- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $100.00

0 out of 5 main slots sold

Layered Core MT5 – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert Layered Core MT5

Name: Layered Core

Version: Latest Version

Developer by: Kareem Abbas

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is Layered Core MT5?

Layered Core MT5 – Adaptive Multi-Layer Algorithm for Institutional-Grade CFD Trading

After more than 7 years of intensive research and development, Layered Core MT5 redefines how algorithmic trading achieves consistency.

Instead of relying on prediction like most EAs, it is engineered around a principle of adaptive evolution — learning and adjusting its positioning dynamically to exploit structural inefficiencies across CFD markets.

In simple terms, Layered Core MT5 doesn’t chase price — it orchestrates it.

Its architecture leverages layered analytical cores, each tuned to interpret volatility, liquidity, and market regime transitions in real time.

The system doesn’t attempt to forecast the next tick; instead, it adapts intelligently to every tick that follows, managing exposure and trade structure through disciplined adaptation rather than blind anticipation.

- Official Website: See here

Core Features

✅ Multi-Layer Decision Hierarchy:

Built on a cascading logic framework, each analytical layer validates and refines trade signals before execution — ensuring precision and reduced noise in dynamic conditions.

✅ Symbol-Specific Intelligence:

Unlike traditional EAs that apply one universal logic across all pairs, Layered Core EA understands each currency’s behavioral DNA.

AUDCAD doesn’t behave like GBPCHF — and the system trades them accordingly.

✅ Volatility & Regime-Shift Filters:

Incorporates over 20 embedded filters to recognize changing volatility regimes, liquidity zones, and market structure transitions.

✅ Pre-Built Risk Profiles:

Includes one-click risk presets — Ultra High, High, Medium, Low, and Ultra Low — making professional-grade control accessible to all users.

✅ Plug-and-Play Simplicity:

Fully automated and hard-coded for ease of use — just set your broker suffix and risk level, no complex input tuning required.

✅ Cross-Broker Compatibility:

Optimized and tested over STP, ECN, and Market Maker (MM) environments to ensure consistent execution quality.

✅ Scalable Multi-Symbol Design:

Planned for up to 28 FX pairs, currently optimized on AUDCAD, EURGBP, EURAUD, AUDJPY, NZDJPY, NZDCAD, EURJPY, and GBPCHF.

Trading Strategy: How Layered MT5 Core Trades

Layered Core EA employs a multi-layer adaptive structure that interacts with market volatility rather than resisting it.

Its decision-making follows a hierarchical validation process, where each layer — from volatility recognition to directional confirmation — must align before executing a trade.

Volatility Detection Layer: Identifies current market regime (low, medium, or high volatility) and adjusts grid density, trade frequency, and risk weight accordingly.

Market Structure Analysis Layer: Evaluates price symmetry, trend bias, and liquidity pressure zones to detect high-probability inefficiencies.

Execution Layer: Opens and manages trades through a profile-specific channel, dynamically adjusting exposure and scaling rules for each pair.

Adaptive Risk Layer: Constantly recalibrates exposure based on real-time performance metrics and equity protection limits.

Rather than predicting market direction, the EA focuses on adapting to ongoing conditions, optimizing profit capture from structural dislocations and minimizing reaction lag.

Why Choose Layered Core MT5?

✅ Engineered for Adaptation, Not Prediction:

Traditional EAs fail when market behavior shifts. Layered Core EA thrives in change — it’s built to evolve.

✅ Institutional-Grade Precision:

20+ adaptive filters and a multi-layer core design provide a level of analytical depth rarely found outside professional trading systems.

✅ Effortless Automation:

Hard-coded optimization removes the need for manual parameter tuning — simply plug in and trade with confidence.

✅ Diversified Pair Coverage:

Each pair runs on its own algorithmic profile, delivering consistent results across uncorrelated assets.

✅ Risk Control Excellence:

Integrated drawdown management and volatility scaling ensure stable equity growth without overexposure.

✅ Proven Across Broker Types:

Backtested and verified on STP, ECN, and MM environments — guaranteeing performance consistency across liquidity models.

