- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $50.00

0 out of 5 main slots sold

Nova RSI Trader MT5 – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert Nova RSI Trader MT5

Name: Nova RSI Trader

Version: Latest Version

Developer by: Anita Monus

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is Nova RSI Trader MT5?

Nova RSI Trader MT5 is a precise, fully automated Expert Advisor (EA) for MetaTrader 5 that harnesses the timeless power of the Relative Strength Index (RSI) — one of the most trusted momentum indicators in trading history.

Rather than blindly trading every overbought/oversold reading, Nova RSI Trader applies strict, multi-layer filters to ensure entries occur only when RSI momentum aligns with clear price structure and market context. This disciplined approach eliminates most false reversals, whipsaws, and low-probability signals, delivering clean, high-conviction trades.

- RSI Momentum Core — Detects overbought (>70) and oversold (<30) conditions, divergences, and failure swings.

- Contextual Confirmation — Requires additional validation (e.g., price action near support/resistance, trend alignment, or volume proxy) before firing a trade.

- Noise Rejection — Stays flat during ranging markets, strong trends against the signal, or unclear setups — trading only when the reversal/continuation probability is genuinely elevated.

- Official Website: See here

Core Features

- Classic RSI Fully Automated — Implements standard RSI logic with professional-grade entry/exit rules — no black-box tweaks.

- High-Conviction Momentum Signals — Trades only on confirmed RSI extremes backed by real market structure — avoids isolated oscillator readings.

- Built-in Risk Discipline — Fixed stop-loss on every position (ATR-based or manual), optional trailing stop, zero martingale, zero grid — safe for prop firms, funded accounts, and serious capital.

- Multi-Asset & Timeframe Flexibility — Reliable on Forex, XAUUSD (gold), indices, and crypto; optimized for H1, H4, and Daily charts where RSI signals are most reliable.

- Simple, Transparent & Fast — Clear parameters, logical rules, lightning execution — easy to understand, backtest, and trust.

Trading Strategy

- RSI Extreme Detection — Spots overbought/oversold levels or bullish/bearish divergences.

- Structure Confirmation — Validates signal with price action (e.g., rejection at key level, candlestick pattern).

- Entry — Fires in the direction of the reversal/continuation when both align.

- Risk Management — Stop-loss beyond recent swing or ATR multiple; trails to lock profits on strong moves.

- Exit — Fixed take-profit, trailing stop, or RSI reversal signal — exits before momentum fades.

Result: Captures high-probability turning points and trend continuations with minimal drawdown and excellent consistency.

Why Choose Nova RSI Trader MT5?

- Elite Signal Quality — Trades infrequently but with very high win probability — smooth equity curve, low stress.

- Prop & Funded-Account Safe — No rule-breaking techniques — passes daily drawdown, consistency scoring, and profit targets easily.

- Timeless Indicator Everyone Knows — RSI is a staple every trader understands — no blind trust in complex AI.

- Sustainable Long-Term Focus — Built for steady compounding, not fragile short-term spikes.

- Versatile Portfolio Addition — One EA that reliably works across multiple assets — simplifies diversification.

