- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

TPHunter EA MT4 – Latest original version | Unlimited

people are currently looking at this product!

Introducing the Expert TPHunter EA MT4

Name: TPHunter

Version: Latest Version

Developer by: Luong Quang Nguyen

The Right Platform: Meta Trader 4 (MT4)

Our Telegram Team: Join now

Our Youtube Channel: Click here

- Delivery time 24h-48h after payment.

What is TPHunter EA MT4?

TPHunter EA MT4 is a precision-engineered automated trading system built for traders who prioritize strict risk control, disciplined execution, and long-term account stability.

Inspired by the agility and accuracy of a black panther hunting its target, TPHunter EA focuses on identifying high-probability entry zones, minimizing exposure, and maintaining a highly protective risk structure.

With over 20 years of trading experience, I can affirm that TPHunter EA’s strongest advantage lies in its risk-first architecture combined with AI-assisted trend detection, enabling the Expert Advisor (EA) to survive market volatility while generating consistent, structured returns.

TPHunter EA MT4 is tailored for traders who demand safety, reliability, transparency, and professional-grade performance.

- Official Website: See here

Main Features

🔹 AI-Driven Trend Recognition (EnableAIEntry)

The EA uses artificial intelligence to analyze dynamic market cycles through AI_TrendPeriod, enabling it to detect optimal entry conditions and avoid noise-based, low-quality setups.

🔹 Intelligent Money Management System

The built-in MoneyManagement module automatically calculates lot size based on account balance and user-defined risk levels — ensuring stable, controlled growth without overexposure.

🔹 Advanced Entry Optimization

TPHunter evaluates volatility, micro-trend direction, and cycle behavior to select precise entry points, reducing false entries and enhancing overall trade accuracy.

🔹 Strict Risk-Control Framework

The EA is built around the principle:

“A system with strong risk management will outlast any market condition.”

Every trade is protected with:

Controlled exposure

Smart lot scaling

Defined risk thresholds

Protection against unexpected volatility

🔹 Highly Customizable Parameters

Users can fine-tune:

Risk settings

Trading hours

Entry filters

Stop-logic

AI sensitivity

This flexibility makes TPHunter suitable for conservative investors, active traders, and even prop-firm environments.

🔹 Non-Martingale, Non-Grid System

No doubling, no grid stacking, no dangerous hedge strategies.

TPHunter uses clean, professional trade logic prioritizing capital safety.

Trading Strategy Overview

TPHunter EA operates on three core strategic pillars:

🔸 AI-Based Dynamic Trend Analysis

The EA reads market structure, volatility environments, and cyclical price behavior to identify genuine opportunities — not random fluctuations.

🔸 High-Probability Entry Selection

Trades are executed only when multiple conditions align:

Momentum confirmation

Trend alignment

Correct cycle phase

Volatility thresholds

This leads to higher accuracy and fewer unnecessary trades.

🔸 Safe, Structured Trade Management

Once in a position, TPHunter uses:

Controlled lot sizing

Strict risk limits

Conservative exposure

Protective stop-logic

All designed to maintain a stable equity curve even during turbulent markets.

Why Choose TPHunter EA MT4?

🔥 1. Built on a Risk-First Philosophy

Most EAs chase profits — TPHunter prioritizes survival, the foundation of true long-term growth.

🔥 2. AI-Enhanced Precision Entries

No impulse trades, no emotional decisions — only calculated, data-driven setups.

🔥 3. Zero Dangerous Techniques

Absolutely no martingale, no grid, no hedge pyramiding — ensuring long-term sustainability.

🔥 4. Ideal for Long-Term Traders and Prop-Firm Requirements

The system’s disciplined exposure and tight risk structure align perfectly with prop-firm rules.

🔥 5. Fully Customizable to Any Trading Style

From conservative to aggressive, every trader can tailor the EA to their personal strategy.

🔥 6. Stable Across All Market Conditions

TPHunter adapts to trending, ranging, and volatile markets through AI-driven cycle detection.

