- Expert Advisor MT4

- Expert Advisor MT5

- HFT EA

- Gold EA

- Forex EA

- PropFirm EA

- Automatic EA

- EA Best Seller

- EA Verified Profits

Main Slot Purchase Phase

Main Slot Price: $90.00

0 out of 5 main slots sold

Valhalla EA MT5 – Latest version | Group Buy

people are currently looking at this product!

Introducing the Expert Valhalla EA MT5

Name: Valhalla EA

Version: Latest Version

Developer by: Andrey Dubeiko

The Right Platform: Meta Trader 5 (MT5)

Our Telegram Team: Join now

Our Youtube Channel: Click here

What is Valhalla EA MT5?

With over 20 years of trading experience in equities, indices, and algo systems, I’ve backtested and traded many momentum-based EAs. Valhalla EA MT5 impresses as a clean, volatility-driven momentum follower optimized for today’s most liquid and trending markets — the major US indices.

Valhalla EA MT5 is a fully automated Expert Advisor (MT5) built on a volatility spike trading model that detects sharp momentum surges, enters in the direction of the breakout/impulse, and rides the move to maximize profits. Designed primarily for intraday trading (same-day closes), with easy settings to switch to medium-term holds. Default parameters are tuned for NASDAQ (US100), S&P 500 (US500), and DJIA (US30) — other assets require optimization.

- Official Website: See here

Core Features

- Volatility Spike Detection — Core engine identifies high-probability momentum bursts for directional entries.

- Flexible Horizon — Intraday (forced daily close) or medium-term via simple toggle.

- Percentage-Based Exits — SL and TP as % of current asset price (asymmetric buys/sells possible); dynamic auto-TP option for adaptive profit-taking.

- Robust Risk Controls — Risk per trade via % equity (SL-based sizing), lot-per-1000-equity, or fixed lot. Built-in loss reduction function dynamically exits early on weakening momentum/trend reversal.

- Time Filter — Restrict trading hours (server time) to high-liquidity sessions only.

- Safety & Simplicity — Mandatory SL, no martingale/grid, magic number, broker-time adjustment (default GMT+2), future updates planned for more flexible settings.

Core Trading Strategy

- Spots volatility spikes (sudden range expansion + momentum) as entry signals.

- Enters long/short in the direction of the impulse, trailing or holding via dynamic/fixed % targets.

- Exits via: % TP/SL, early loss reduction on momentum fade, or hard daily close (intraday mode).

- Capitalizes on indices’ frequent strong trends and intraday momentum bursts while avoiding chop with volatility filters.

- Focuses on high-conviction setups rather than over-trading.

Why Traders Should Choose Valhalla EA MT5?

- Momentum Edge on Indices — Volatility-spike model captures explosive moves in US100/US500/US30 better than lagging-indicator bots.

- Dual Horizon Flexibility — One-click switch between scalping-style intraday and swing/medium-term trades.

- Smart Risk Protection — % risk sizing + dynamic early exits + mandatory SL = controlled drawdown in volatile markets.

- Plug-and-Play for Majors — Optimized defaults for the most traded indices — high liquidity, tight spreads, 24/5 action.

- Clean & Future-Proof — No dangerous techniques, easy settings, planned upgrades — ideal for serious index traders seeking reliable automation.

