- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $60.00

0 out of 5 main slots sold

Strategy B EA MT5 – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert Strategy B EA MT5

Name: Strategy B EA

Version: Latest Version

Developer by: Ivan Pochta

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is Strategy B EA MT5?

Strategy B EA MT5 is a fully automated trading system developed specifically for the cryptocurrency market, with a primary focus on Bitcoin (BTCUSD) and Ethereum (ETHUSD) — the two most liquid and trend-driven crypto assets.

The system is built on classical Price Action–Momentum trading, relying strictly on clean market structure, impulse detection, and disciplined risk management. It deliberately avoids indicator stacking and black-box prediction models, eliminating the risk of overfitting and unrealistic backtest behavior.

From a professional trader’s perspective, Strategy B is not designed to trade frequently or chase every move. It is engineered to capture medium and strong directional trends, which is exactly where crypto markets deliver their highest reward potential.

- Official Website: See here

Core Features of Strategy B EA

🔹 Pure Price Action & Momentum Core

Strategy B does not rely on indicator overload.

Only two technical tools are used — strictly as support mechanisms:

ADX – to distinguish ranging vs trending markets and confirm impulse strength

Bollinger Bands – used exclusively as a dynamic trailing stop, not for entries

👉 All entry signals are based on raw Price Action, ensuring clarity and robustness.

🔹 Professional Reward-to-Risk Ratio (Above 3:1)

Strategy B maintains an average Reward-to-Risk ratio above 3:1, a benchmark commonly required in professional trading environments.

This structure:

Creates strong mathematical expectancy

Allows profitability even with moderate win rates

Maximizes returns during directional crypto moves

🔹 S&P 500 Trend Filter (Enabled by Default)

Strategy B includes an advanced S&P 500 trend filter, designed to protect the system from false impulses and manipulative price behavior, which are common in crypto markets.

Filter logic:

S&P 500 bullish → Long trades only

S&P 500 bearish → Short trades only

While this filter reduces trade frequency, it significantly improves:

Trade quality

Risk awareness

Stability during high-risk macro conditions

🔹 Bidirectional Trading with Direction Control

The EA supports multiple trading modes:

Bidirectional (Long + Short) – default mode

Long-only – for bullish market regimes

Short-only – for bearish market conditions

This flexibility allows traders to align Strategy B with market cycles and portfolio positioning.

🔹 Strict Risk Discipline – No Dangerous Recovery Methods

Strategy B does not use:

❌ Martingale

❌ Grid

❌ Averaging

❌ Lot scaling

Each trade is executed with:

Fixed Stop Loss

Defined Take Profit

Trailing Stop to lock profits during strong moves

Risk is controlled and identical per trade, preventing account-destroying behavior.

Strategy B EA MT5 – Trading Strategy Explained

🔹 Momentum-Driven Execution

Momentum appears when:

Liquidity enters the market

Large participants push price directionally

Volatility expands in favor of trend continuation

Crypto markets exhibit these conditions frequently, making momentum-based trading repeatable, scalable, and statistically reliable.

🔹 Optimized for M15 & H1 Timeframes

Current presets are optimized for:

M15: BTCUSD, ETHUSD

H1: BTCUSD, ETHUSD

Recommended preset portfolio:

M15: BTC_M15_A, BTC_M15_B, ETH_M15_A (with S&P 500 filter)

H1: BTC_H1_B, ETH_H1_B (with filter), ETH_H1_A (without filter)

This portfolio approach allows:

Risk diversification

Multi-timeframe trend capture

Professional-grade crypto portfolio management

Why Choose Strategy B EA MT5?

✅ Built with Professional Trading Logic

Strategy B follows principles used by experienced traders:

Trade less, but trade better

React to confirmed momentum, not predictions

Protect capital before pursuing profit

✅ Perfectly Aligned with Crypto Market Behavior

Crypto markets are:

Highly volatile

Prone to manipulation

Extremely trend-driven

Strategy B is designed to exploit strong directional movement while avoiding chaotic noise.

✅ Capital Protection First

With high Reward-to-Risk, strict execution rules, and macro-level filtering, Strategy B prioritizes account survival and long-term growth, not short-term gambling.

