- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $120.00

0 out of 5 main slots sold

Kingsley EA MT5 – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert Kingsley EA MT5

Name: Kingsley

Version: Latest Version

Developer by: Benjamin Junior Nkoa Nkoa

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is Kingsley EA MT5?

Kingsley EA MT5 is a professional, emotion-free automated trading system built specifically for precise, low-stress day trading during the high-liquidity New York session opening. It eliminates the #1 reason most traders lose money — failure to follow their own plan — by handling everything: volatility analysis, news filtering, signal confirmation, entry execution, stop loss placement, break-even protection, and dynamic profit management. Kingsley turns disciplined trading into set-it-and-forget-it automation without dangerous grids, martingales, or over-optimization.

- Official Website: See here

Main Trading Strategy

- NY Session Precision Window — Focuses exclusively on the high-volume New York open window where institutional order flow is strongest and spreads are tightest.

- News Calendar Filter — Automatically checks economic calendar and skips trading during high-impact news events to avoid whipsaws and stop hunts.

- Multi-Factor Signal Confirmation — Analyzes:

- Current volatility conditions

- Directional coherence (trend alignment)

- Overbought/oversold extremes

- Clear technical price movement confirmation Only enters when all factors align for high-probability setups.

- Intelligent Trade Management — Once in position:

- Automatic Stop Loss placement based on volatility

- Break-Even activation at predefined profit threshold

- Dynamic trailing stop that adapts to price action — locks in gains aggressively while giving winners room to run

- Ultra-Simple Setup — User only selects broker timezone and risk per trade (fixed $ amount or % of capital). No complex parameters, no curve-fitting required.

Standout Features

- Strict NY session focus + automatic news avoidance

- Volatility + directional + extreme condition filtering

- 100% mechanical signal confirmation (no guesswork)

- Auto SL, break-even, and adaptive trailing stop

- Risk control via fixed or percentage-based position sizing

- Designed for clean, disciplined execution — removes emotional interference completely

- Minimal maintenance: set timezone & risk → run 24/7

Who It’s Designed For (and Realistic Expectations) Minimum recommended capital: $500+ (ideally $1,000+ for comfortable risk levels). Perfect for:

- Day traders craving consistent, rule-based execution

- Traders tired of emotional overrides, revenge trading, or FOMO

- Busy professionals wanting reliable automation without babysitting

- Anyone seeking an EA that reduces risk rather than adding dangerous leverage tricks

Why serious traders should choose Kingsley EA MT5?

- Solves the real killer: discipline failure — After two decades, I can tell you 80–90% of losses come from breaking rules, not bad analysis. Kingsley enforces the plan every single time.

- Targets the best trading window — NY open offers the cleanest moves and best risk-reward in forex — Kingsley exploits it surgically while dodging news bombs.

- Emotion-neutral automation — Removes fear, greed, hesitation — the mental enemies that destroy even great manual traders.

- Dead-simple & low-maintenance — No endless parameter tweaking or strategy hopping. Set risk and timezone — it just works.

- Risk-aware by design — Fixed/percentage sizing + news filter + dynamic trailing = controlled drawdowns and protected capital, unlike many reckless EAs.

