- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $1,980.00

0 out of 5 main slots sold

Sevolter EA MT5 – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert Sevolter EA MT5

Name: Sevolter

Version: Latest Version

Developer by: Yuriy Bykov

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

- Delivery time 24h-48h after payment.

What is Sevolter EA MT5?

Sevolter EA MT4 is an advanced automated trading system designed to operate across multiple correlated currency pairs, executing several simple but proven trading strategies simultaneously.

Rather than relying on a single optimized algorithm, the Expert Advisor (EA) aggregates signals from multiple strategies that have each been independently optimized over the last five years, allowing it to adapt more effectively to changing market conditions.

The core objective of the system is risk-balanced, long-term capital growth, achieved through diversification, statistical validation, and volatility-driven execution.

- Official Website: See here

Core Features

🔹 Multi-Strategy Signal Engine

The EA runs multiple lightweight trading algorithms in parallel, each designed to operate during periods of increased market volatility—when price movements offer the highest statistical edge.

🔹 “Wisdom of the Crowd” Statistical Model

Instead of acting on a single signal, the EA applies the principle of signal averaging, opening trades only when a consensus direction emerges from multiple strategies.

This reduces false entries and increases overall trade quality.

🔹 Cross-Instrument Correlation Management

By trading correlated instruments simultaneously, the EA smooths equity fluctuations and reduces exposure to unfavorable single-pair market phases.

🔹 Automated Drawdown Governance

The Expected Maximum Drawdown (%) parameter dynamically adjusts position sizing to ensure risk remains within predefined limits—providing built-in capital protection without manual intervention.

🔹 Flexible Capital Allocation

The Fixed Deposit for Trading option allows traders to:

Use the full account balance (recommended)

Or restrict trading to a fixed capital allocation for conservative risk segmentation

Trading Strategy Explained

🔹 Volatility-Triggered Execution

Trades are opened during statistically favorable volatility regimes, avoiding stagnant or low-probability market conditions.

🔹 Consensus-Driven Market Entries

Positions are only executed when multiple strategies align, reinforcing directional confidence and reducing random exposure.

🔹 Dynamic Risk Scaling

Position size is continuously adapted based on:

Historical performance metrics (5-year testing)

The user-defined maximum drawdown threshold

🔹 Portfolio-Style Trading Logic

By distributing trades across multiple instruments and strategies, the EA achieves a more uniform equity curve, reducing sharp peaks and deep drawdowns.

Why Choose Sevolter EA MT5?

🔹 Built for Market Uncertainty

The combination of multi-strategy logic and consensus filtering makes the EA more resilient during unpredictable market phases.

🔹 Risk Control Embedded by Design

Unlike EAs that rely on fixed lot sizes or manual risk tuning, this system actively enforces drawdown limits through adaptive position sizing.

🔹 Diversification Without Complexity

Traders gain the benefits of portfolio-style diversification without the burden of managing multiple EAs manually.

🔹 Consistent Growth Profile

By smoothing growth cycles and avoiding reliance on a single market condition, the EA aims for steady, repeatable performance over time.

🔹 Suitable for Long-Term Automation

The EA’s structure makes it ideal for long-term live accounts, portfolio integration, and traders who prioritize sustainability over aggressive speculation.

