- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $60.00

0 out of 5 main slots sold

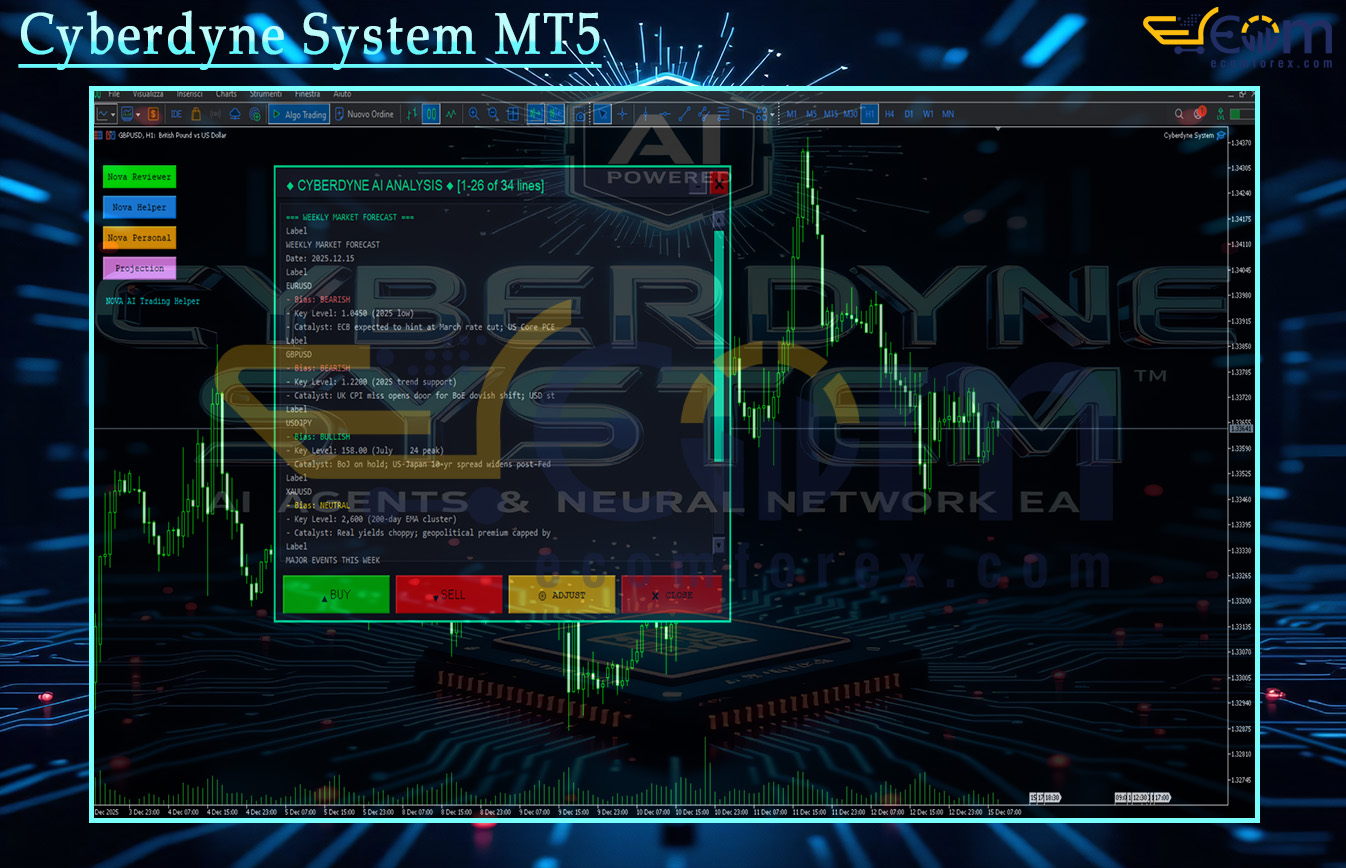

Cyberdyne System MT5 – Latest version | Group Buy

people are currently looking at this product!