✅ Flexible & Scalable Architecture

Fully configurable parameters

Custom preset creation

Expandable to other crypto assets and markets

Performance of Strategy B EA MT5

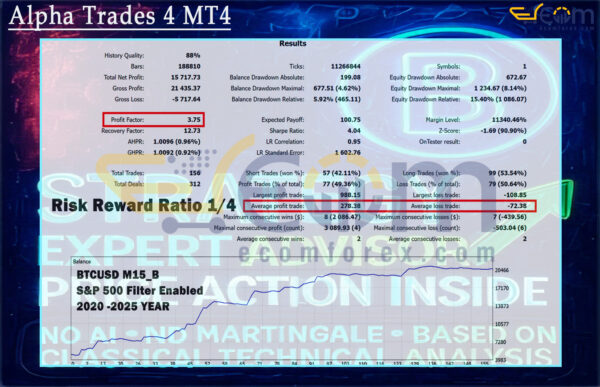

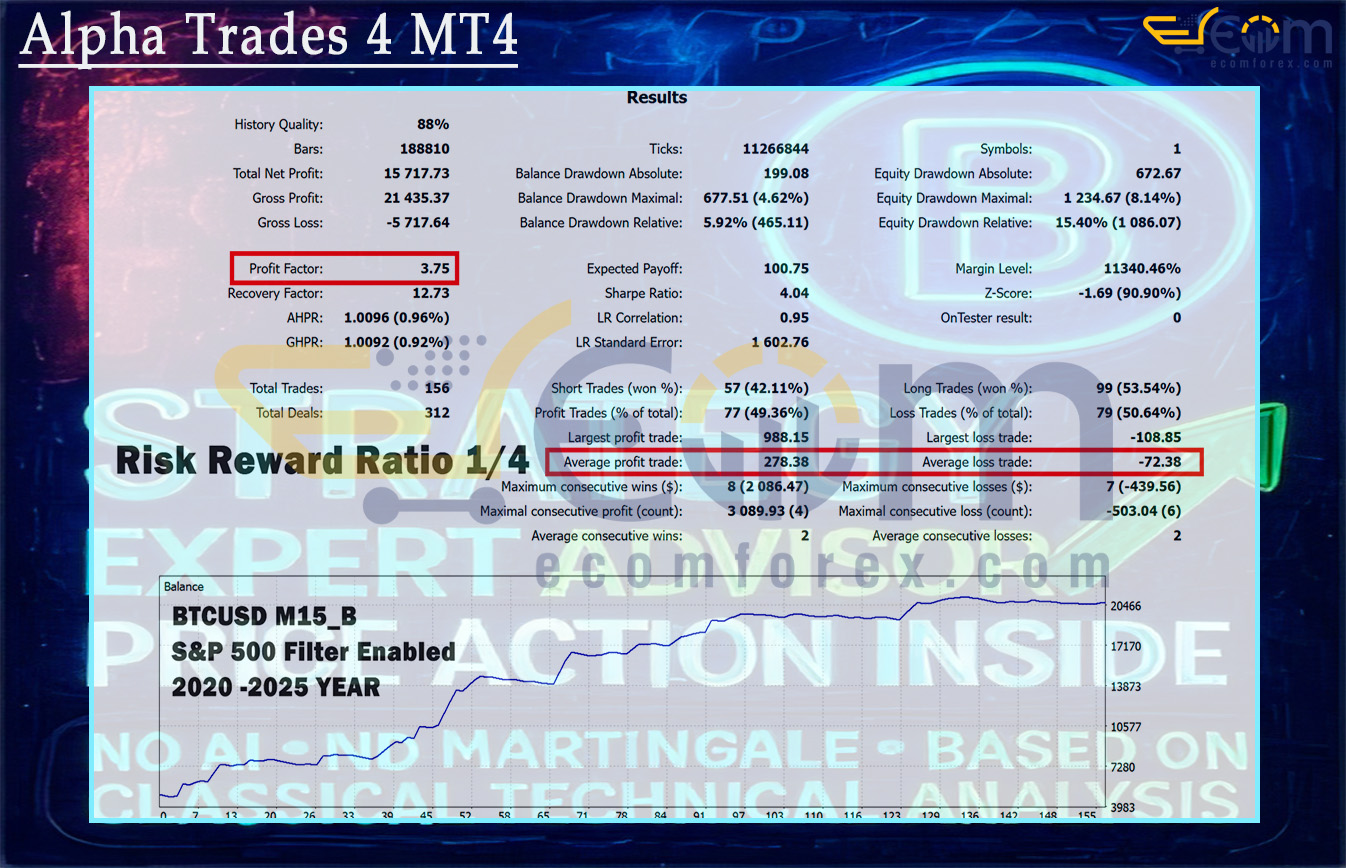

Strategy B EA MT5 delivered robust long-term profitability over a 5-year backtest (2020–2025) on the BTCUSD M15 timeframe, demonstrating a disciplined Price Action–Momentum trading model enhanced by an S&P 500 macro trend filter.

