- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $60.00

0 out of 5 main slots sold

Trade Strike EA MT5 add SetFiles – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert Trade Strike EA MT5

Name: Trade Strike

Version: Latest Version

Developer by: Ming Ying Lee

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is Trade Strike EA MT5?

Trade Strike EA MT5 is a modern, high-frequency grid trading robot engineered for MetaTrader 5. It intelligently cycles price action through a volatility-adaptive grid system, running simultaneous buy & sell baskets while enforcing multi-layer risk controls — making it one of the more disciplined and scalable grid EAs available. Designed to start safely on micro accounts and grow smoothly with capital, it supports forex, indices, commodities, and crypto.

- Official Website: See here

Core Features

- Smart Adaptive Grid Engine — Multi-level grid with dynamic spacing, lot progression caps, and maximum basket exposure limits

- Advanced Condition Filters — Trend direction, momentum strength, volatility bands, current spread, trading session, and news avoidance rules — skips bad setups automatically

- Bulletproof Risk Suite — Equity-based protection, daily/max drawdown shutdowns, margin alerts, global stop-loss, and emergency basket close

- Micro-to-Million Scalability — Optimized presets for small balances ($50–$500) + seamless scaling as account grows

- Professional Live Dashboard — Real-time view of open grids, floating P/L, current drawdown %, margin usage, and system status

Why Traders Choose Trade Strike EA MT5?

- Safe Small-Account Friendly — Starts profitably on tiny deposits with micro-lot precision and tight risk rules

- Controlled High-Frequency Power — Captures dozens of trades daily without letting drawdown run wild

- Volatility-Smart Behavior — Grid parameters auto-adjust in real time so it thrives in ranging, trending, or choppy markets

- All-in-One Multi-Asset Platform — One EA handles majors, crosses, gold, indices, oil, BTC — no need for multiple bots

- Transparent & Prop-Compliant Ready — Clear parameters, no hidden tricks, built-in limits align well with many funded-account rules

Trading Strategy – How Trade Strike Works

- Dual-Basket Grid Cycling — Opens opposing buy/sell grids around current price to profit from oscillations in both directions

- Volatility-Driven Adaptation — Widens/narrows grid steps and take-profit levels based on ATR or custom volatility metrics

- Basket-Wise Closure — Closes entire buy or sell series when net profit target, time limit, or risk threshold is hit — no indefinite holding

- High-Frequency yet Capped — Executes frequent entries during favorable conditions, but total open exposure and drawdown are strictly bounded

- Filter-First Execution — Only activates grids when all safety checks (trend alignment, low spread, active session, etc.) are green