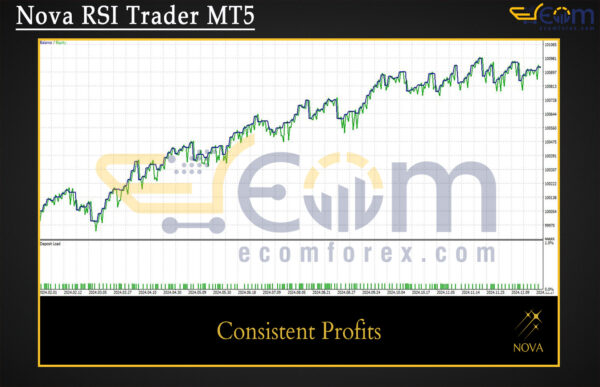

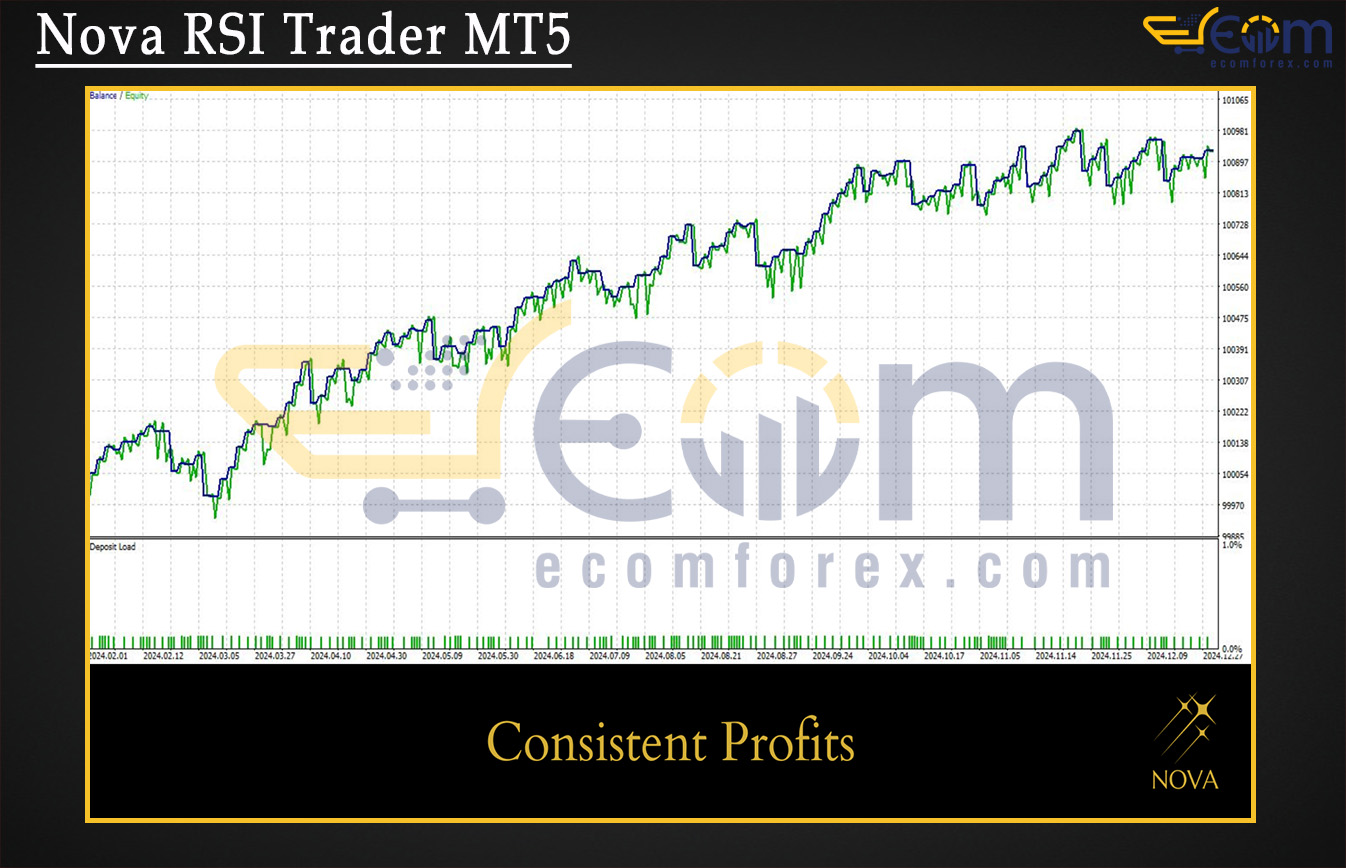

Performance of Nova RSI Trader MT5

Nova RSI Trader MT5 delivered impressive, high-quality performance in this backtest, posting a strong 71.43% win rate while maintaining ultra-tight drawdown across 5,688 bars of perfect (100%) historical data.

The EA’s disciplined RSI filtering — requiring confirmed overbought/oversold signals backed by price structure and momentum context — clearly excels: it trades selectively (only 126 trades), rejects noise aggressively, and generates remarkably smooth equity growth with almost no volatility, even on a shorter timeframe setup.

Key Backtest Highlights

- Initial Deposit: $100,000

- Total Net Profit: $927.76

- Win Rate: 71.43% (90 winning trades out of 126)

- Maximum Equity Drawdown: 0.26% (only $262.42 in absolute terms)

- Maximum Balance Drawdown: 0.19% ($190.04)

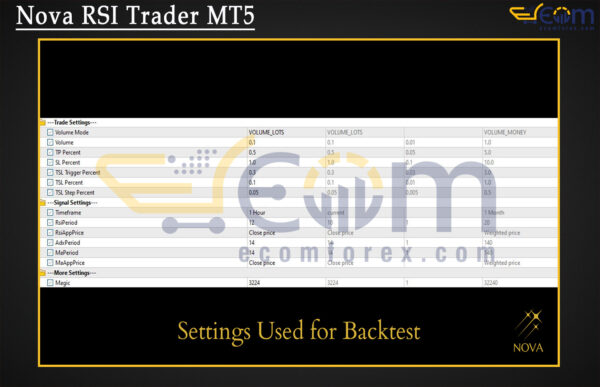

Recommended Configuration for Nova RSI Trader MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | Any |

| Currency pairs | Any |

| Min / Recommended deposit | Any |

| Min / Recommended leverage | Any |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