Performance of Layered Core MT5

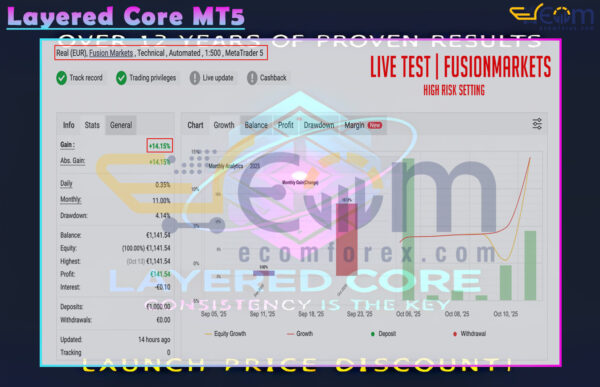

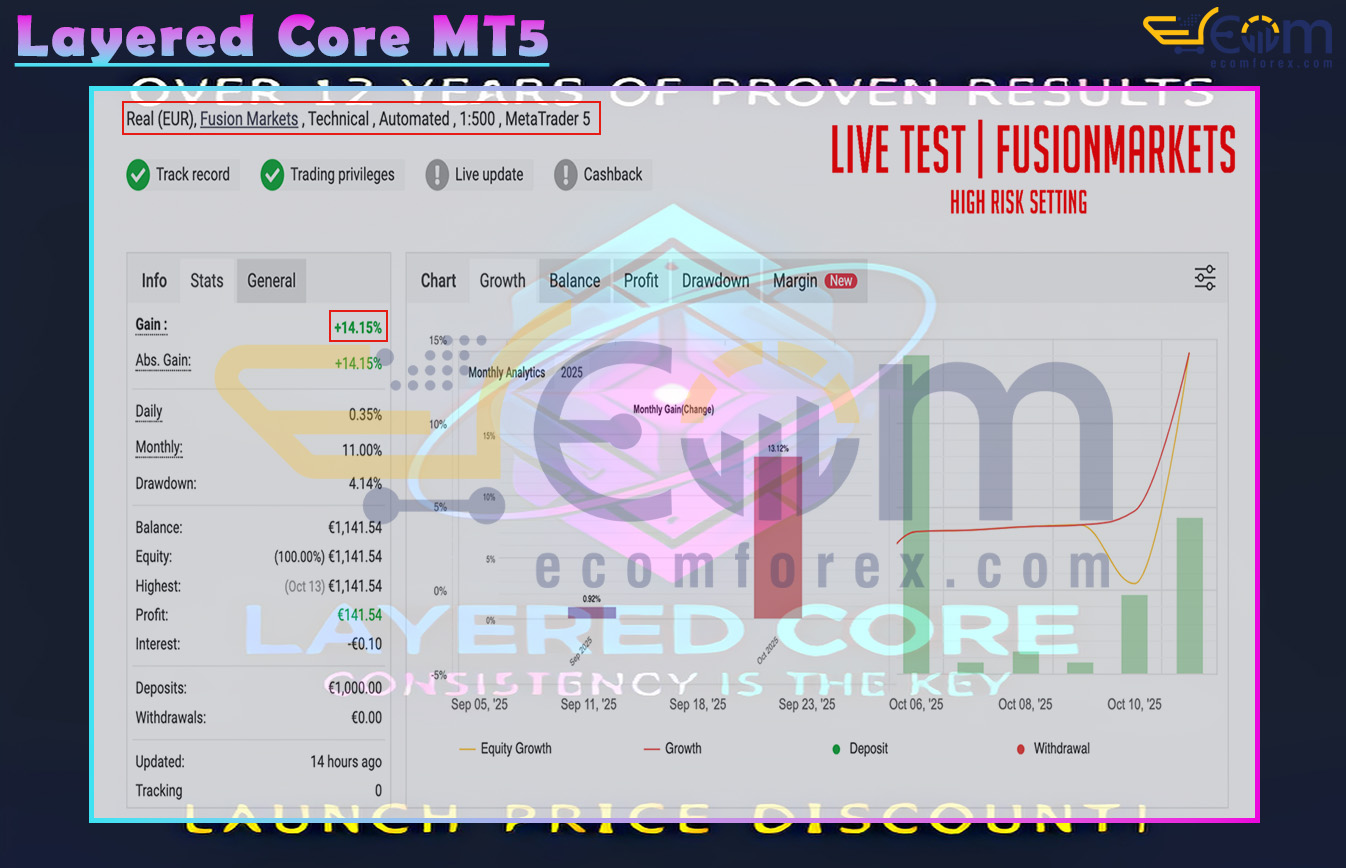

LayeredCore MT5 High Risk Fusion has demonstrated verified live trading results on a real account hosted on Fusion Markets, confirming its strong consistency and adaptive performance even under a high-risk configuration.

The system delivers steady growth with excellent drawdown control, reflecting its intelligent, multi-layer decision-making and adaptive algorithmic core.

