- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $100.00

0 out of 5 main slots sold

Daily Candle Scalper MT5 – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert Daily Candle Scalper MT5

Name: Daily Candle Scalper

Version: Latest Version

Developer by: Salvatore Caligiuri

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is Daily Candle Scalper MT5?

Daily Candle Scalper MT5 – Smart Elasticity Strategy with Customizable Money Management

In the world of Forex trading, most investors seek a tool that is transparent, stable, and low-risk while still delivering sustainable growth. The Daily Candle Scalper EA (Elasticity EA) provides exactly that. Unlike “history reader” bots with unrealistic backtest results, this system is 100% genuine, built on customizable money management and a proven elasticity-based trading strategy.

The EA analyzes every tick of the market, capturing sharp price movements and retracements to generate consistent profits. More importantly, it includes flexible capital allocation and risk management, allowing traders to distribute exposure across individual assets or an entire portfolio.

- Official Website: See here

Core Features of Daily Candle Scalper MT5

- Elasticity Strategy – Capturing Market Reversions

By analyzing historical data, volatility, and technical indicators, the EA identifies potential price expansions and contractions, seizing high-probability reversion opportunities.

- Customizable Money Management

Traders can configure % of balance allocation, risk exposure, lot sizing, equity stop loss, max drawdown, and profit targets. This flexibility makes it suitable for both small accounts ($250+) and larger portfolios ($10,000+).

- Advanced Technical Integration

Seamlessly integrates with indicators such as Moving Averages, Bollinger Bands, RSI, and trend-following tools to enhance trade quality.

- Automated Trade Execution

The EA executes trades with built-in SL/TP, trailing stop, and basket management for optimized performance and risk control.

- Backtesting & Optimization

Enables in-depth backtesting with historical data and parameter optimization, ensuring the EA adapts to changing market conditions.

- User-Friendly Settings

Clear, simple parameters make it easy for both beginner and professional traders to set up and customize.

Benefits of Using Daily Candle Scalper MT5

✅ Transparency & Realism: Provides live account monitoring and avoids fake backtests.

✅ Flexible & Scalable: Suitable for all account sizes and trading goals.

✅ Diversified Strategies: Can be used as a standalone EA or as part of a portfolio.

✅ Capital Protection: Strong drawdown control and equity stop-loss features.

✅ Long-Term Growth: Built for traders who prioritize discipline, safety, and sustainability over short-term hype.