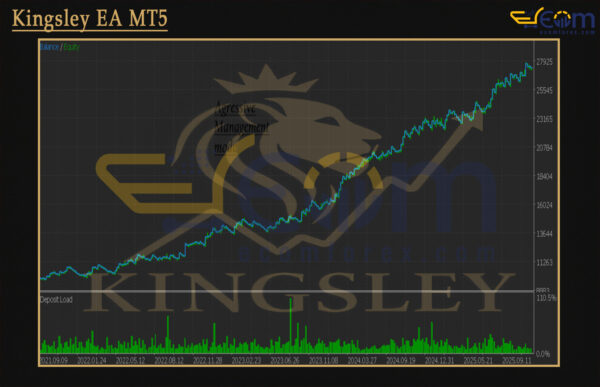

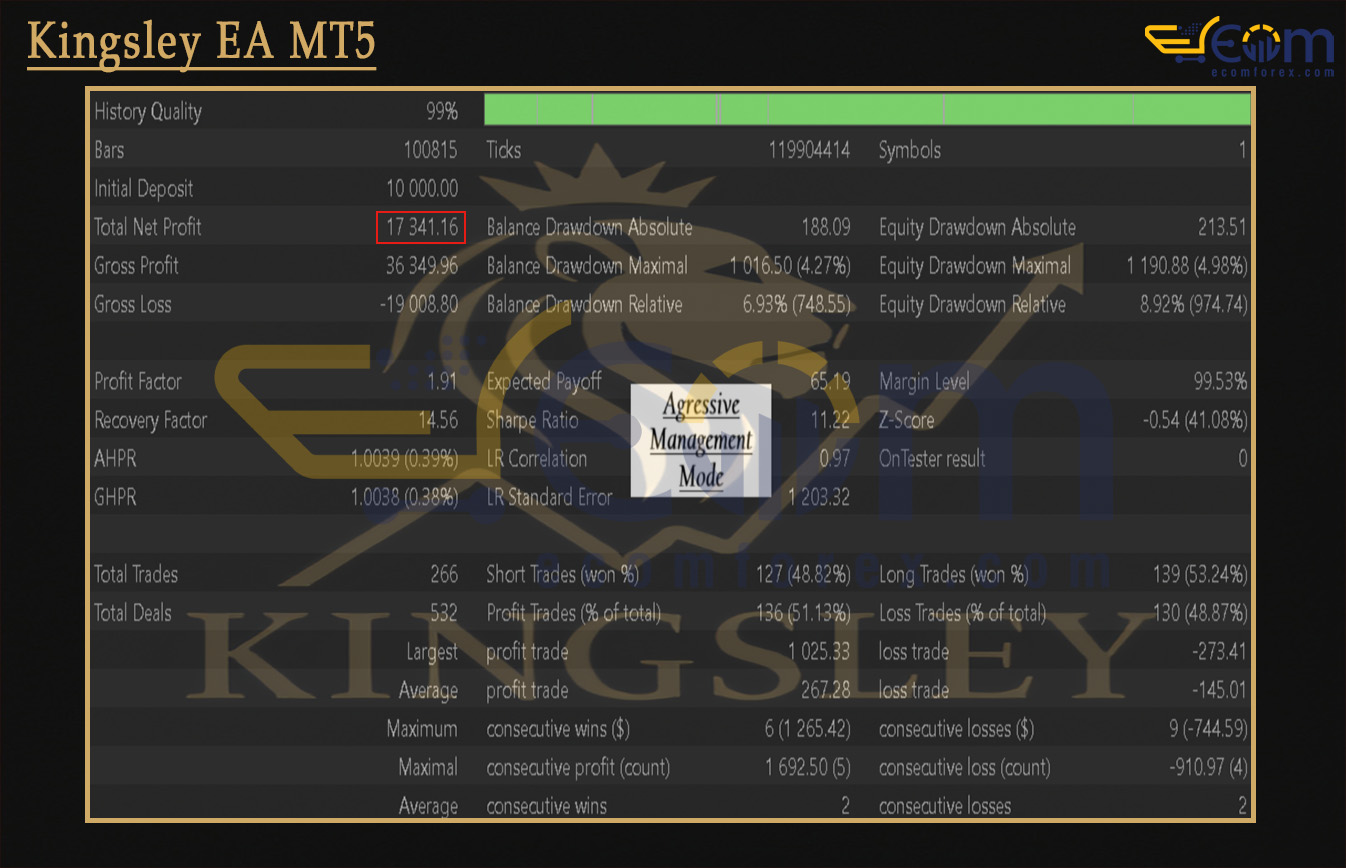

Performance of Kingsley EA MT5

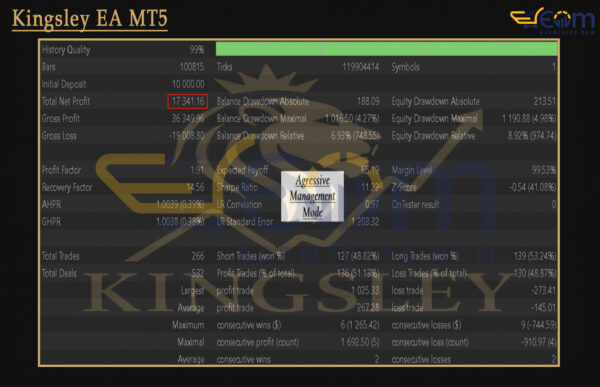

Aggressive Management Mode EA delivered strong profitability in this backtest (likely on a major forex pair or volatile asset), achieving excellent returns on the M1 timeframe with robust risk controls. Its disciplined entry filtering, aggressive yet managed position handling, and adaptive trade management enabled significant account growth while maintaining remarkably low and controlled drawdown.

- Initial Deposit: $10,000

- Total Net Profit: $17,341.16 (173.41% return)

- Maximum Equity Drawdown: 4.98% (Max: $1,190.88)