- ✅ Initial Deposit: €1,000

- ✅ Total Profit: €141.54

- ✅ Total Gain: +14.15%

- ✅ Average Daily Growth: 0.35%

- ✅ Average Monthly Growth: 11.00%

- ✅ Maximum Drawdown: 4.14%

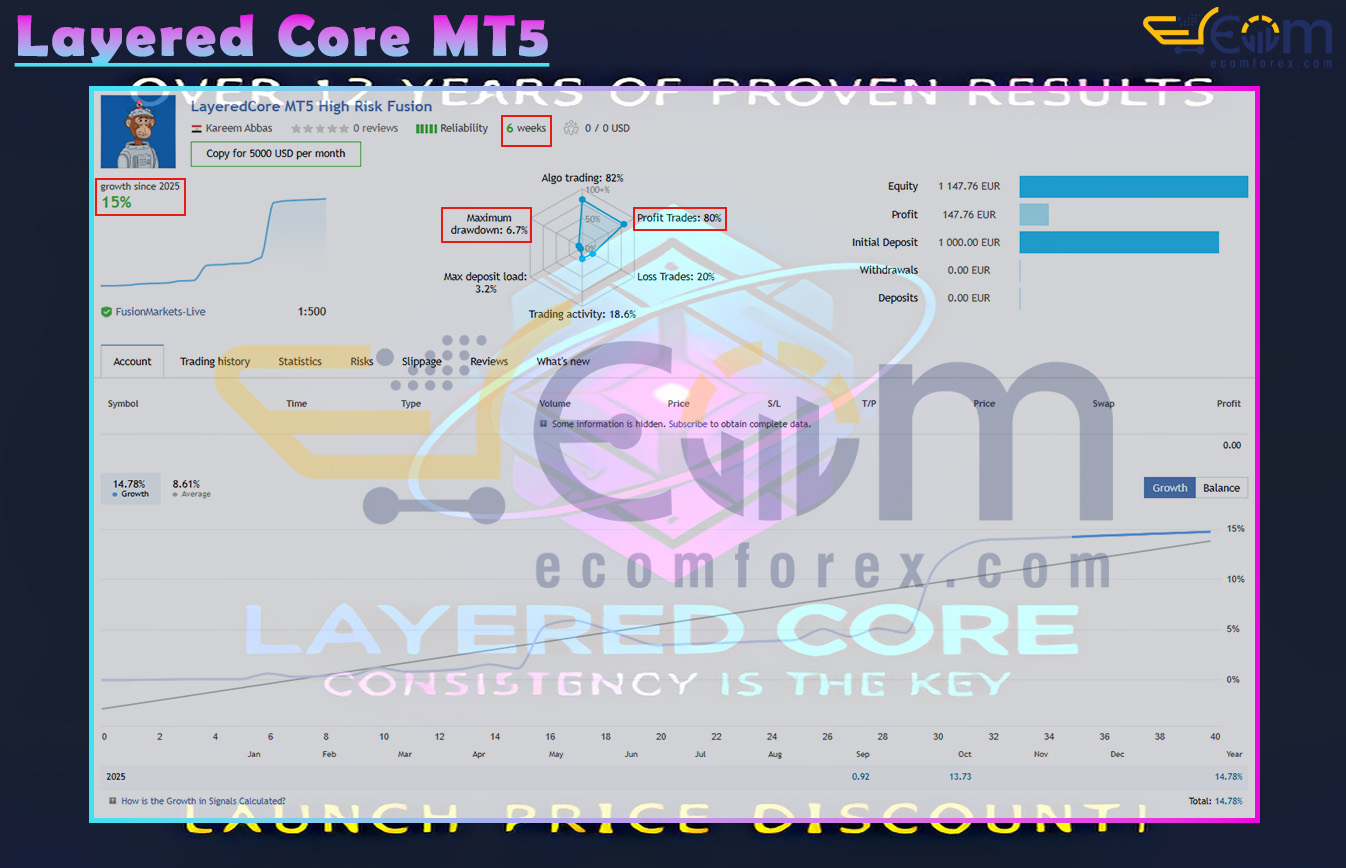

LayeredCore MT5 High Risk Fusion has demonstrated verified live trading performance, fully tracked and confirmed on Myfxbook over a 6-week real-account period.

The system showcases a strong blend of profitability, precision, and adaptive risk management, maintaining consistent growth with minimal drawdown.