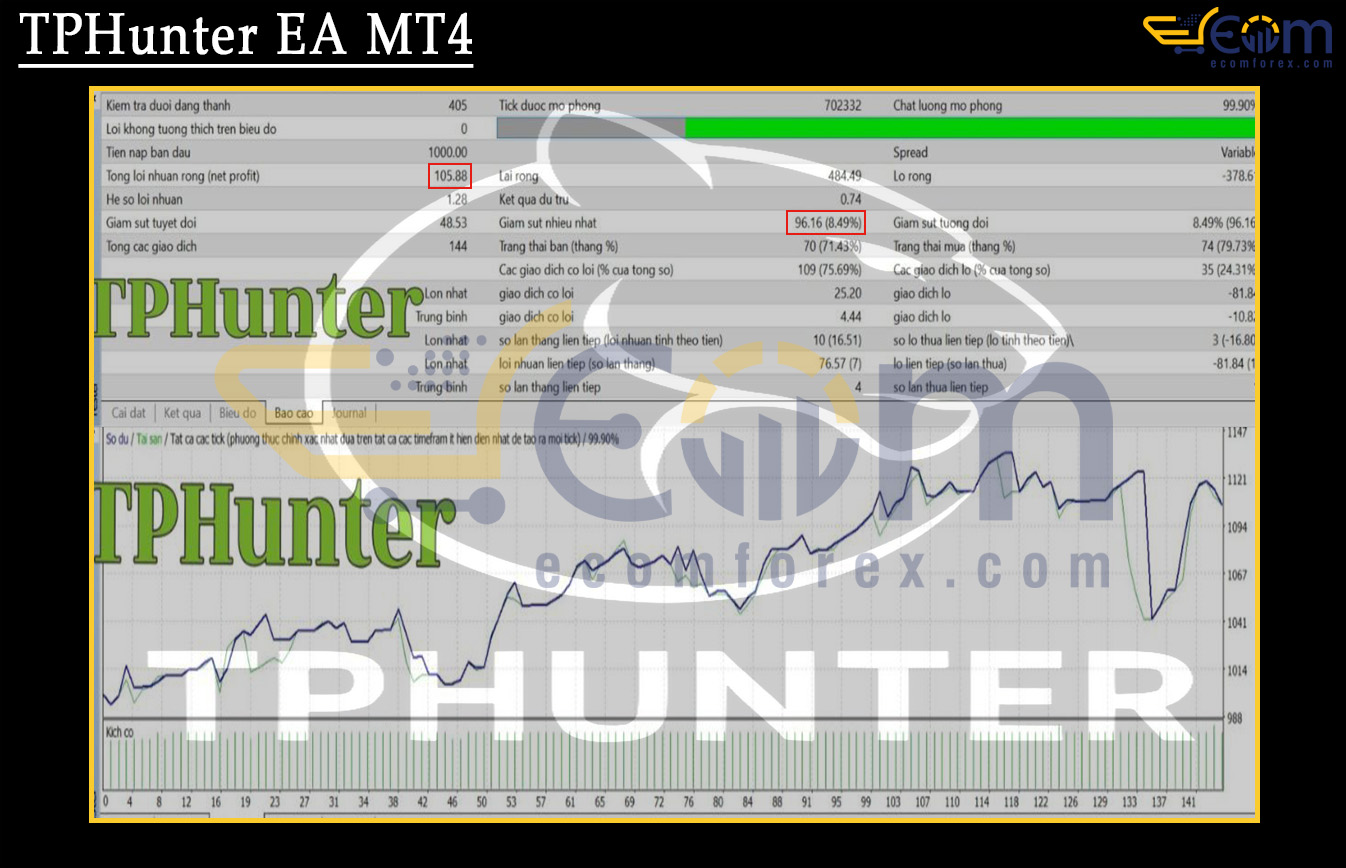

Performance of TPHunter EA MT4

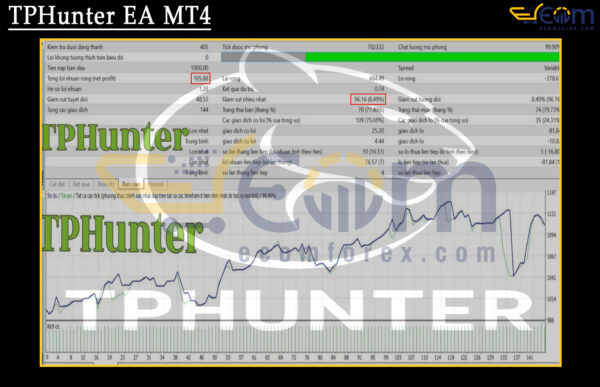

TPHunter EA delivered stable and consistent profitability in this backtest, maintaining controlled performance and a smooth equity curve across 144 executed trades.

Its disciplined risk-managed framework, AI-assisted entry logic, and structured money-management engine enabled the system to achieve steady growth while keeping drawdown at a manageable level.

📌 Key Backtest Metrics

- ✅ Initial Deposit: $1,000

- ✅ Total Net Profit: $105.88

- ✅ Maximum Relative Drawdown: 8.49%

- ✅ Win Rate: 75.69% profitable trades (109/144)

Recommended Configuration for TPHunter EA MT4

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 4 (MT4) |

| Time frames | H1 (60 minute chart) |

| Currency pairs | Major Forex pairs |

| Min / Recommended deposit | $1,000 |

| Min / Recommended leverage | 1:100 |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Expert Advisor:

- TPHunter EA_fix.ex4

🤗WISH YOU SUCCESSFUL TRADING🤗