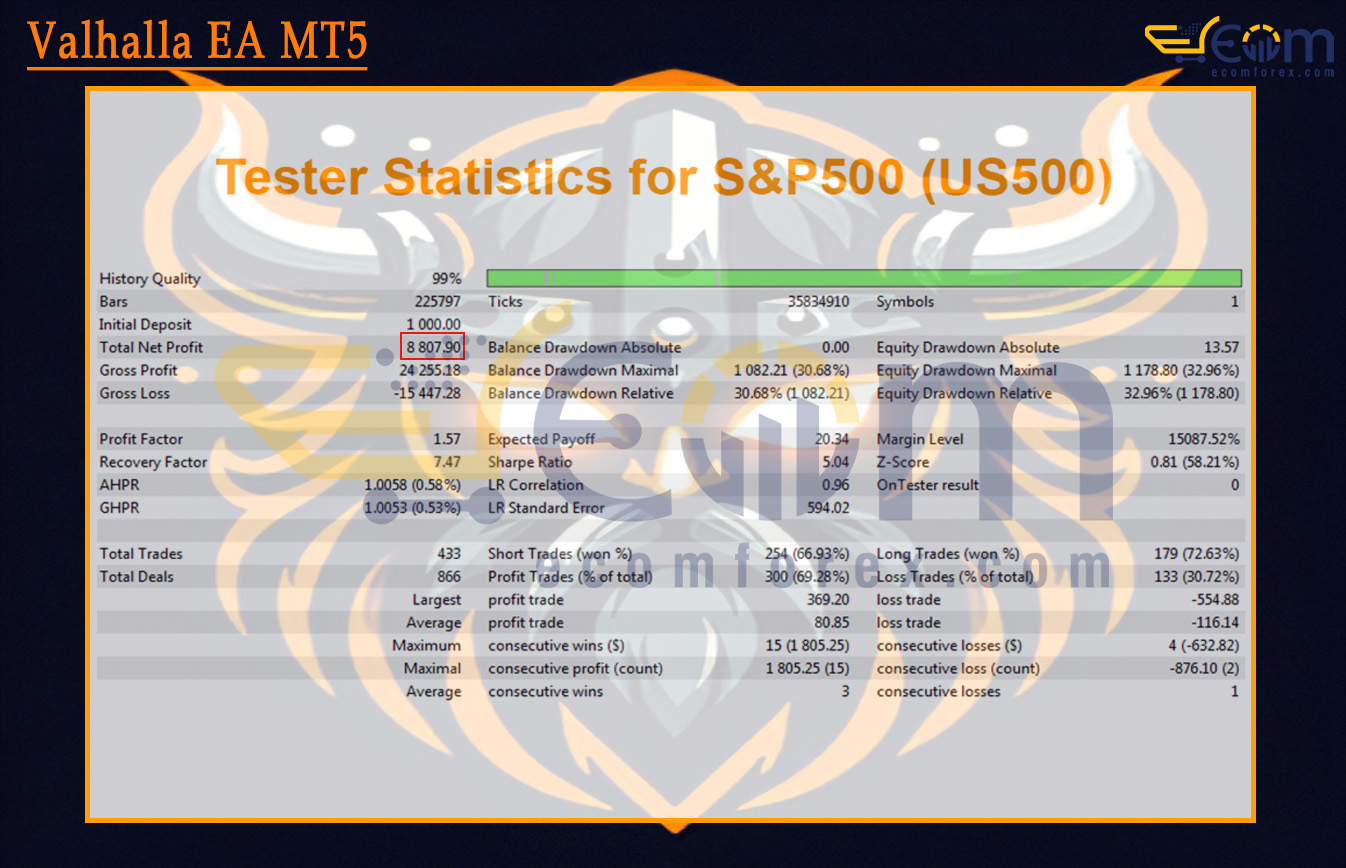

Performance of Valhalla EA MT5

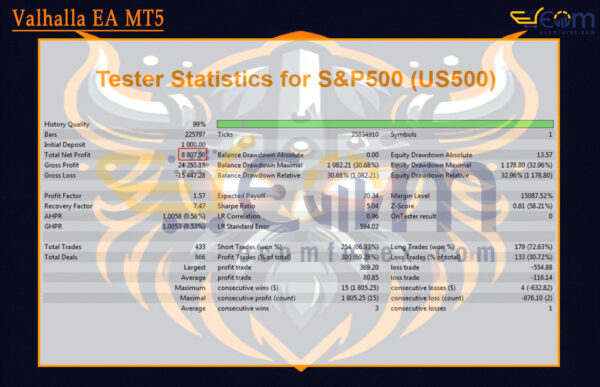

Valhalla EA delivered strong and consistent profitability over this high-quality backtest on the S&P 500 (US500) index, powered by its volatility spike momentum model that effectively captures and rides intraday impulse moves. The system achieved solid returns with a healthy profit factor, excellent recovery strength, and well-managed drawdown relative to the momentum style, backed by near-perfect modeling quality (99%).

