- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $140.00

0 out of 5 main slots sold

GoldSmart EA MT5 – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert GoldSmart EA MT5

Name: GoldSmart

Version: Latest Version

Developer by: Dechathorn Meetip

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is GoldSmart EA MT5?

GoldSmart EA MT5 is a professional-grade automated trading system engineered specifically for EURUSD on the H1 timeframe, combining precise RSI reversal logic with an intelligent, adaptive recovery grid to deliver consistent performance in both counter-trend and trend-following conditions.

GoldSmart EA uses the RSI to detect high-probability reversal zones during active trading sessions (counter-trend mode) while seamlessly switching to trend-continuation entries outside those windows. When the market moves against the initial position, the built-in smart recovery grid activates — opening hedged, balanced orders with dynamic spacing and lot progression — designed to recover drawdown efficiently without reckless risk escalation.

- Official Website: See here

Main Features

- Dual-Mode RSI Strategy — Counter-trend reversals during high-liquidity sessions + trend-following entries outside session hours.

- Intelligent Recovery Grid — Automatically hedges losing positions with calculated lot sizing and spacing — closes the entire basket once profitable.

- Auto Lot Scaling — Fully compatible with any broker (supports micro lots from 0.01 up to 1.0+), auto-adjusts according to account balance.

- Global Profit Target — Closes all open positions (including grid) when predefined profit level is reached — no manual intervention needed.

- Session Time Filter — Default trading window 19:00–21:00 (configurable) to focus on high-volatility periods.

- Robust Safety Features — Full error checking (margin, volume, filling mode), Magic Number support for running alongside other EAs without conflict.

- Clean & Stable Execution — No external DLLs, no over-optimization — built for real-market reliability.

Why Traders Choose GoldSmart EA MT5?

With 20+ years of trading experience, I consider GoldSmartEA one of the most balanced and professionally implemented RSI + smart grid systems available. It combines the proven edge of RSI reversals with a conservative, controlled grid recovery mechanism — avoiding the common pitfalls of over-aggressive martingale or uncontrolled grid spacing.

Key advantages:

- High-probability entries backed by RSI + session context

- Smart hedging & recovery that protects capital instead of gambling it

- Fully broker-agnostic with micro-lot support

- Time-filtered to exploit the best liquidity windows

- Transparent, low-maintenance logic — safe to run with other strategies

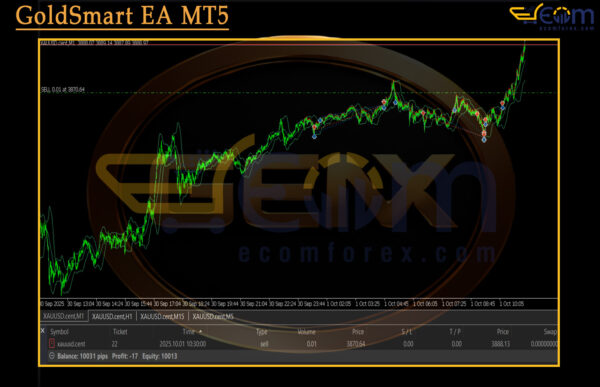

Performance of GoldSmart EA MT5

GoldSmartEA Strategy Logic (refined & clearer version)

1. Entry Rules (RSI-based, session-aware)

- RSI > 71 → Overbought signal • During active session (default 19:00–21:00): Counter-trend → Sell • Outside session: Trend-following → Buy (continuation of strength)

- RSI < 29 → Oversold signal • During active session: Counter-trend → Buy • Outside session: Trend-following → Sell (continuation of weakness)

2. Hedging Activation When the initial position moves 300 points against it, the EA automatically opens an opposite-direction hedge position to neutralize directional exposure and prepare for recovery.

3. Smart Recovery Grid

- Continuously monitors net exposure on both sides.

- Adds incremental volume to the currently smaller/losing side with intelligent spacing.

- Goal: Gradually balance the basket until the total position becomes net profitable.

4. Global Exit Condition

- All open positions (initial + all recovery/hedge orders) are closed simultaneously once the basket profit target is reached.

- No partial closes — clean, full basket closure for maximum efficiency.

Recommended Configuration for GoldSmart EA MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | M1 |

| Currency pairs | EURUSD, XAUUSD |

| Min / Recommended deposit | $1000 |

| Min / Recommended leverage | 1:500 or higher |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