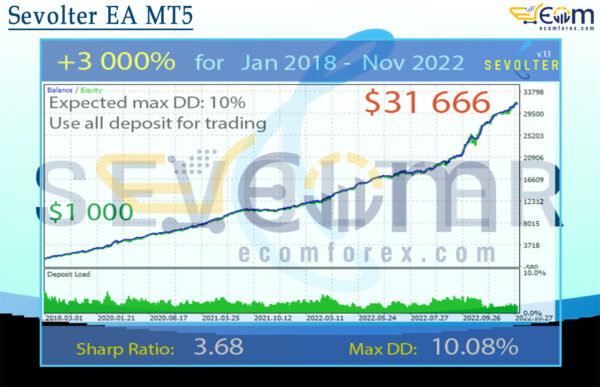

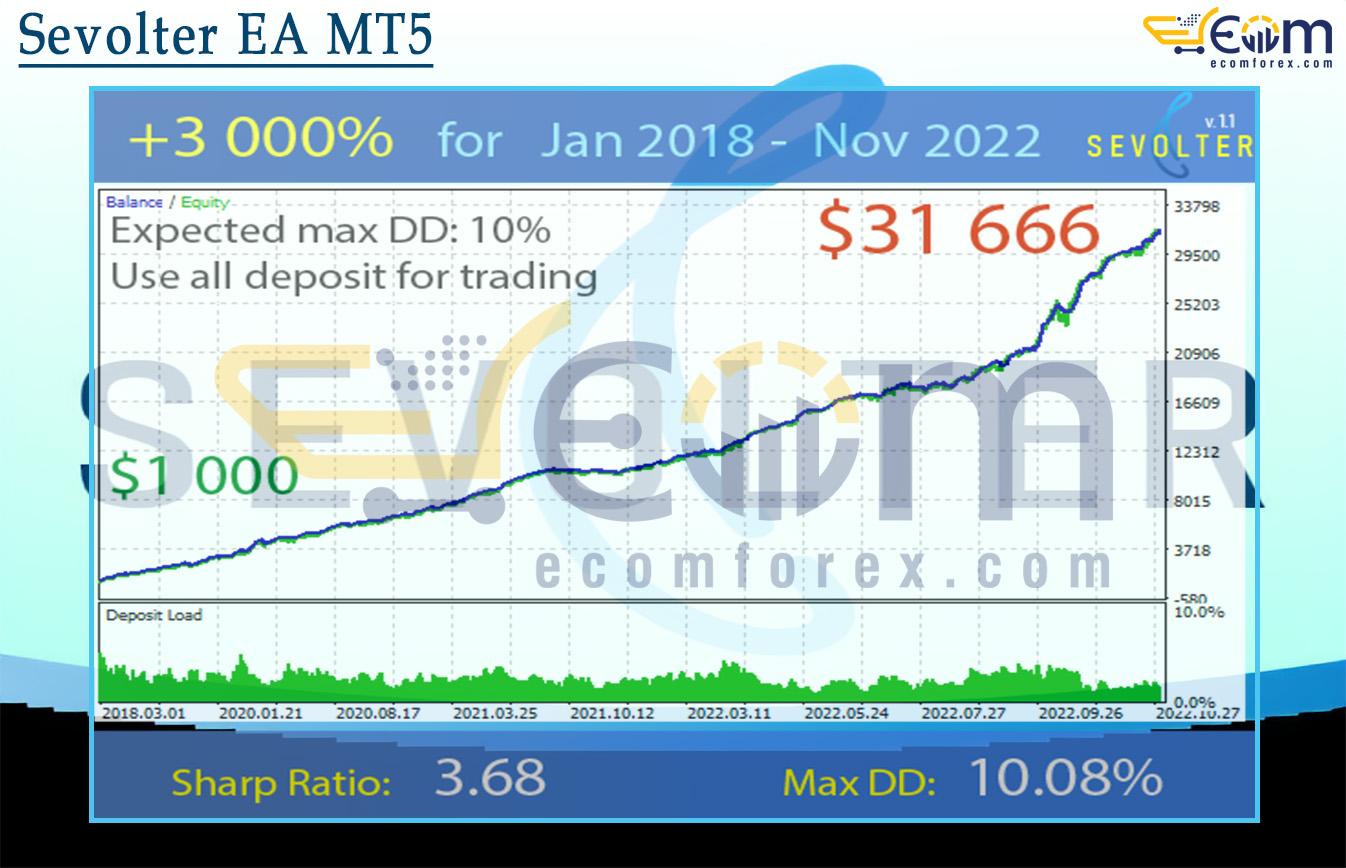

Performance of Sevolter EA MT5

Sevolter EA delivered exceptional long-term profitability over an extensive multi-year backtest from January 2018 to November 2022, demonstrating a highly stable and professionally controlled trading performance.

