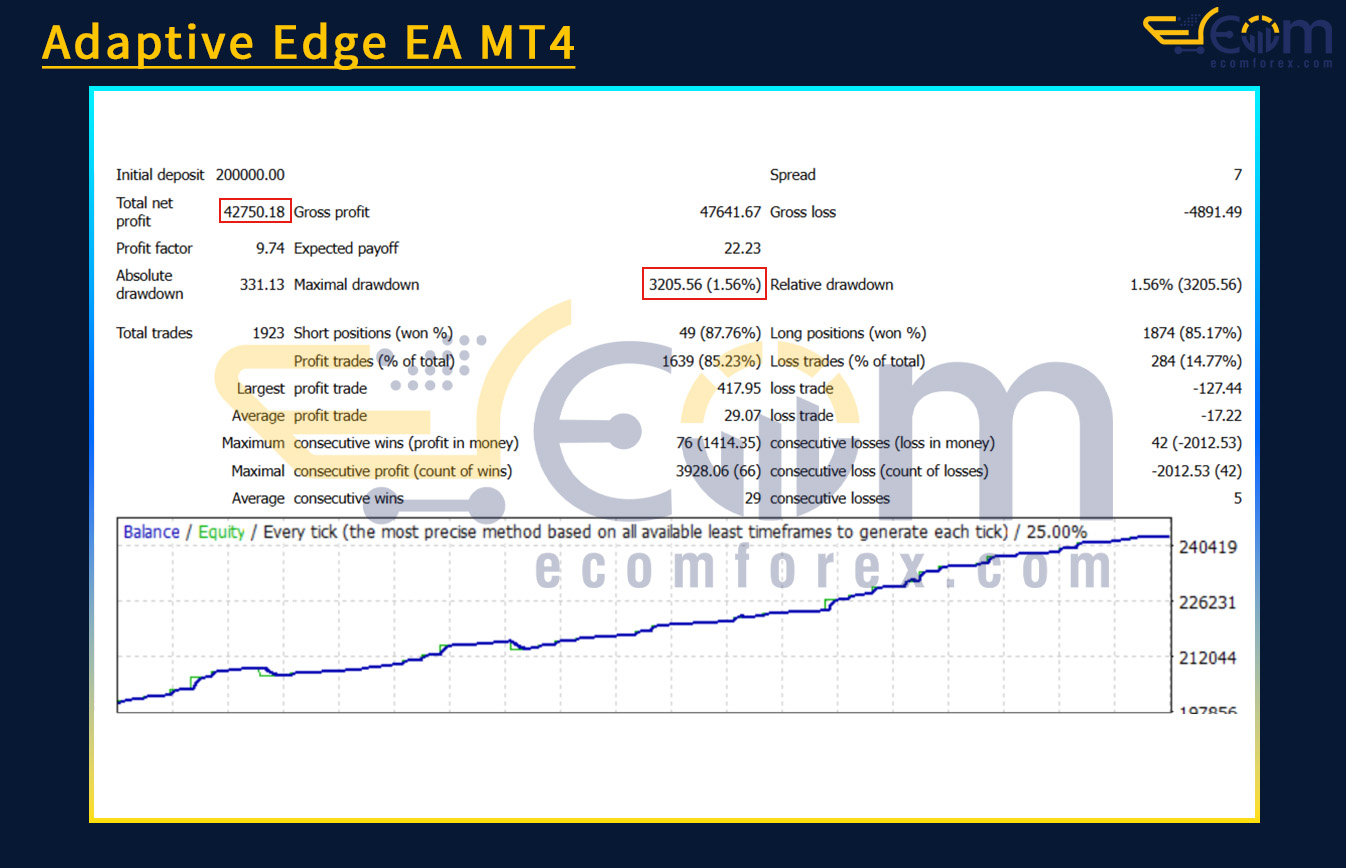

Adaptive Edge EA is a precision-built algorithmic trading solution tailored for traders who demand both consistent profitability and exceptional risk control. Designed with a statistical edge and fine-tuned for live market adaptability, this EA demonstrates institutional-grade stability on large capital deployments.

The included backtest, executed using real tick data modeling on a $200,000 account, highlights its credibility and strategic depth — far beyond demo-level simulations.

- Performance Summary (Backtest Report):

- Initial Deposit: $200,000

- Total Net Profit: $42,750

- Maximum Drawdown: Just 1.56% – showcasing superior risk management

- Win Rate (Profitable Trades): 85.23% – consistency that matters

If you’re seeking an EA that balances precision, protection, and proven returns, Adaptive Edge EA is purpose-built for the task.

Recommended Configuration for Adaptive Edge EA MT4

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 4 (MT4) |

| Time frames | M1, M5, M15 |

| Currency pairs | Any |

| Min / Recommended deposit | $1,000 |

| Min / Recommended leverage | 1:100 |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Experts Advisor:

- Adaptive Edge EA MT4 (Unlimited).ex4

🤗WISH YOU SUCCESSFUL TRADING🤗