- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Neon Trade EA MT4 – Latest original version | Unlimited

people are currently looking at this product!

Introducing the Expert Neon Trade EA MT4

Name: Neon Trade EA MT4

Version: Latest Version

Developer by: Evgeniy Ilin

The Right Platform: Meta Trader 4 (MT4)

Our Telegram Team: Join now

Our Youtube Channel: Click here

- Delivery time 24h-48h after payment.

What is Neon Trade EA MT4?

Neon Trade EA MT4 is a next-generation automated trading solution that combines machine learning, cloud computing, and advanced trading techniques into a single adaptive system.

Designed to serve multiple trading objectives, Neon Trade is suitable for both rapid small-account growth (1–2 months) and long-term, multi-year investment strategies. Its unique strength lies in a client–server architecture, where the majority of market analysis and machine-learning computations are performed on remote servers, allowing the system to adapt quickly to changing market conditions without relying heavily on local hardware.

Neon Trade is not a one-size-fits-all robot. It is a flexible trading platform that can be configured to match the specific goals and risk tolerance of each trader.

- Official Website: See here

Core Features of Neon Trade EA

🔹 Machine Learning–Driven Trading Engine

Neon Trade uses machine learning algorithms to:

Analyze multi-dimensional market data

Detect behavioral changes in price action

Continuously refine trade decision logic

This allows the EA to adapt dynamically, rather than following rigid, static rules.

🔹 Cloud-Based Computing Architecture

Most computations are executed on powerful remote servers, which provides:

Reduced load on the trader’s computer

Continuous AI upgrades and improvements

Stable performance during high-volatility periods

🔹 True Multi-Currency Capability

Neon Trade is designed to operate across multiple instruments simultaneously, without being dependent on a single currency pair.

This makes it suitable for Forex, metals, indices, and other tradable assets (depending on configuration).

🔹 Dynamic Risk Allocation & Portfolio Logic

Risk is:

Automatically distributed across multiple instruments

Continuously recalculated based on market conditions

Balanced to maintain a target profitability ratio

This reflects a portfolio-based trading approach, rather than isolated single-trade execution.

🔹 Drawdown Reduction via Hedging & Multi-Timeframe Trading

By combining:

Hedging techniques

Multi-pair exposure

Multiple timeframes

Neon Trade smooths equity curves and reduces drawdown, a critical requirement for long-term capital growth.

🔹 High Reliability & Fault Tolerance

Automatically restores positions after terminal restarts

Resistant to short-term disconnections

Bar-based execution minimizes latency sensitivity

🔹 Extensive Configuration Flexibility

Traders can:

Select specific instruments

Choose operating modes

Enable long, short, or bi-directional trading

Apply conservative or aggressive SET files depending on objectives

Trading Strategy

Neon Trade does not rely on a single fixed strategy. Instead, it operates as a multi-strategy adaptive trading system, built on:

Price-behavior analysis

Cross-market correlation evaluation

Portfolio-level risk management

Probability optimization rather than prediction

Typical Use Cases:

Aggressive growth of small accounts ($300+) for traders willing to accept higher risk

Long-term capital growth for experienced investors prioritizing stability

Passing proprietary trading firm challenges (FTMO, Darwinex, etc.) with drawdown-optimized configurations

This reflects a professional trading mindset:

👉 The system adapts to the trader’s objective — not the other way around.

Why Choose Neon Trade EA MT4?

🔹 One System, Multiple Objectives

Neon Trade replaces the need for multiple robots by supporting short-term growth, long-term investment, and prop-firm trading within a single platform.

🔹 Technology Beyond Traditional EAs

The combination of machine learning, cloud computing, and client–server architecture places Neon Trade well ahead of conventional retail EAs.

🔹 Suitable for Both Retail & Prop Firm Traders

Configurable to prioritize either growth or risk compliance, depending on the trading environment.

🔹 Low Hardware Dependency

Efficient cloud processing reduces reliance on high-performance local machines or ultra-low-latency VPS setups.