The equity curve shows smooth, continuous growth with minimal equity shocks, reflecting a strategy built around statistical consistency, disciplined risk control, and efficient capital utilization.

By operating with a clearly defined expected maximum drawdown target of 10%, the system successfully maintained risk within controlled boundaries while achieving strong compounding returns—an essential trait for long-term automated trading.

📌 Key Backtest Performance Metrics

- ✅ Initial Deposit: $1,000

- ✅ Final Balance: $31,666

- ✅ Total Gain: +3,000%

- ✅ Maximum Drawdown: 10.08%

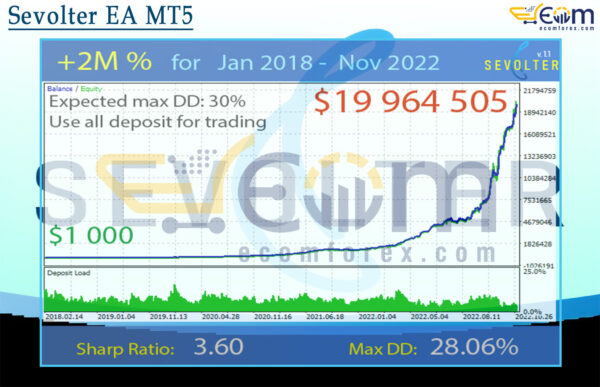

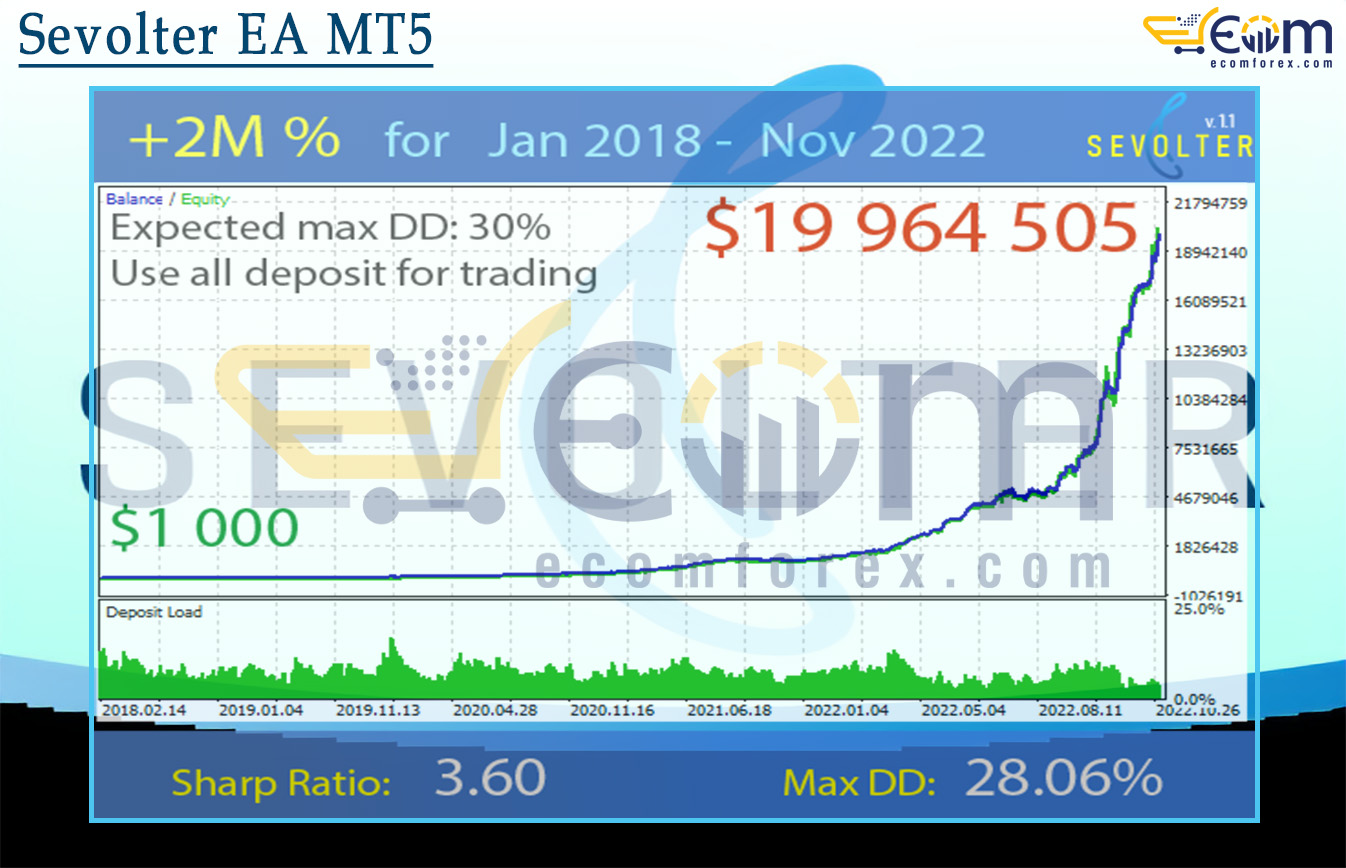

Sevolter EA MT5 showcased explosive long-term growth and aggressive capital deployment in this extended multi-year backtest spanning January 2018 to November 2022.

Unlike the conservative configuration, this run utilized 100% of the deposit for trading, allowing the system to fully exploit compounding effects and momentum across favorable market cycles.

The equity curve reveals a classic exponential growth profile: long periods of controlled accumulation followed by a powerful acceleration phase toward the later years. Despite operating under a much higher expected drawdown threshold (~30%), the EA maintained structural discipline, avoiding chaotic equity swings and preserving strategic consistency.

A standout highlight is the exceptional Sharpe Ratio of 3.60, signaling outstanding risk-adjusted performance even under aggressive settings. This indicates that returns were not merely the result of high exposure, but of high-quality signal execution and strong trade efficiency.

📌 Key Backtest Metrics

- ✅ Initial Deposit: $1,000

- ✅ Final Balance: $19,964,505

- ✅ Total Growth: +2,000,000% (≈ +2M%)