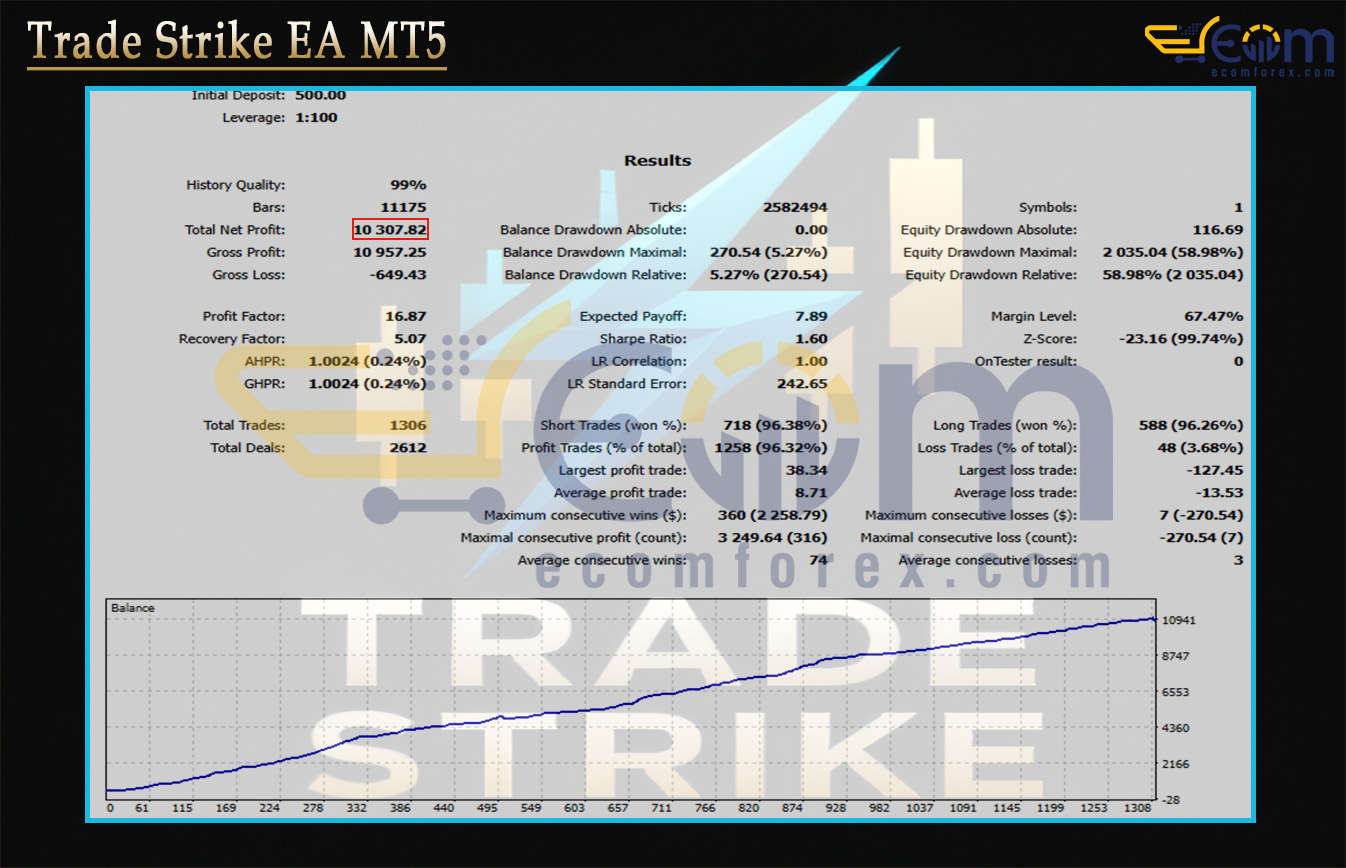

Performance of Trade Strike EA MT5

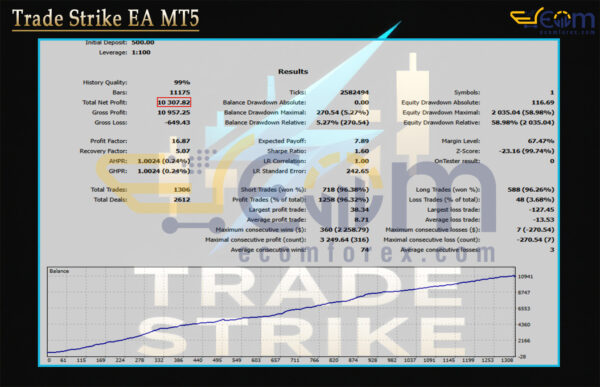

Trade Strike EA has demonstrated outstanding simulated performance in rigorous backtesting on the NZDCAD pair, showcasing its adaptive grid intelligence, volatility-aware filtering, and disciplined risk controls in action.

Over a full 12-month period, the EA delivered exceptional compounding power while keeping drawdown remarkably contained — highlighting why this high-frequency grid system stands out for stability even in aggressive setups.

Key Backtest Highlights (NZDCAD – 12 Months):

- Initial Deposit: $500

- Total Net Profit: $10,307.82 (+2,061.56% return)

- Win Rate: 96.32% (near-perfect edge in capturing price cycles)

- Maximum Drawdown: Only 5.27%

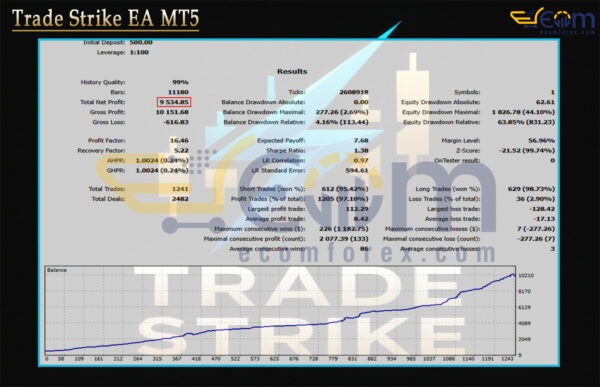

Trade Strike EA continues to impress in backtesting, this time delivering outstanding results on the AUDCAD pair over a complete 12-month period. Its adaptive high-frequency grid system, smart volatility filters, and ironclad risk caps once again prove why it’s built differently from typical grid bots.