Performance of Daily Candle Scalper MT5

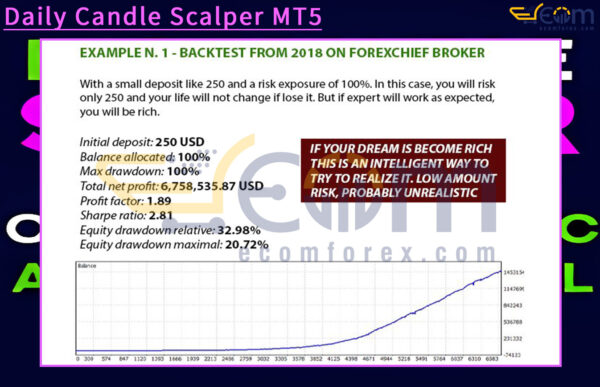

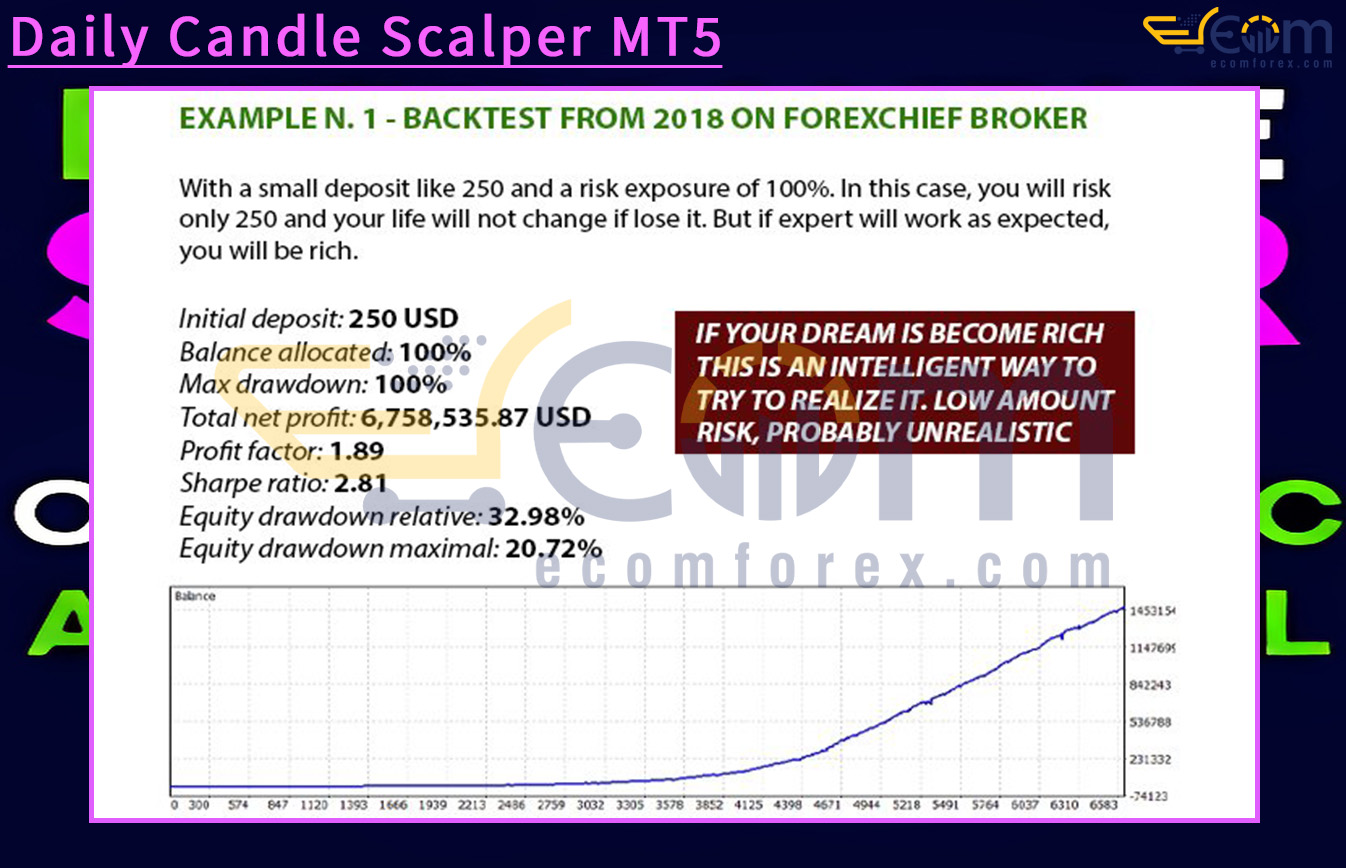

The Daily Candle Scalper EA backtest highlights outstanding profit potential with aggressive risk exposure, proving its ability to generate exponential growth from even a very small initial deposit. While this strategy is highly aggressive, the system maintained a relatively stable equity curve over a multi-year period, showcasing both the strengths of its elasticity-based trading logic and the risks associated with high leverage. This makes it a bold choice for traders aiming to maximize returns with minimal starting capital, though caution is advised due to the extreme risk profile.