Despite a moderate win rate, the system achieved outstanding performance through a high Reward-to-Risk structure (approximately 1:4), where average winning trades significantly outweighed losing ones — a hallmark of professional momentum-based crypto strategies.

The backtest reveals a smooth and steadily rising equity curve, supported by a very high Profit Factor (3.75) and strong risk-adjusted metrics. By focusing on capturing medium-to-strong directional moves rather than frequent trading, Strategy B maintained controlled drawdown while allowing profits to compound efficiently across multiple crypto market cycles.

📌 Key Backtest Metrics

- ✅ Initial Deposit: ~$5,000

- ✅ Total Net Profit: $15,717.73

- ✅ Maximum Balance Drawdown: 4.62%

- ✅ Maximum Equity Drawdown: 15.40%

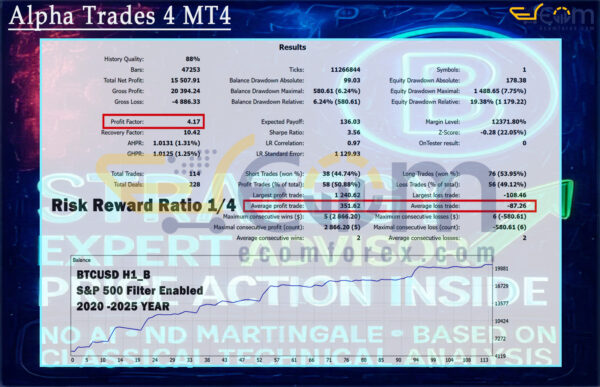

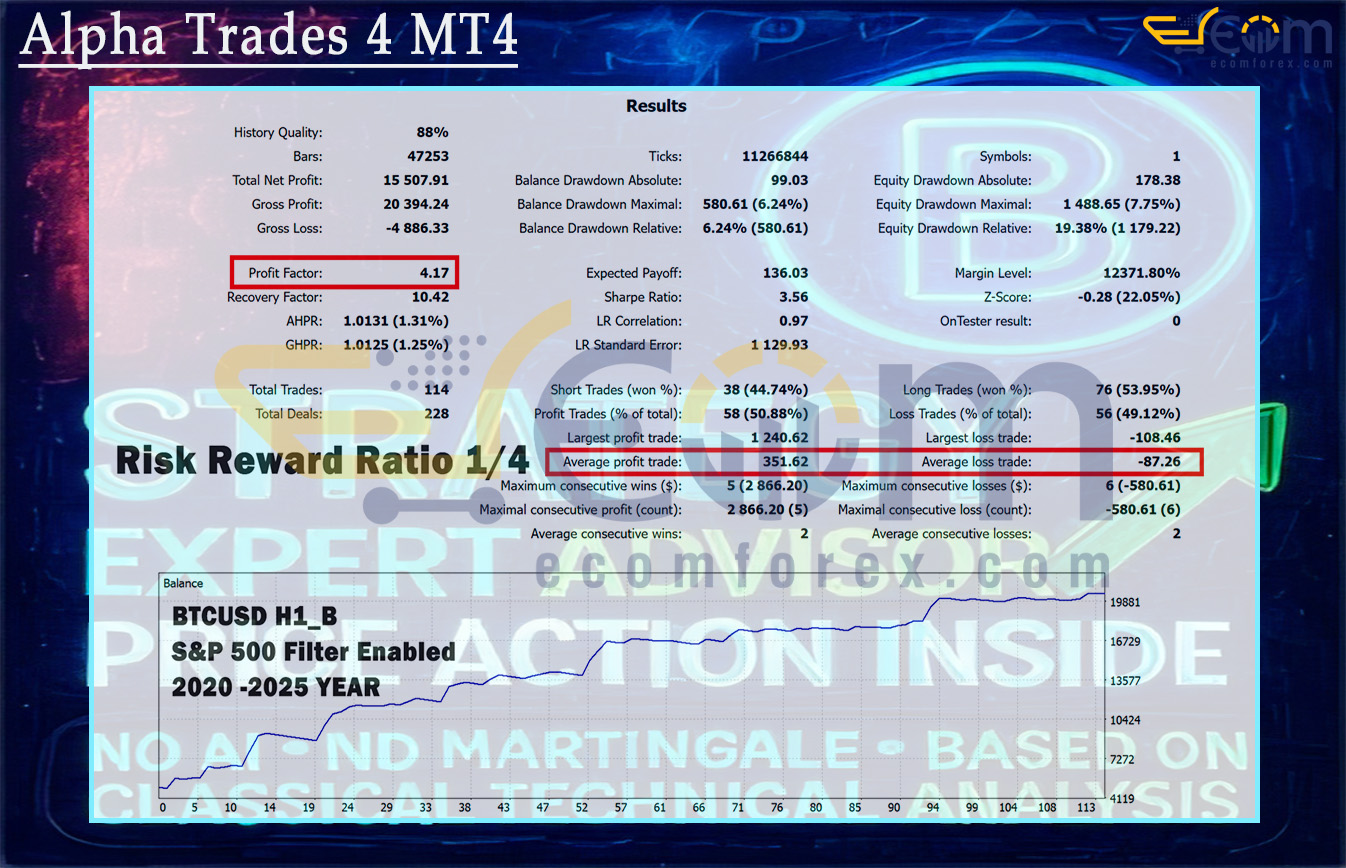

Strategy B EA MT5 delivered strong and highly consistent long-term profitability over a 5-year backtest (2020–2025) on the BTCUSD H1 timeframe, showcasing a disciplined Price Action–Momentum strategy enhanced by an S&P 500 macro trend filter.

Operating on the higher H1 timeframe, the system produced a smooth, steadily rising equity curve by prioritizing high reward-to-risk opportunities (approximately 1:4) rather than frequent trade execution.

The backtest clearly highlights Strategy B’s professional risk architecture, where the average winning trade ($351.62) is multiple times larger than the average losing trade (-$87.26). This payoff asymmetry allows the strategy to remain profitable even with a near-balanced win rate, a defining trait of robust, momentum-driven crypto systems.

Supported by an exceptionally high Profit Factor of 4.17 and a solid Sharpe Ratio of 3.56, the strategy demonstrates excellent risk-adjusted performance. Drawdown levels remain controlled throughout multiple Bitcoin market cycles, reinforcing the system’s suitability for long-term, rule-based crypto trading.