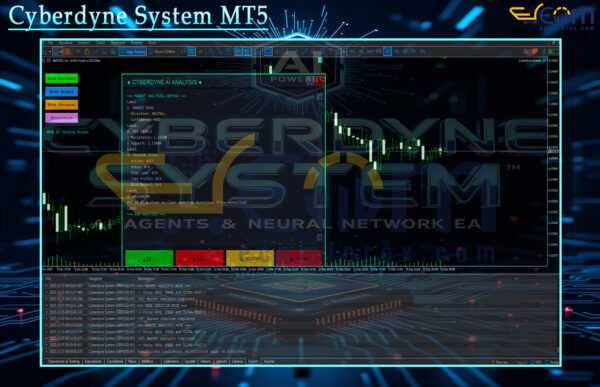

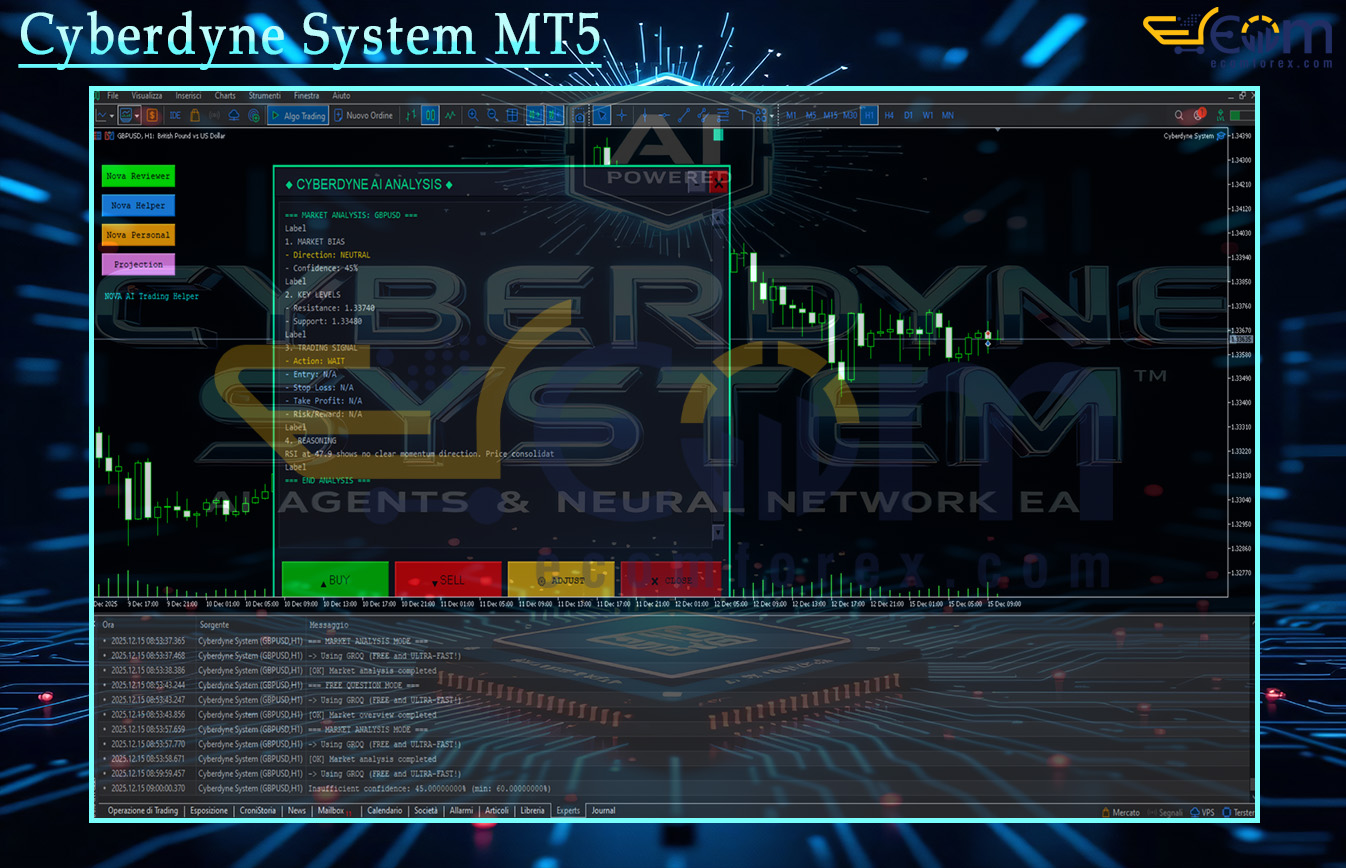

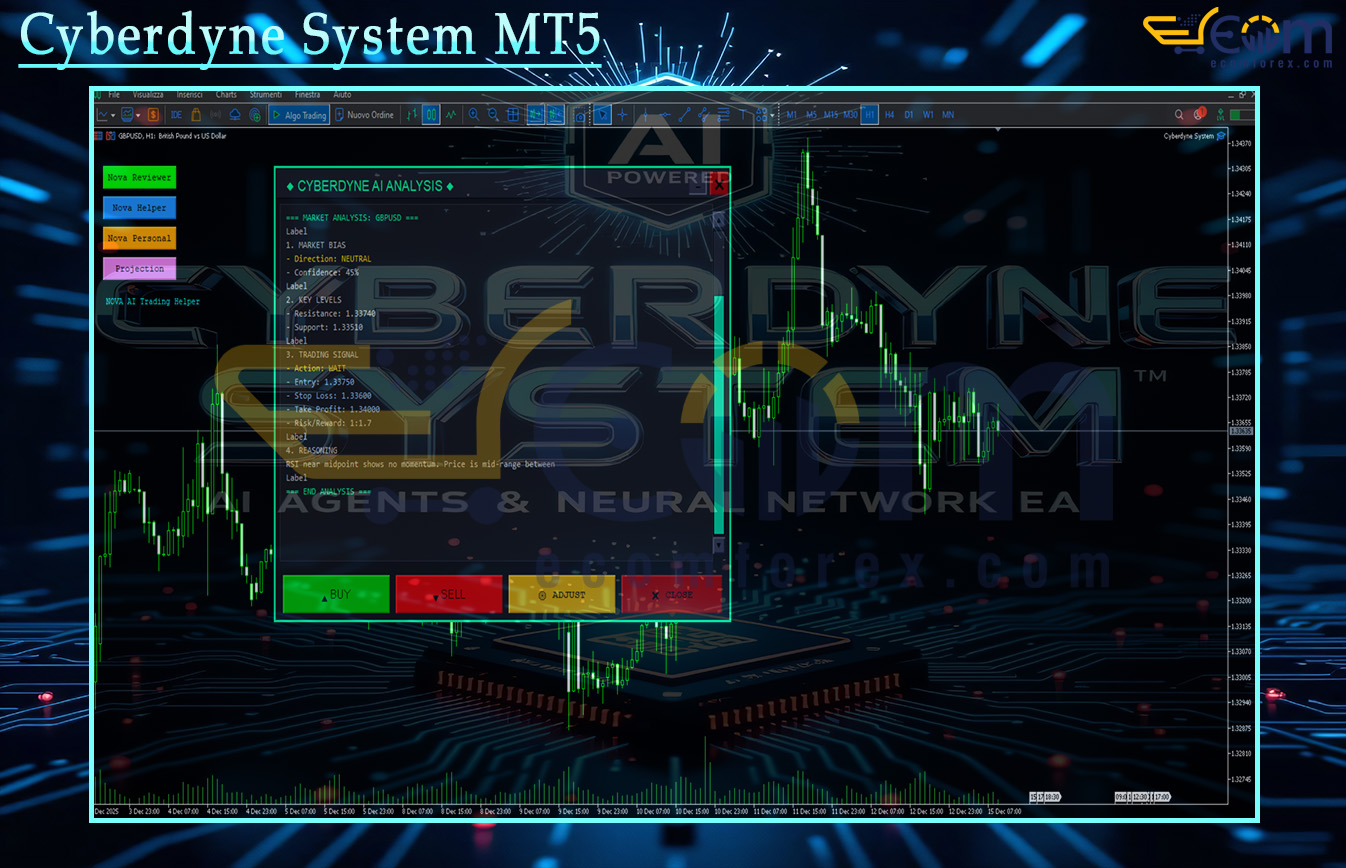

Introducing the Expert Cyberdyne System MT5

Name: Cyberdyne System MT5

Version: Latest Version

Developer by: Giordan Cogotti

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is Cyberdyne System MT5?

Cyberdyne System MT5 is not a conventional Expert Advisor (EA) with AI features layered on top.

It is a fully autonomous, institutional-grade AI trading intelligence, built from the ground up using the same architectural principles applied by professional trading desks.

After more than 20 years in the markets, one reality is undeniable:

Most retail EAs fail not because of bad strategies, but because they lack independent decision validation, professional risk separation, and continuous learning capability.