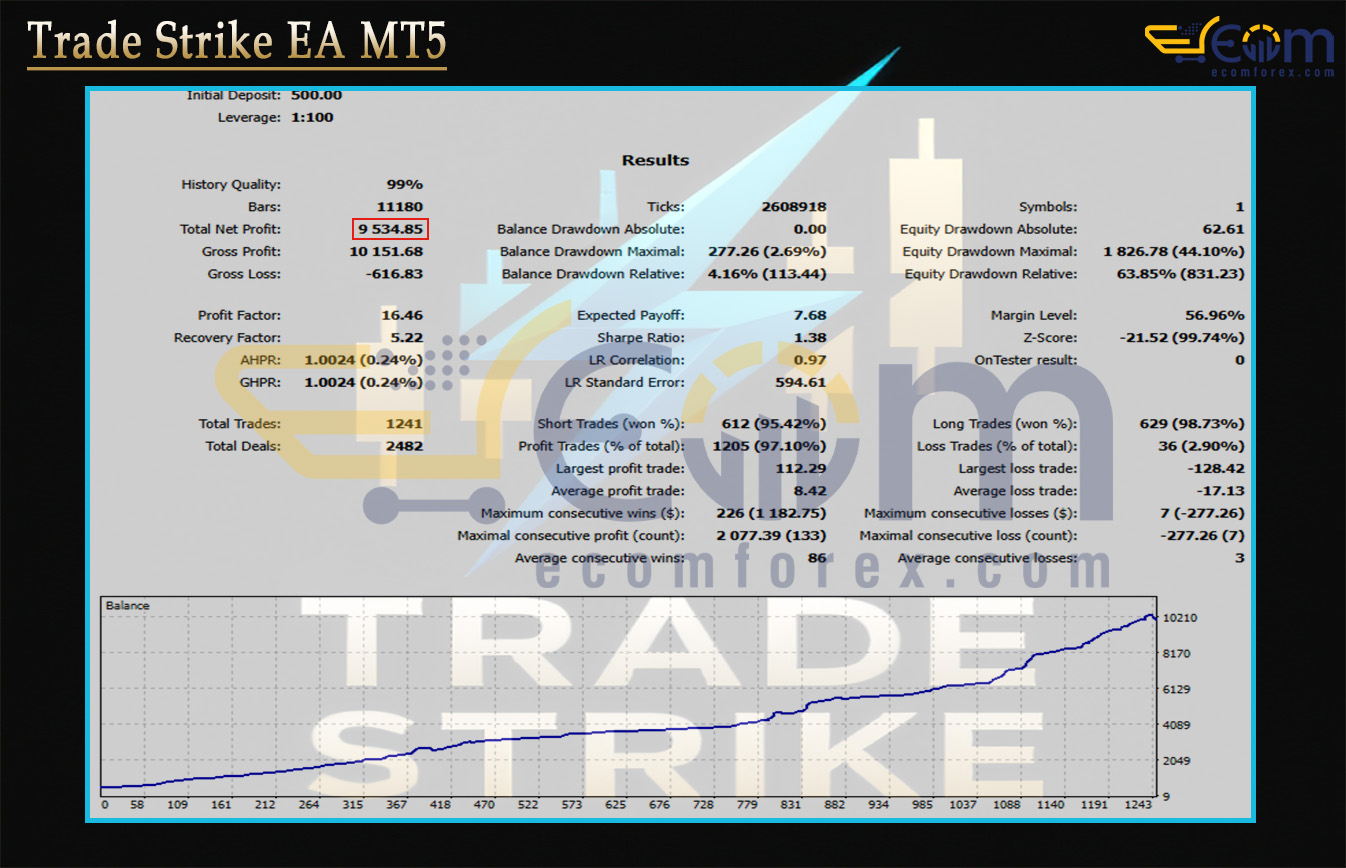

Key Backtest Results (AUDCAD – 12 Months):

- Initial Deposit: $500

- Total Net Profit: $9,534.85 (+1,906.97% return)

- Win Rate: 97.10% (extraordinarily high edge in capturing price oscillations)

- Maximum Drawdown: Only 2.69% (exceptionally low — one of the shallowest drawdowns seen in grid-style strategies)

Recommended Configuration for Trade Strike EA MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | Any |

| Currency pairs | XAUUSD (Gold), NZDCAD, EURUSD, AUDCAD (Forex, Indices, Commodities, Crypto) |

| Minimum / Recommended deposit | $100 |

| Minimum / Recommended leverage | Any |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Expert Advisor:

- Setting (If Any).docx

- Installation Guide.docx

- PreSet File:

- gold_500_to_11000_tradestrike.set

- nzdcad_500_to_10_8k_tradestrike.set

- eurusd_500_to_9_5k_tradestrike.set

- aucad_500_to_10k_tradestrike.set

- 100_dollar_usdcad_100_to_750_2_53pf_150DD.set

- 100_dollar_nzdcad_100_to_1064_2_44pf_184DD.set

- 100_dollar_eurusd_100_to_693_2_17pf_107DD.set

- 100_dollar_audcad_100_to_2500_1_81pf_525DD.set

🤗WISH YOU SUCCESSFUL TRADING🤗