Key Backtest Metrics

Initial Deposit: $250

Total Net Profit: $6,758,535.87

Maximum Drawdown: 100% (high-risk setup)

Equity Drawdown Relative: 32.98%

Equity Drawdown Maximal: 20.72%

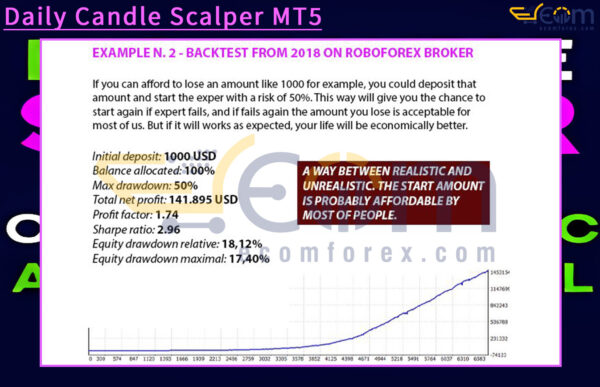

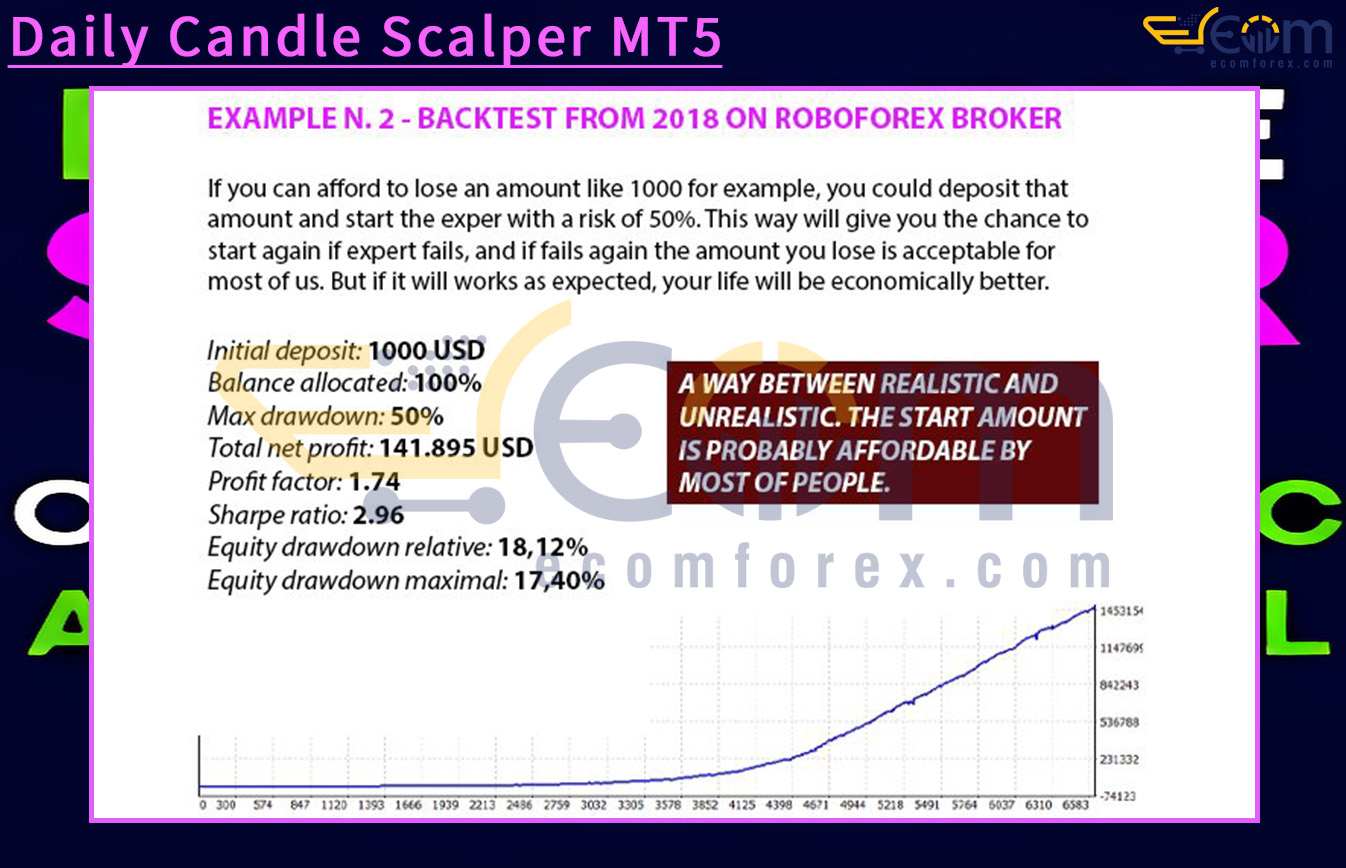

The Daily Candle Scalper EA backtest highlights a more balanced approach compared to the extreme high-risk setup. By starting with a moderate deposit and a 50% risk allocation, the system demonstrates the ability to generate strong profits while maintaining controlled drawdowns. Over the multi-year test period, the EA delivered steady equity growth, showcasing its capability to balance profitability with acceptable levels of risk. This makes it a more practical option for traders who want to maximize returns without exposing their entire capital to excessive risk.