- Initial Deposit: $1,000.00

- Total Net Profit: $8,807.90

- Maximum Drawdown: 32.96%

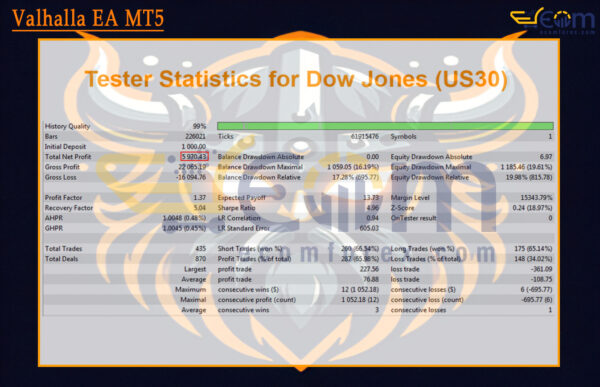

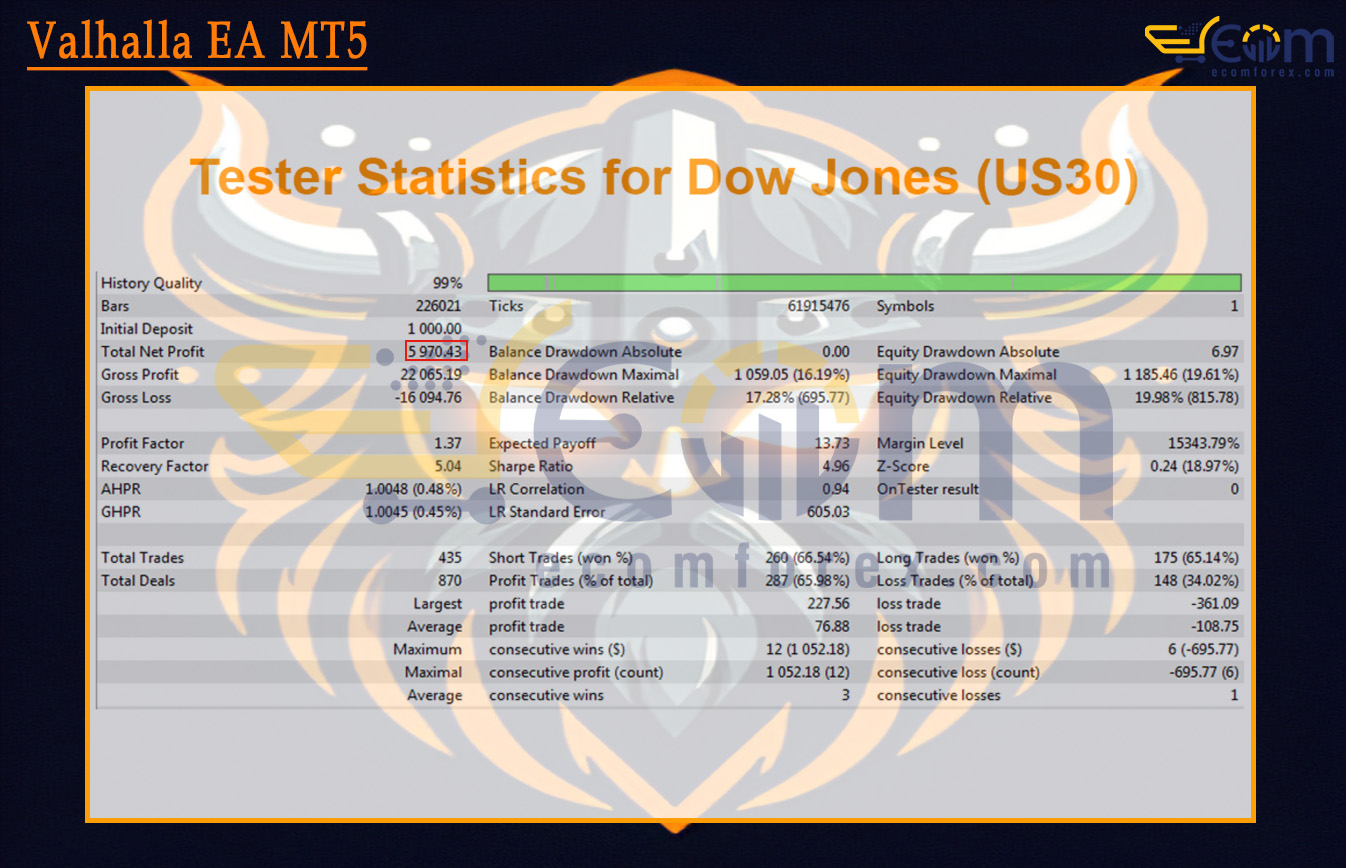

Valhalla EA delivered solid and reliable profitability over this high-quality backtest on the Dow Jones (US30) index, leveraging its volatility spike momentum model to effectively capture and follow strong intraday impulses in one of the most stable yet trend-capable major indices. The system showed balanced performance across directions, a healthy profit factor, excellent recovery metrics, and well-contained drawdown relative to momentum trading, all with near-perfect modeling quality (99%).

- Initial Deposit: $1,000.00

- Total Net Profit: $5,970.43

- Maximum Drawdown: 19.98%

Recommended Configuration for Valhalla EA MT5

| Name | Fit |

|---|---|

| Trading platform | Meta Trader 5 (MT5) |

| Time frames | Any |

| Currency pairs | NASDAQ, SP 500 and DJ 30 (US100, US500 and US30) indices |

| Min / Recommended deposit | Any |

| Min / Recommended leverage | Any |

| VPS | Optional, for uninterrupted advisor operation. |

What do you get After Downloading?

- Setting (If Any).docx

- Installation Guide.docx

🤗WISH YOU SUCCESSFUL TRADING🤗