Cyberdyne System was engineered specifically to solve those structural weaknesses.

- Official Website: See here

Core Stregths

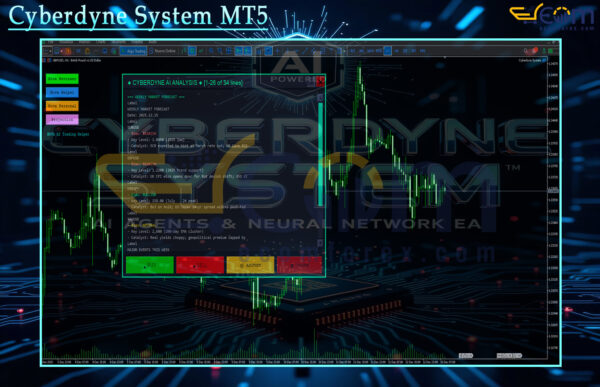

🔹 Institutional Multi-Model AI Ecosystem

Cyberdyne System integrates over 60 advanced AI models through intelligent selective activation.

Each model contributes a specialized analytical role, ensuring decisions are never dependent on a single AI source—a core requirement in professional trading infrastructure.

🔹 Analyst–Risk Manager Dual Architecture

Two independent AI entities operate simultaneously:

Analyst AI identifies market opportunities

Risk Manager AI validates risk, exposure, and execution logic

This separation mirrors institutional trading desks and eliminates single-bias decision making—one of the most common failure points in retail automation.

🔹 Chrono-Phi Institutional Position Management

A proprietary position management system designed to:

Absorb market noise

Adjust for swap and commission costs

Target profits in absolute currency terms, not arbitrary pip counts

This approach is derived from institutional scaling mathematics, not retail grid logic.

🔹 Zero-Downtime Operational Reliability

Automatic primary–secondary API failover ensures continuous operation with no interruption, meeting mission-critical standards used in real trading environments.

🔹 Continuous Neural Evolution

Cyberdyne System learns from:

Trade outcomes

Analyst–Risk Manager decision patterns

Changing market conditions

Each validated trade strengthens neural decision pathways, allowing the system to evolve and improve over time, rather than remain static like traditional EAs.

🔹 Professional Trading & Prop Firm Control Suite

Includes:

Daily and total drawdown limits

Balance-based stops

Currency exposure control

Full prop-firm compliance framework

These are survival tools, not marketing features.

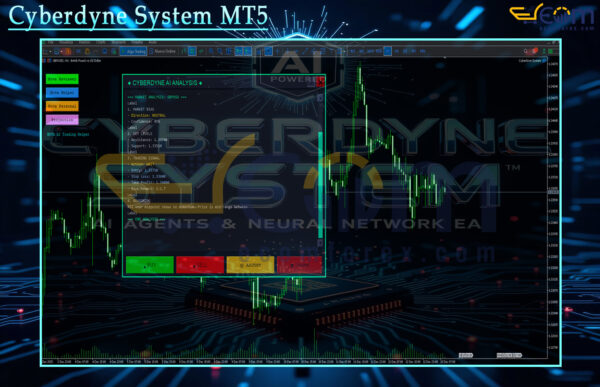

Cyberdyne System MT5 Trading Strategy Explained

Cyberdyne System does not rely on a single fixed strategy.

It operates on a multi-layer institutional decision framework, combining:

Primary trend analysis (Daily timeframe)

Momentum validation (H1)

Precision execution (M15)

Timeframes can be customized from Weekly down to M1, depending on trading style and risk tolerance.

Core strategy principles:

Multi-timeframe confirmation

Independent risk validation

Adaptive position management based on live conditions

In simple terms:

Cyberdyne System trades like a professional trading desk, not a retail robot.

Why Serious Traders Choose Cyberdyne System MT5

🔹 Not a “get-rich-quick” EA, but a decision-driven trading intelligence

🔹 Architecture inspired by institutional trading operations, not retail shortcuts

🔹 Continuously learns and adapts instead of relying on static rules

🔹 Designed for:

Large-capital traders

Prop firm environments

Long-term capital preservation and scalability

Performance of Cyberdyne System MT5

Recommended Configuration for Cyberdyne System MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | Any |

| Currency pairs | Any |

| Min / Recommended deposit | Any |

| Min / Recommended leverage | Any |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