- ✅ Maximum Drawdown: 28.06%

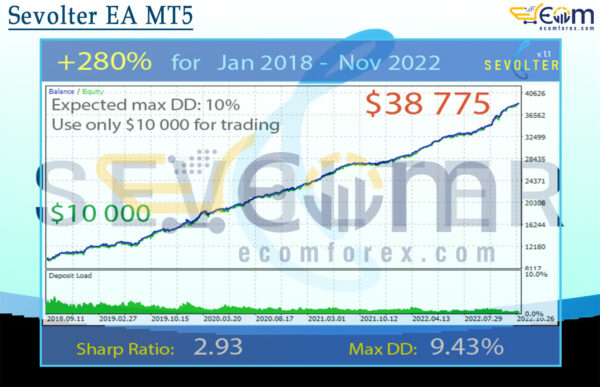

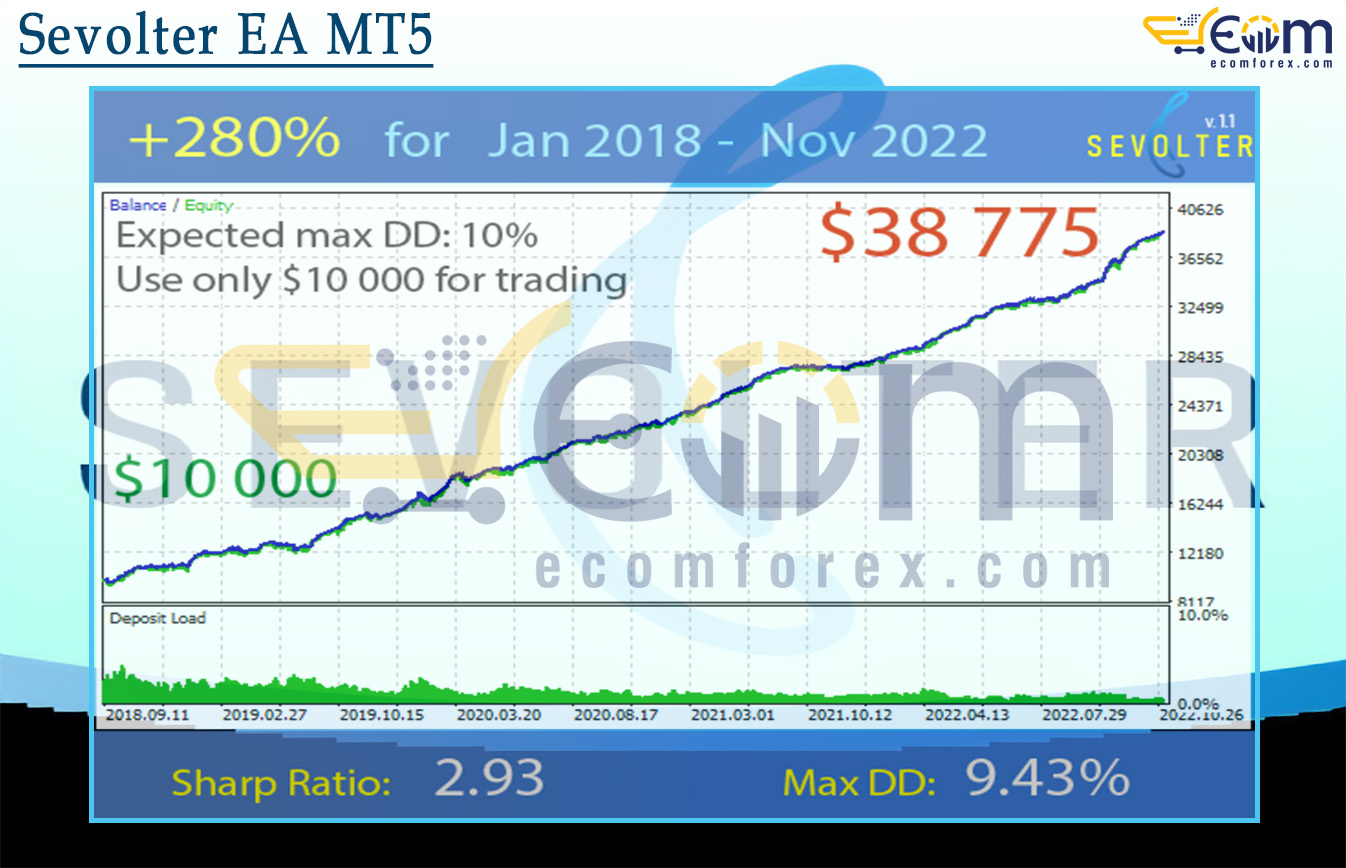

Sevolter EA MT5 demonstrated impressive long-term consistency and capital efficiency throughout this extended multi-year backtest from January 2018 to November 2022.

The system maintained a smooth, steadily rising equity curve, reflecting disciplined execution and strong risk control rather than aggressive over-leveraging.

Operating with a conservative expected drawdown target of just ~10%, Sevolter EA successfully grew the account by +280%, turning a modest trading capital into substantial profits while preserving stability during various market cycles.

Its high Sharpe Ratio of 2.93 highlights excellent risk-adjusted returns, confirming that the growth was achieved with minimal volatility and well-balanced trade distribution. Even during turbulent phases, the EA maintained composure, avoiding equity shocks and large recovery phases.

📌 Key Backtest Metrics

- ✅ Initial Deposit: $10,000

- ✅ Final Balance: $38,775

- ✅ Total Growth: +280%

- ✅ Maximum Drawdown: 9.43%

Recommended Configuration for Sevolter EA MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 4 (MT4) |

| Time frames | Any |

| Currency pairs | Any |

| Min / Recommended deposit | $1000 |

| Min / Recommended leverage | Any |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