Key Backtest Metrics

Initial Deposit: $1,000

Total Net Profit: $141,895 USD

Maximum Drawdown: 50%

Equity Drawdown Relative: 18.12%

Equity Drawdown Maximal: 17.40%

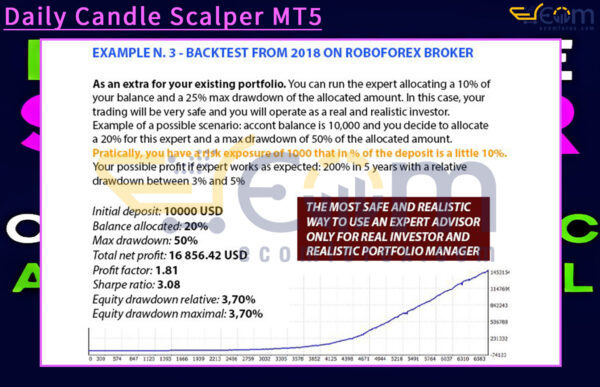

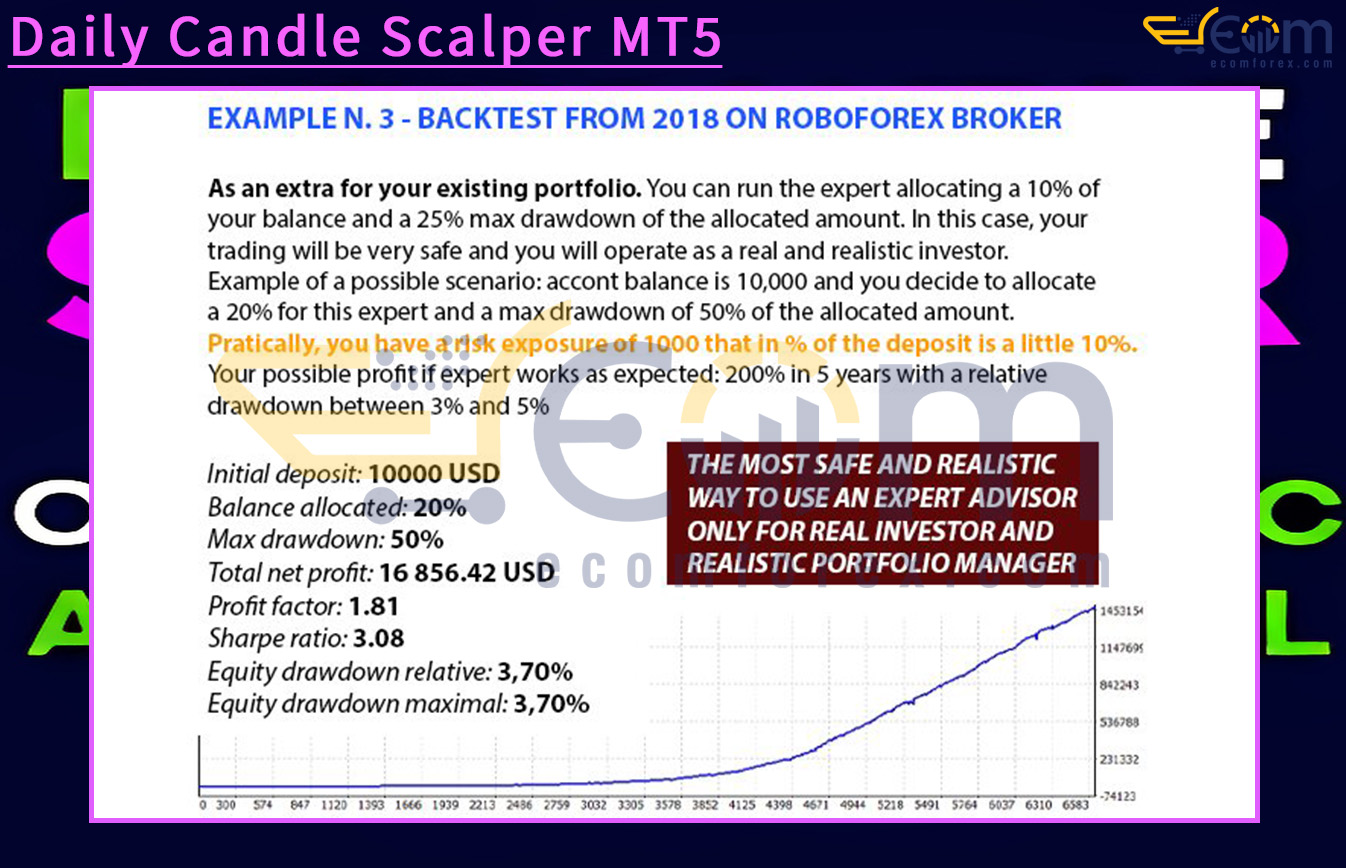

The Daily Candle Scalper EA backtest highlights the safest and most realistic approach to integrating the EA into a trading portfolio. Instead of risking the entire account, only a portion of the capital is allocated (20%), with a maximum drawdown cap of 50% on that allocation. This ensures that overall account exposure remains very low while still capturing solid growth. Over the multi-year test, the EA delivered steady and consistent equity progression, proving its ability to function as a reliable component of a diversified trading strategy.

This setup is particularly suited for serious investors and portfolio managers who prioritize capital preservation and controlled risk while still benefiting from algorithmic trading profits.

Key Backtest Metrics

Initial Deposit: $10,000

Total Net Profit: $16,856.42 USD

Maximum Drawdown: 50% (on allocated balance)