- ✅ Initial Deposit: €1,000

- ✅ Total Profit: €147.76

- ✅ Total Gain: +14.78%

- ✅ Win Rate: 80% profitable trades

- ✅ Maximum Drawdown: 6.7%

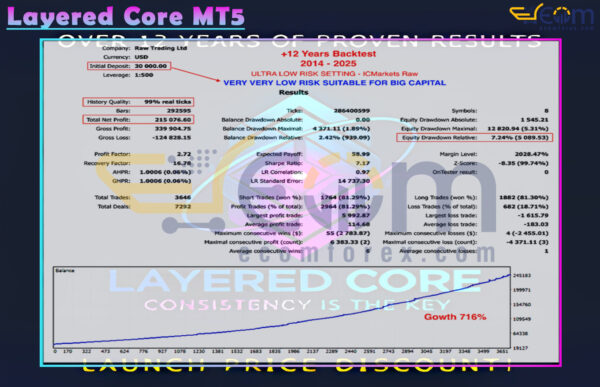

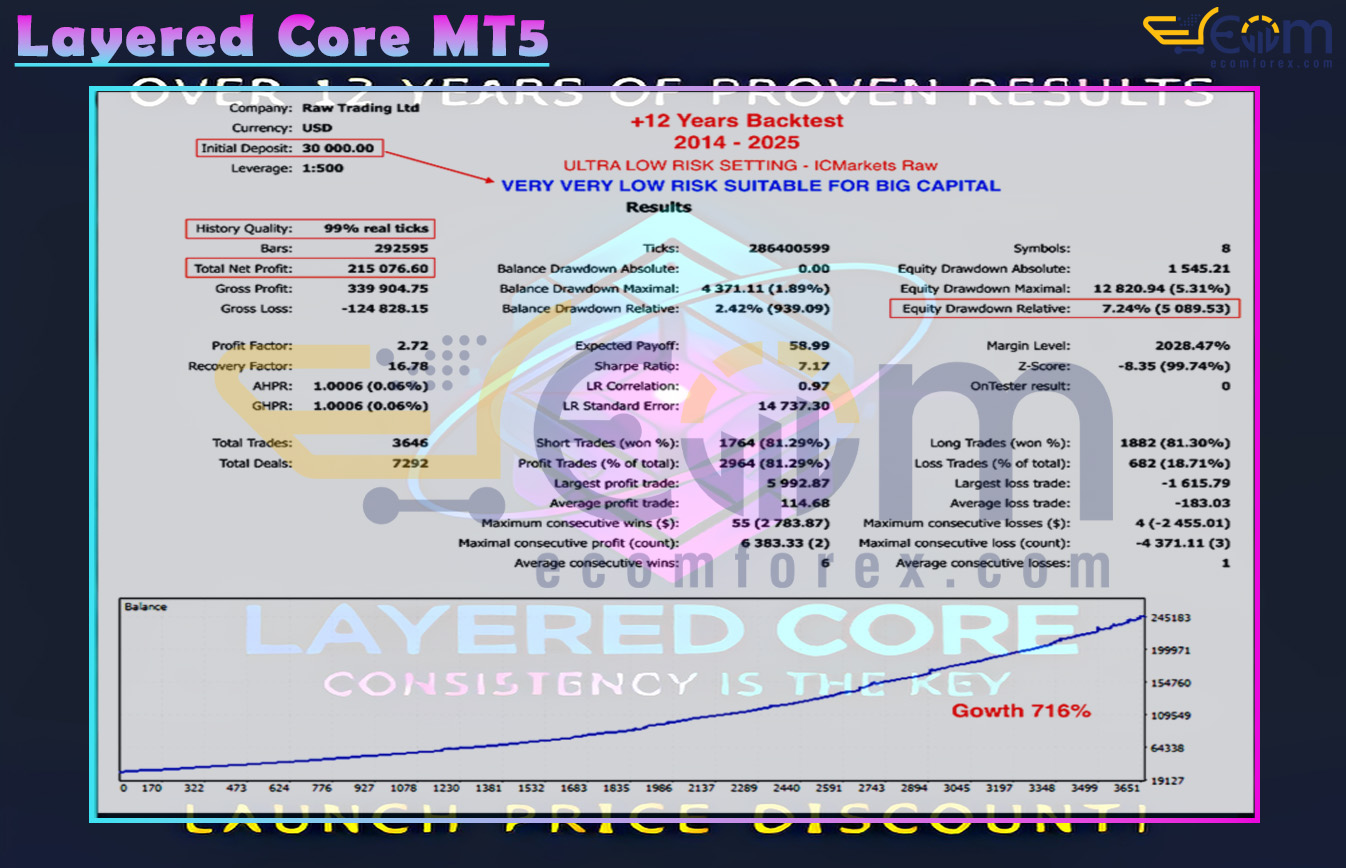

Layered Core EA has demonstrated exceptional long-term stability and profitability, verified through a 12-year backtest (2014–2025) on ICMarkets Raw using ultra-low risk settings.

The system showcases institutional-grade consistency, delivering steady compounded growth while maintaining remarkably low drawdown — perfectly suited for large-capital and professional trading environments.

- ✅ Initial Deposit: $30,000

- ✅ Total Net Profit: $215,076.60

- ✅ Total Gain: +716%

- ✅ Profit Factor: 2.72

- ✅ Win Rate: 81.3% profitable trades

- ✅ Maximum Equity Drawdown: 7.24%

Recommended Configuration for Layered Core MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | M15 |

| Currency pairs | on the 28 FX pairs (currently on AUDCAD, EURGBP, EURAUD, AUDJPY, NZDJPY, NZDCAD, EURJPY, GBPCHF) |

| Min / Recommended deposit | $1000 |

| Min / Recommended leverage | 1:500 |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