🔹 Strong Ecosystem & Developer Support

Telegram community

Conservative and aggressive SET files

Live monitoring with conservative profiles

Detailed guides and direct developer consultation

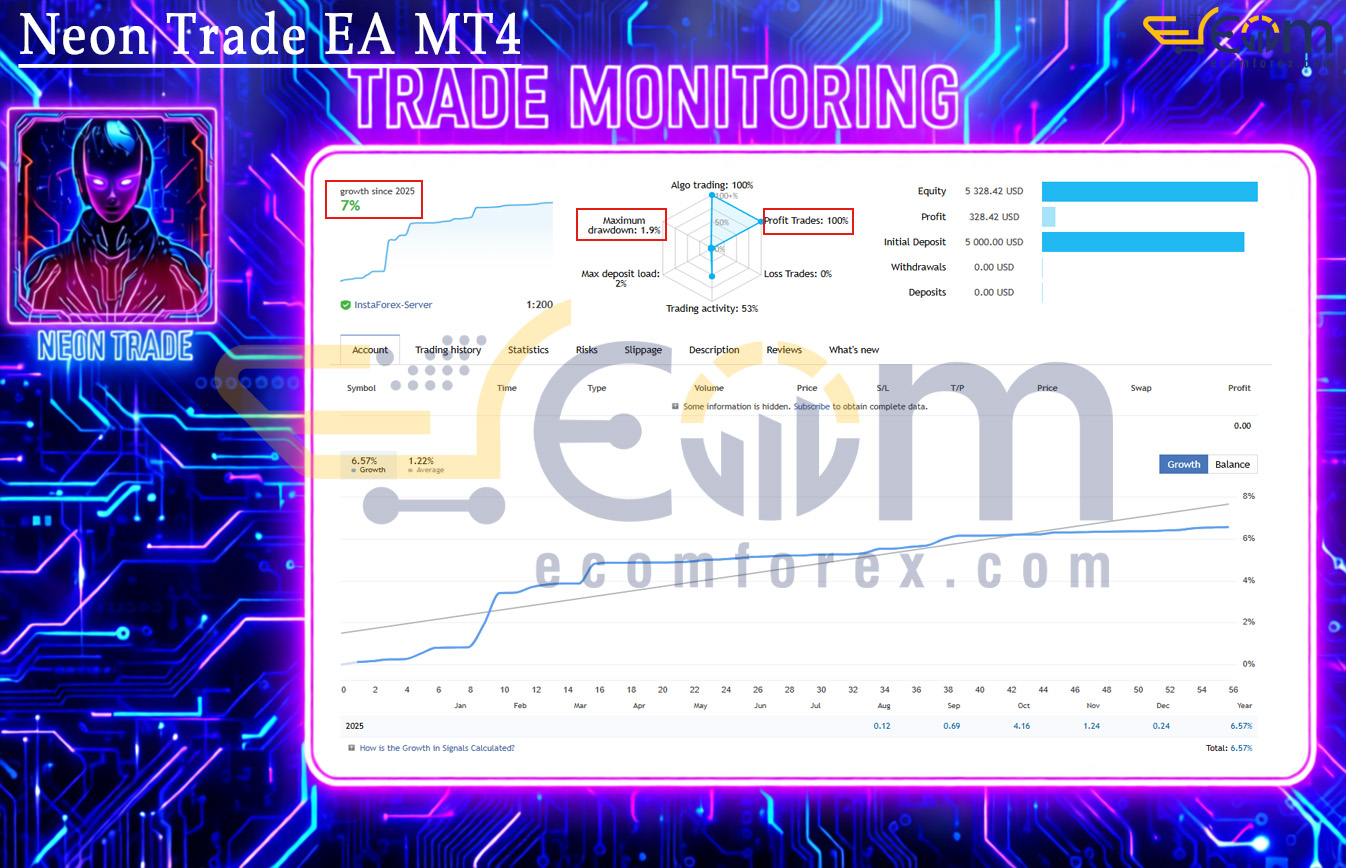

Performance of Neon Trade EA MT4

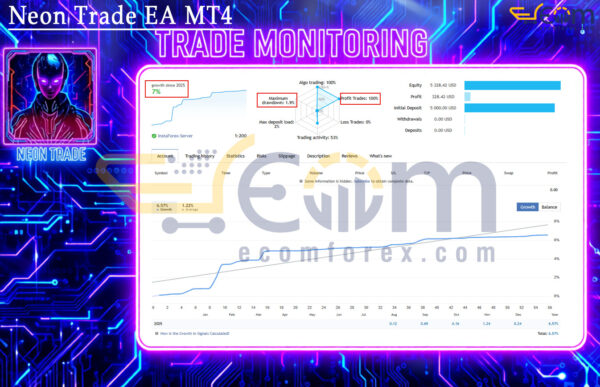

Neon Trade MT5 has delivered verified live trading performance, fully tracked on a real trading account over a 17-week trading period.

The system demonstrates a steady and disciplined growth profile, focusing on capital preservation and controlled exposure rather than aggressive risk-taking.

Throughout the live run, Neon Trade maintained extremely low drawdown, consistent trade execution, and a smooth equity curve — highlighting its suitability for conservative investors and long-term portfolio deployment.