Equity Drawdown Relative: 3.70%

Equity Drawdown Maximal: 3.70%

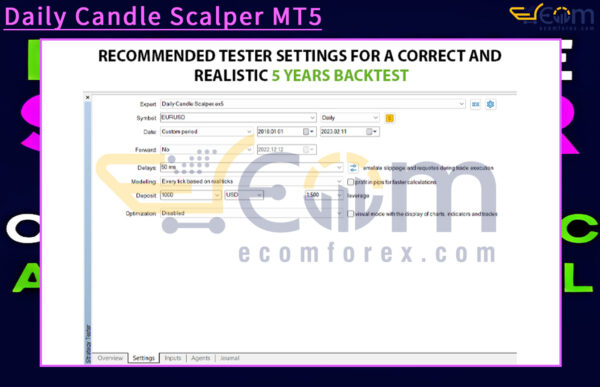

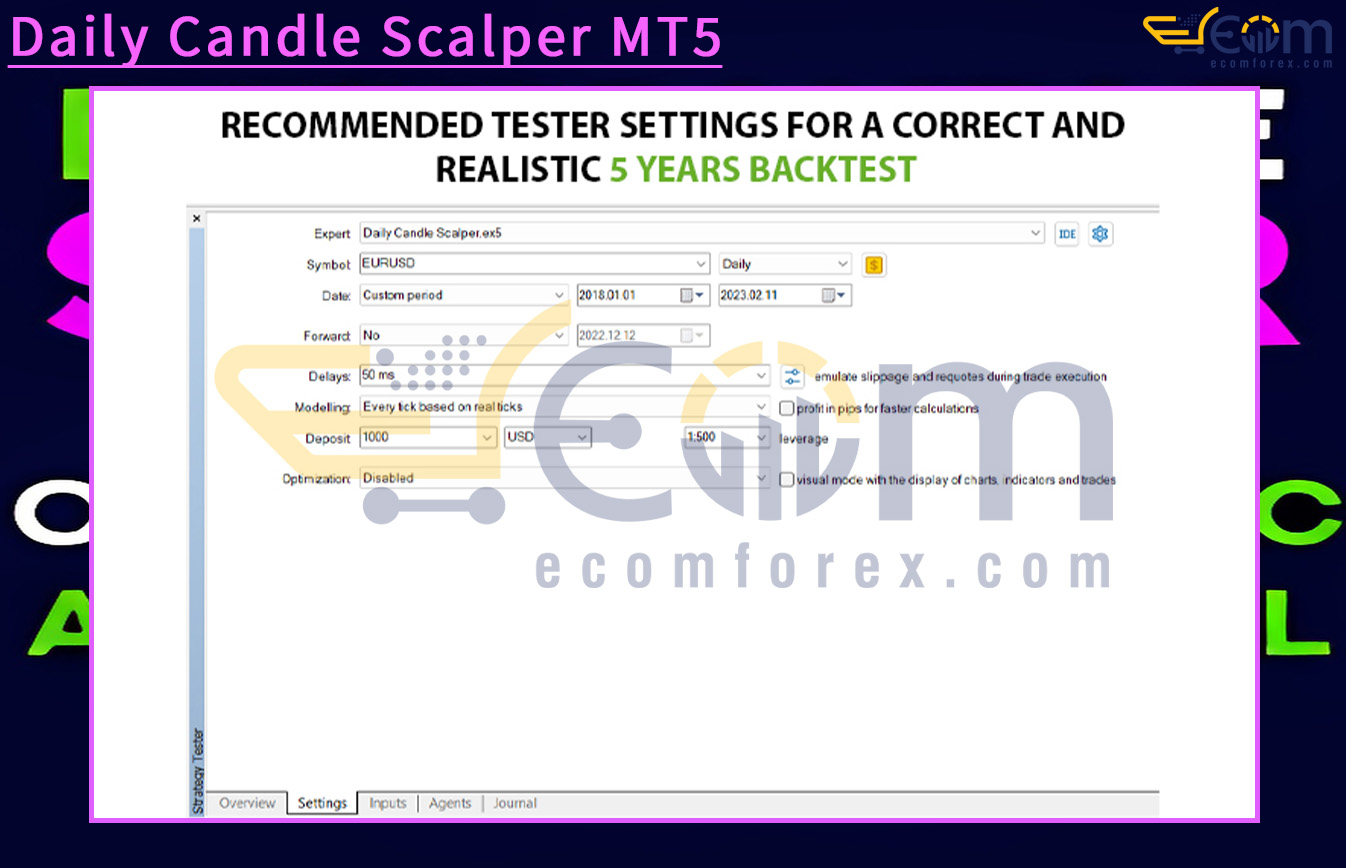

Recommended Configuration for Daily Candle Scalper MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | D1 |

| Currency pairs | EURUSD |

| Min / Recommended deposit | $250 |

| Min / Recommended leverage | 1:30 |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