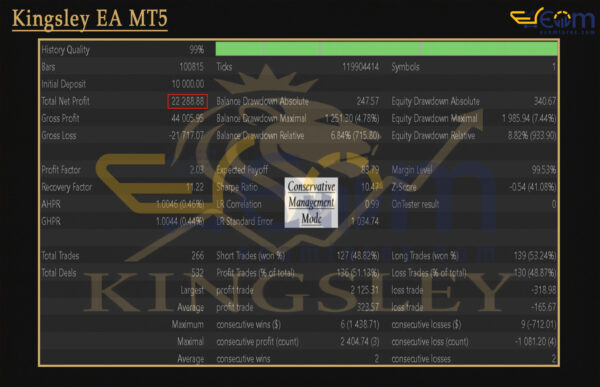

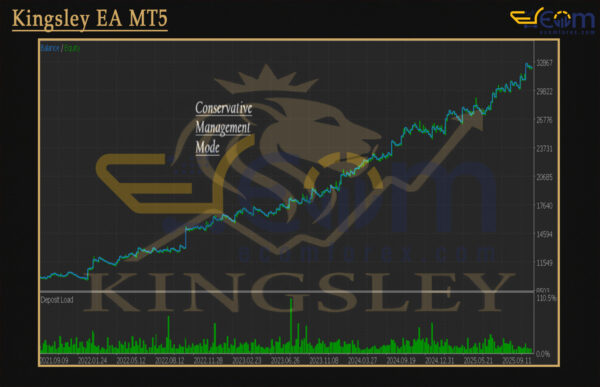

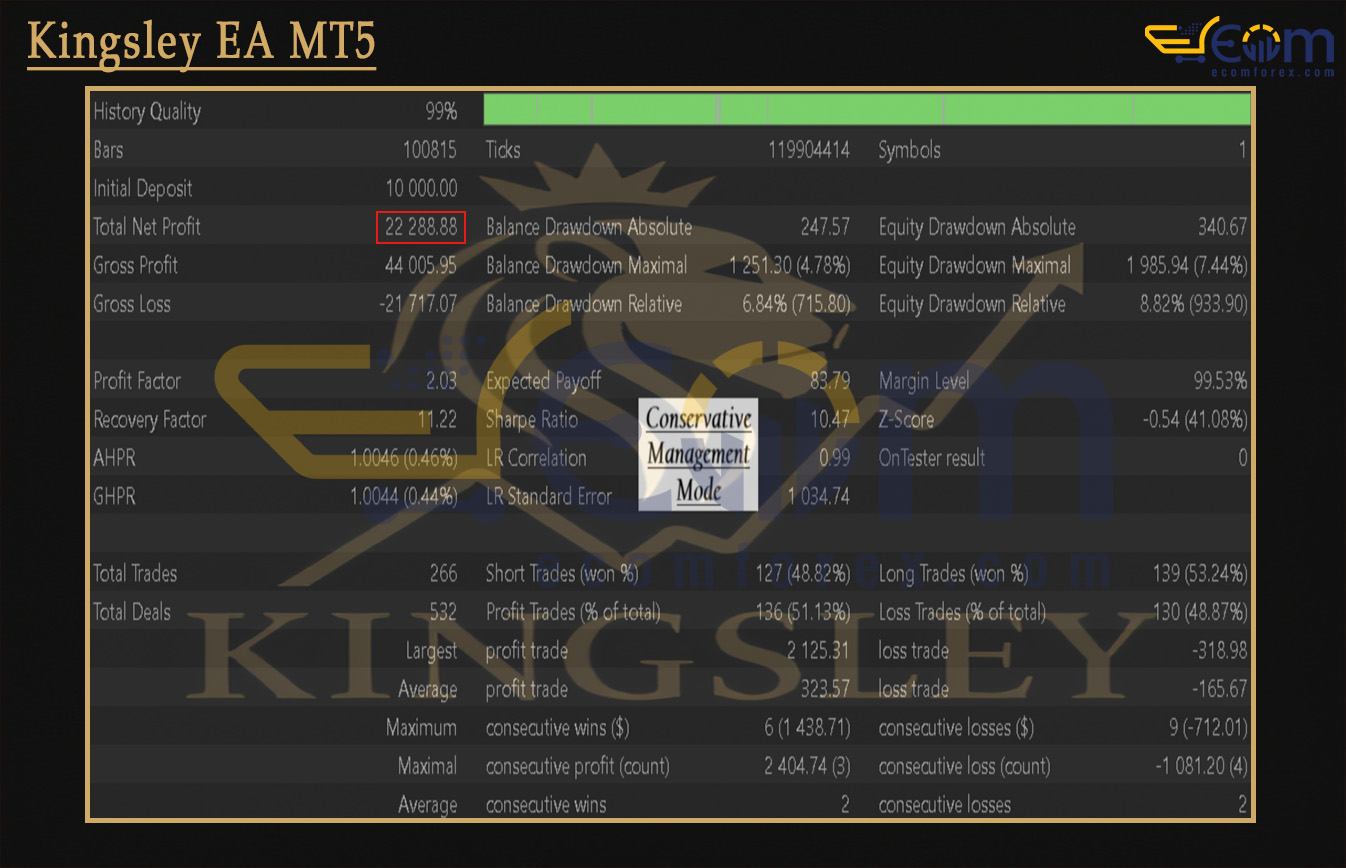

Conservative Management Mode EA delivered excellent risk-adjusted profitability in this backtest (likely on a major forex pair or similar asset), achieving strong returns on the M1 timeframe with outstanding capital protection. Its disciplined signal filtering, conservative position sizing, and adaptive trade management enabled consistent account growth while keeping drawdown exceptionally low and controlled.

- Initial Deposit: $10,000

- Total Net Profit: $22,288.88 (222.89% return)

- Maximum Equity Drawdown: 7.44% (Max: $1,985.94)

Recommended Configuration for Kingsley EA MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | M15 |

| Currency pairs | XAUUSD |

| Min / Recommended deposit | $500 |

| Min / Recommended leverage | 1:500 |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