📌 Key Live Trading Metrics

- ✅ Initial Deposit: $5,000

- ✅ Current Equity: $5,328.42

- ✅ Total Gain: +6.57%

- ✅ Maximum Drawdown: 1.9%

- ✅ Profit Trades: 100%

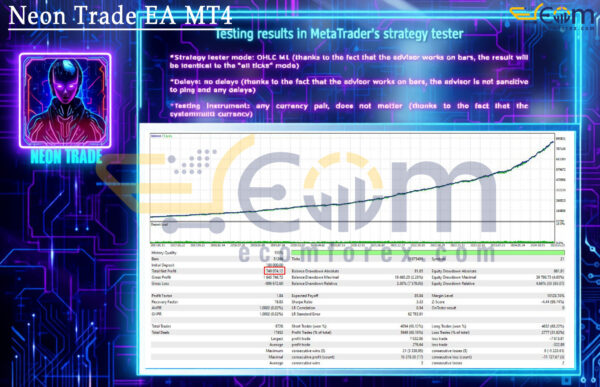

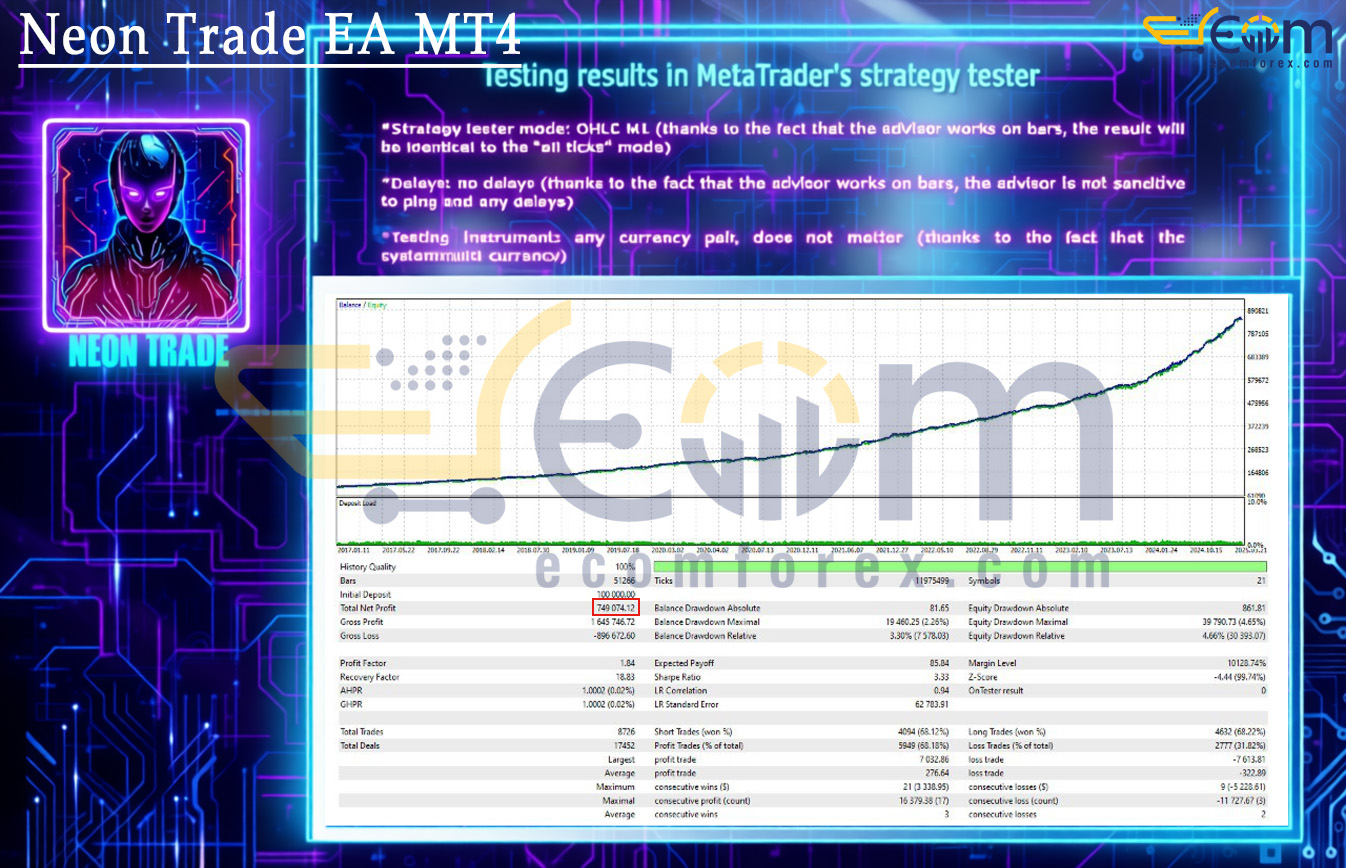

Neon Trade EA delivered exceptional long-term profitability over this multi-year backtest conducted in MetaTrader’s Strategy Tester, demonstrating a smooth, steadily rising equity curve and highly consistent performance across changing market conditions.

Operating in OHLC (bar-based) testing mode, the system showed full independence from tick delays, slippage, or latency issues. Thanks to its bar-based execution logic, the results remain robust and reproducible, even across different symbols and brokers.

Throughout the test period, Neon Trade maintained controlled drawdown levels while achieving strong compounding growth, highlighting its suitability for long-term systematic trading and portfolio-style deployment rather than short-term speculation.

📌 Key Backtest Metrics

- ✅ Initial Deposit: $1,000

- ✅ Total Net Profit: $740,974.12

- ✅ Winning Trades: 68.12%

- ✅ Maximum Drawdown: ~4.66% (Relative)

Recommended Configuration for Neon Trade EA MT4

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 4 (MT4) |

| Time frames | Any |

| Currency pairs | multi-currency |

| Min / Recommended deposit | $300 |

| Min / Recommended leverage | 1:200 |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Experts Advisor:

- Neon Trade EA MT4_fix.ex4

🤗WISH YOU SUCCESSFUL TRADING🤗