📌 Key Backtest Metrics

- ✅ Initial Deposit: ~$5,000

- ✅ Total Net Profit: $15,507.91

- ✅ Maximum Balance Drawdown: 6.24%

- ✅ Maximum Equity Drawdown: 19.38%

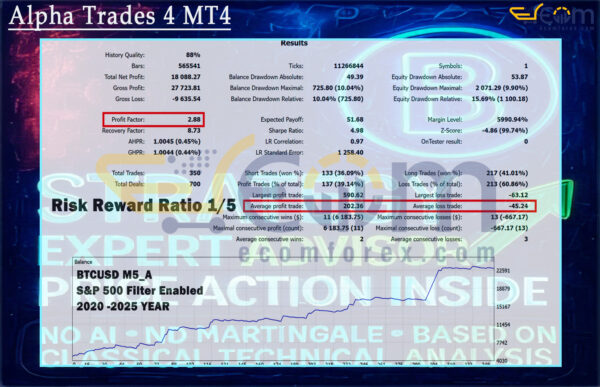

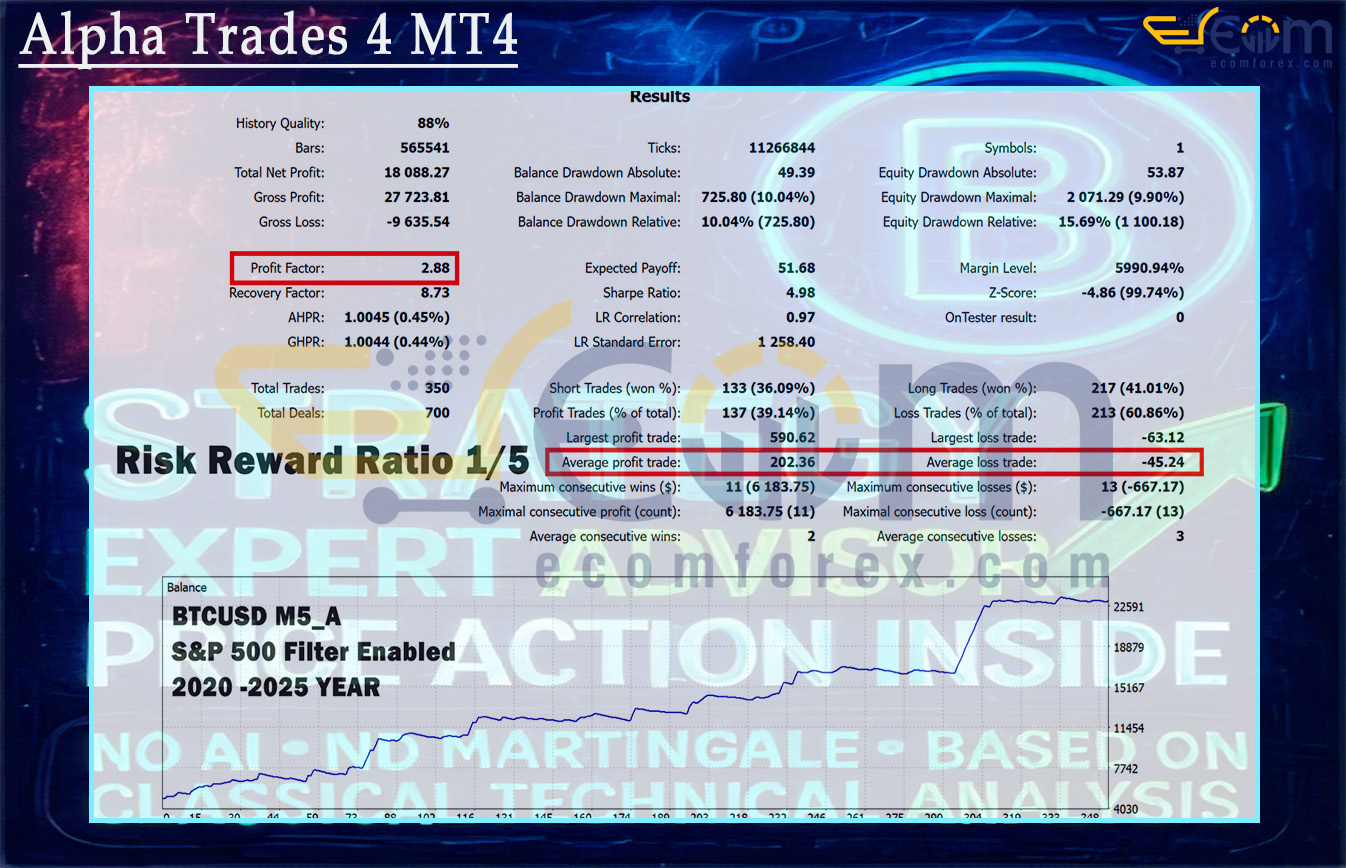

Strategy B EA delivered solid long-term profitability over a 5-year backtest (2020–2025) on the BTCUSD M5 timeframe, demonstrating a disciplined Price Action–Momentum strategy reinforced by an S&P 500 macro trend filter.

Despite operating on a fast intraday timeframe, the system maintained a smooth and steadily rising equity curve by focusing on high reward-to-risk opportunities (approximately 1:5) rather than trade frequency.

The backtest highlights Strategy B’s professional risk structure, where average winning trades significantly exceed average losses, allowing the system to remain profitable even with a win rate below 40%. This asymmetric payoff profile is a defining characteristic of robust momentum-based crypto systems.

Supported by a strong Profit Factor of 2.88 and a high Sharpe Ratio of 4.98, the strategy shows excellent risk-adjusted performance while keeping drawdown within controlled limits across multiple Bitcoin market cycles.

📌 Key Backtest Metrics

- ✅ Initial Deposit: ~$5,000

- ✅ Total Net Profit: $18,088.27

- ✅ Maximum Balance Drawdown: 10.04%

- ✅ Maximum Equity Drawdown: 15.69%

Recommended Configuration for Strategy B EA MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | M15, H1 |

| Currency pairs | BTCUSD, ETHUSD |

| Min / Recommended deposit | $1000 |

| Min / Recommended leverage | Any |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