- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Desbot MT4 – Latest original version | Unlimited

people are currently looking at this product!

Introducing the Expert Desbot MT4

Name: Desbot

Version: Latest Version

Developer by: Luke Joel Desmaris

The Right Platform: Meta Trader 4 (MT4)

Our Telegram Team: Join now

Our Youtube Channel: Click here

- Delivery time 24h-48h after payment.

What is Desbot MT4?

Desbot MT4 is a fully automated MetaTrader 4 Expert Advisor (EA) built around discipline, probability, and strict risk management, designed for traders who want consistent execution without emotional interference.

Unlike high-frequency or over-trading systems, Desbot trades only when clear market conditions align, using trend structure, candlestick patterns, and multi-moving-average confirmation. Its primary objective is not trade volume, but high-quality entries with predefined risk.

- Official Website: See here

Core Features of Desbot EA

🔹 Risk-Based Position Sizing

Desbot allows traders to define risk per trade using RiskPercentage, ensuring each position risks a fixed percentage of account equity.

This provides consistent exposure control and makes the EA suitable for both small and large accounts.

🔹 Fixed Stop Loss & Take Profit Logic

Using SLTicks and TPTicks, Desbot sets clear stop loss and take profit levels before entering any trade.

Every position has a defined risk-to-reward structure — no unlimited drawdowns or undefined exits.

🔹 Time-Window Trading Filter

Trades are only placed within the user-defined startHour and endHour, helping traders:

Avoid low-liquidity sessions

Reduce exposure during erratic market conditions

Focus on statistically favorable trading hours

🔹 Triple Moving Average Trend Filter

Desbot uses three moving averages:

MALow

MAMedium

MAHigh

Trade logic:

BUY only when MALow > MAMedium > MAHigh

SELL only when MALow < MAMedium < MAHigh

This ensures trades align with established market trends, a core principle of professional trading.

🔹 RSI-Based Risk Reduction Filter

RSI is applied as a secondary confirmation filter, helping avoid entries with a high probability of early reversal and reducing stop-loss hits.

🔹 Intelligent Multi-Order Execution for Large Accounts

When the required position size exceeds the broker’s maximum allowed lot, Desbot automatically splits the trade into multiple smaller orders, maintaining the correct total risk percentage.

This feature is particularly valuable for high-balance accounts.

Desbot MT4 Trading Strategy Explained

Desbot follows a trend-following strategy combined with candlestick pattern recognition, focused on probability and consistency rather than prediction.

Trade execution process:

Confirms trading time is within allowed hours

Ensures no active trades are open

Identifies valid candlestick patterns

Confirms trend direction using moving averages

Applies RSI confirmation

Calculates lot size based on risk percentage

Executes trade with predefined SL and TP

If conditions are not met, no trade is placed — capital protection takes priority.

Why Choose Desbot MT4?

🔹 Emotion-Free Trading Discipline

Desbot removes common trader mistakes such as:

Overtrading

Revenge trading

FOMO

Breaking risk rules

🔹 Ideal for Beginner Traders

Desbot helps new traders:

Learn proper risk management

Avoid emotional decisions

Build consistent trading habits

🔹 Reliable for Serious Traders

Experienced traders benefit from:

Transparent logic

No grid, no martingale strategies

Easy optimization across brokers and symbols

🔹 Transparent & Backtest-Friendly

Desbot performs reliably in Strategy Tester, allowing backtests across multiple brokers and spread environments without relying on exploitative tactics.

🔹 Flexible & Broker-Friendly

Optimized for:

Accounts from $500–$1,000+

Leverage 1:30 or higher

24/7 VPS execution

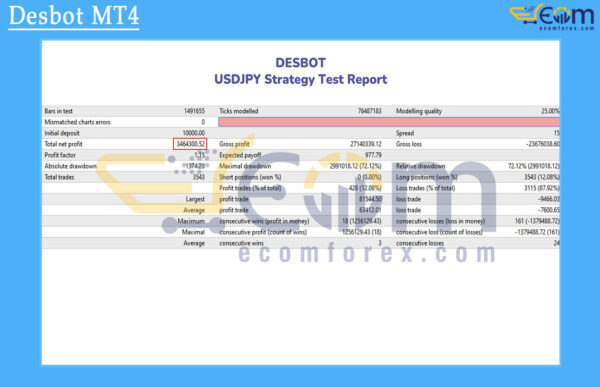

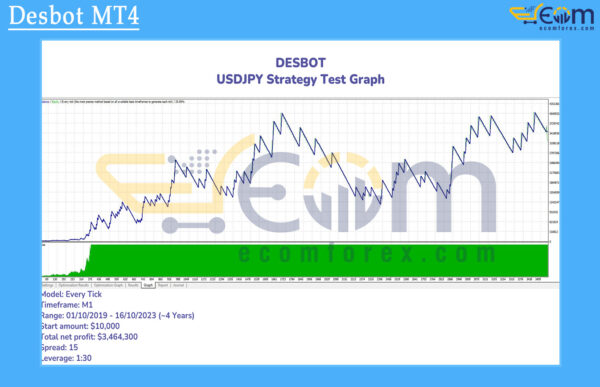

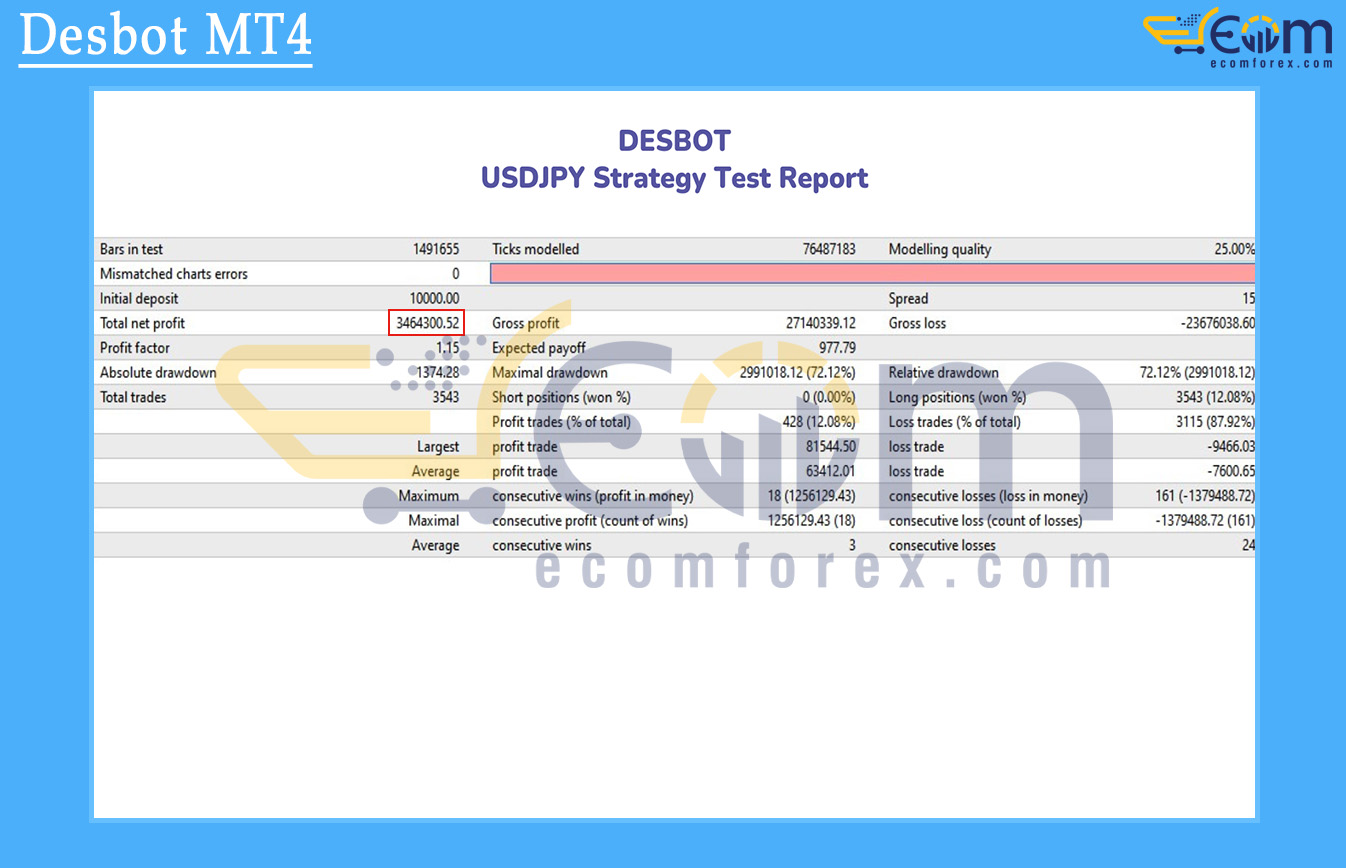

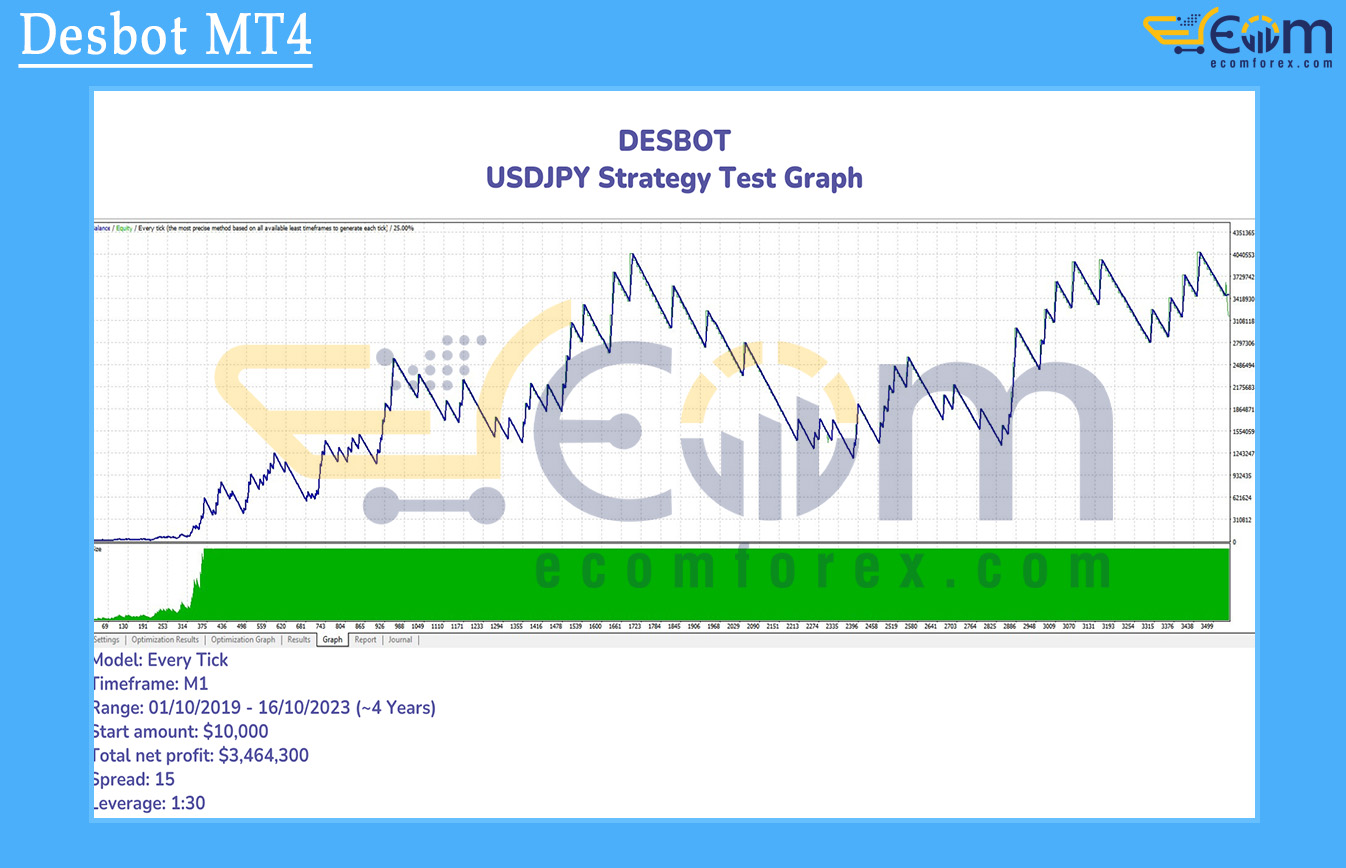

Performance of Desbot MT4

DESBOT EA demonstrated high-profit potential over this extensive USDJPY backtest, leveraging a trend-following structure combined with fixed-risk execution.

The system was able to generate substantial net profits across a very large number of trades, highlighting its capability to exploit directional market movements over long testing periods.

However, the results also reveal that this profitability came with significant drawdown exposure, indicating a strategy profile that prioritizes return generation over capital smoothness. This configuration is therefore more suitable for aggressive testing, strategy research, or further optimization, rather than direct conservative deployment.

📌 Key Backtest Metrics

- ✅ Initial Deposit: $10,000

- ✅ Total Net Profit: $3,464,300.52

- ✅ Total Trades: 3,543

Recommended Configuration for Desbot MT4

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 4 (MT4) |

| Time frames | Any |

| Currency pairs | EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, AUD/USD, NZD/USD |

| Min / Recommended deposit | $500 |

| Min / Recommended leverage | at least 1:30 |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Experts Advisor:

- Desbot MT4_fix.ex4

🤗WISH YOU SUCCESSFUL TRADING🤗